Panic is contagious.

The cryptocurrency markets showed that this week. As one of the largest exchanges in the world, FTX, were revealed to have “misappropriated” client assets (we put together a “wtf happened” piece here), people have been pulling their Bitcoin from exchanges en masse.

Are you looking for fast-news, hot-tips and market analysis? Sign-up for the Invezz newsletter, today.

Cold storage refers to storing one’s bitcoins offline. This allows investors to take advantage of Bitcoin’s unique “no counterparty” attribute. Otherwise, customers are required to trust exchanges such as FTX to store their bitcoins.

And that trust is breaking.

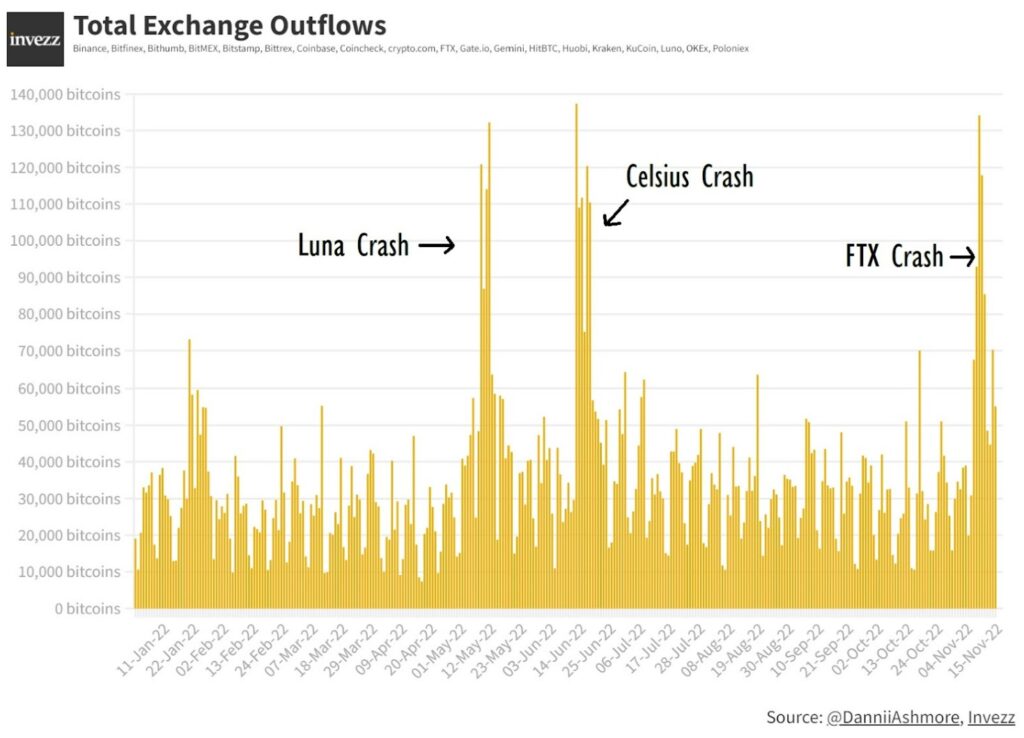

The below chart shows how many people have pulled their Bitcoin off exchanges since the FTX implosion, as the cryptocurrency news cycle got worse and worse.

Biggest one-week decline since July 2017

Entering Monday morning on November 7th, there was 2.419 million bitcoins on exchanges. By the end of the week, as the daily totals from the above chart show, this balance had dipped 4.7% to 2.317 million bitcoins.

That’s an outflow of over 100,000 bitcoins in less than a week – in fact, it’s the biggest one-week decline since July 2017.

Even looking at the balance of Bitcoin on exchanges over a ten year sample, one can notice the expedited run in the last couple of weeks at the tail end of the graph. But the truth is, people have been pulling bitcoin off exchanges for a while now.

I then plotted these figures against the total Bitcoin supply. Only 12.08% of bitcoins currently reside on exchanges – that is the lowest figure since January 2018.

The below chart dives further into the deluge of bitcoins flowing out of exchanges this past week – comparing to the two other crises the market has endured this year: Luna’s death spiral on May 8th and Celsius suspending withdrawals on June 12th. There is no better picture to show the panic in the market, then the sudden flood of bitcoins for the exit doors.

Safer exchanges

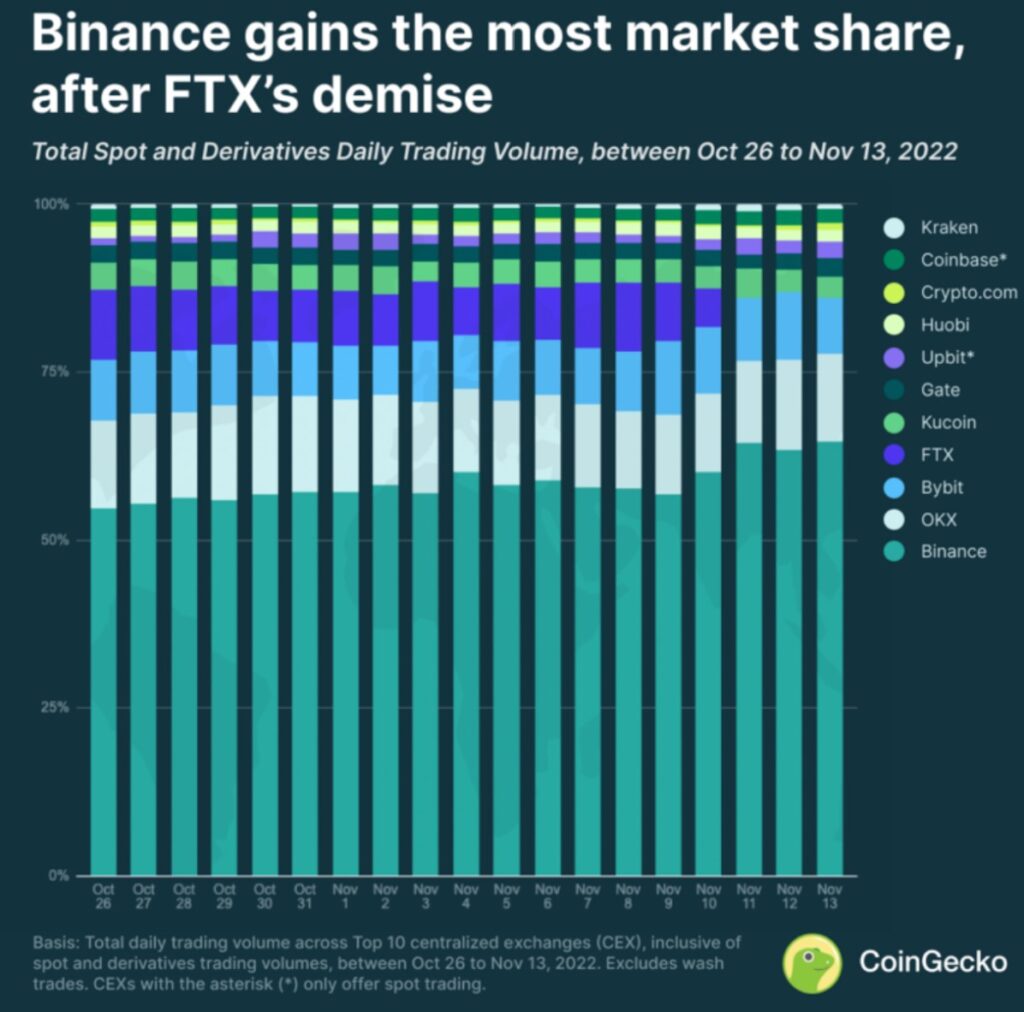

Binance has already eaten up nearly all of the surrendered FTX market share. CoinGecko data below shows that in terms of trading volume, their dominance rose to 64% from 57% among the top 10 crypto exchanges between November 11th and November 13th, a staggering 7% jump in three days.

The other big winner was OKX, rising from 11.9% to 13%.

Yet in terms of storing bitcoins on exchanges, while Binance may have gained in the short-term via the demise of such a large rival, the long-term trend appears headed towards cold storage.

Final Thoughts

FTX was royalty. Sam Bankman-Fried was the golden boy, gracing the cover of every magazine, speaking before Congress, and representing the industry at large.

Shockingly, it was all a facade.

People are shook. Who is now trustworthy enough to store your Bitcoins safely? Cold storage means you don’t need to answer that question. It leverages the power of the blockchain to store it offline.

Sadly, it feels like no central entities can be trusted in the space right now. This latest scandal is yet further evidence of that, and a prime advertisement for cold storage. The data is showing that people are listening.

Invest in the top cryptocurrencies quickly & easily with the worlds largest and most trusted broker, OKX.

[ad_2]

Image and article originally from invezz.com. Read the original article here.