[ad_1]

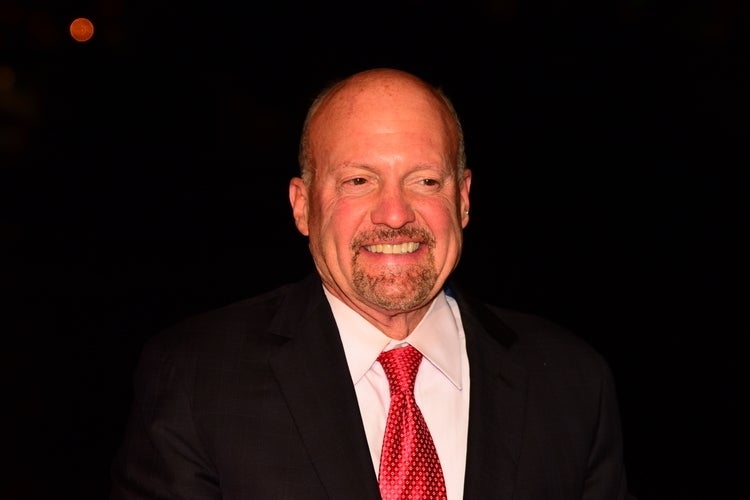

Prominent market commentator Jim Cramer said on Thursday that despite what Wall Street bears might believe, the economy could be on its way toward a soft landing, according to a CNBC report.

“It doesn’t have to be a recession. The economy just needs to stabilize at a lower level, which I think is already starting to happen. This is the winning hand that nobody playing the recession parlor game seems willing to acknowledge, even as I bet it’s become the most likely outcome,” he said.

Also Read: Gold IRA Kit

Major Wall Street indices closed in the green on Thursday after investors and traders questioned the possibility of continued aggression by the Federal Reserve following the release of the jobless claims data. The number of Americans submitting new claims for unemployment benefits grew marginally last week, marking the eighth straight week of flat or higher continuing jobless claims, the longest trend since the 2009 financial crisis.

The SPDR S&P 500 ETF Trust SPY closed 0.78% higher on Thursday while the Vanguard Total Bond Market Index Fund ETF BND ended 0.28% lower.

Bearishness: Cramer believes that bearish economic commentary from bank executives, misconceptions about food prices that have actually come down, and a labor shortage that is steadily resolving have led Wall Street into believing a recession is coming.

“Basically, the [Federal Reserve] doesn’t have to bring the pain if we inflict the pain on ourselves, and I think that’s exactly what we’re doing,” he said according to the report.

Read Next: EXCLUSIVE: Crypto Contagion Infects Fintech — But It’s Apples And Oranges, Symbiont CEO Says

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.