[ad_1]

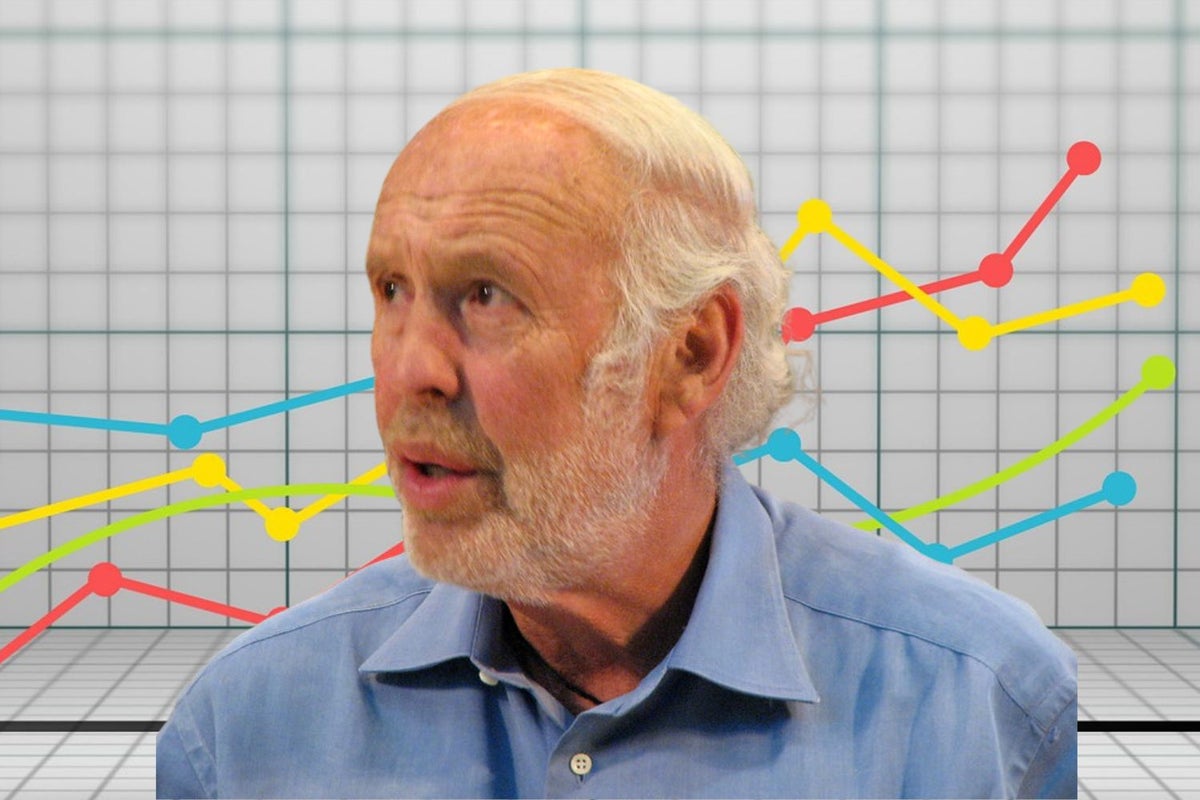

Jim Simons is the founder and hedge fund manager of Renaissance Technologies, which currently has a total portfolio value north of $77 billion, per Stock Circle. This hedge fund uses a quantitative strategy in determining its stock trades.

Simons’ quantitative approach has had legendary success. Gregory Zuckerman wrote, “The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution,” which is a story about how Simons pioneered the era of the algorithm, earning at least $23 billion in doing so. Renaissance Technologies has a ten-year return performance of 128%, although last year it struggled, producing a negative return of 19.01%, according to Stock Circle.

Check out three healthcare stocks Simons trimmed, while expanding an existing position in a fourth.

See Also: Tiger Global Lost $16 Billion In 4 Months, But Held These 2 Dividend Payers

Gilead Sciences Inc. GILD is offering a dividend yield of 3.50% or $2.92 per share annually, using quarterly payments, with a notable track record of increasing its dividends for six consecutive years. Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C.

Simons sold more than 3.3 million shares, or 25.3% of his stake in Gilead Sciences, over the course of the third quarter.

Merck & Company Inc. MRK is offering a dividend yield of 2.66% or $2.76 per share annually, through quarterly payments, with a stellar track record of increasing its dividends for 11 consecutive years. Merck makes pharmaceutical products to treat a variety of conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections.

Renaissance Technologies decreased its stake in Merck by at least 2.2 million shares, or roughly 33% in the third quarter.

Novo Nordisk A/S NVO is offering a dividend yield of 1.03% or $1.16 per share annually, making quarterly payments, with a decent track record of increasing its dividends for three consecutive years. Novo Nordisk is the leading provider of diabetes-care products in the world and has nearly 50% market share by volume of the global insulin market.

Renaissance Technologies sold over 2.2 million shares or 13% of its stake in Novo Nordisk during the third quarter, but remains the fund’s top owned stock, accounting for 2.2% of the total portfolio.

Eli Lilly & Co. LLY is offering a dividend yield of 1.09% or $3.92 per share annually, utilizing quarterly payments, with a strong track record of increasing its dividends for eight consecutive years. Eli Lilly is a drug firm with a focus on neuroscience, endocrinology, cancer, and immunology.

Simons increased his stake in Eli Lilly by approximately 613,764 shares or 153.1% in the third quarter.

Photo: Courtesy of Graham Leuschke on flickr

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.