[ad_1]

Nexo, the crypto lending platform, announced Monday that it is pulling out of the US market. It blamed the hostile US regulatory environment for the move, following a collapse in longtime talks with lawmakers.

Our decision comes after more than 18 months of good-faith dialogue with US state and federal regulators which has come to a dead end

Nexo said in its statement

Of course, the crypto lending industry has been decimated like the toilet paper aisle of the supermarket during the first COVID lockdown in 2020 – there really is not much left. Nexo is one of the last remaining major lenders, following the bankruptcy of a host of other firms, including Celsius (deep dive here), Voyager Digital and, as of last week, BlockFi (who got caught up in the FTX crash).

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

Whether unfair or not, the question is only natural – is Nexo safe?

Nexo suffering from hit to crypto legitimacy

As we all know by now, there is an $8 billion hole on the FTX balance sheet. Given its vital role at the centre of the crypto ecosystem – it was one of the big three exchanges – the dominoes have been falling.

Major US broker Genesis has halted withdrawals in a last-ditch effort to avoid bankruptcy. Customers of Gemini, the exchange headed by the Winklevoss twins that offers 8% on crypto lending through its Earn programme, reportedly have $900 million of assets tied up in Genesis. BlockFi, a (former) rival lender of Nexo’s, filed for bankruptcy last week.

And yet despite all this contagion, I wrote last week that the starkest problem arising out of all this is the dent to crypto’s reputation. This piece is an extension of that – we are now forced to look at every single firm in the industry and ask whether their business is safe.

For the honest firms in the space, that is a real shame. On the flipside, it makes perfect sense. Sam Bankman-Fried was the golden boy and FTX were exchange royalty – if they can spiral to zero in a web of reckless risk management, lies and deception, then what is to say any other firm cannot?

As Luna went down, I warned people off all these crypto lending services until the dust settles, for the reason that there was a complete lack of transparency. In the case of the below, Celsius and Voyager Digital soon filed for bankruptcy, with customers having no clue about what was going on behind the scenes. This time around, I’m not saying that will happen, but the eventuality needs to be assessed.

Where does Nexo’s yield come from?

It’s the most simple question around, but it’s also the most important.

The yield offered on stablecoins right now is a baseline 8%, with boosts up to 12% available if customers hold certain amounts of the Nexo token, the native coin of the platform. This contrasts to a risk-free yield of 4% on US Treasury bills, and basement-level rates in DeFi, which have come down to 1%-1.5%.

According to Nexo, the excess yield on top of the risk-free rate comes from lending out customer assets at above-market rates. Again looking at stablecoins as a proxy, the APR charged for borrowing ranges from 0% (if the customer holds a sufficient amount of the Nexo tokens and meets other requirements) to a maximum of 13.9%.

I’ll discuss this in more detail below, but the ins and outs of the average APY charged, which customers pay what, the total collateral held, the counterparties on the book and other financial metrics have not been revealed.

Who runs Nexo?

Nexo has come through the many crashes and meltdowns unscathed thus far.

I interviewed co-founder Antoni Trenchev last April, before the death spiral of Luna, and when all was well in the world of crypto lending. I was impressed by two things. The first was that the unsatiable thirst for yield was not there, unlike other platforms.

Trenchev maintained that “we won’t offer products where we can’t compete with DeFi rates”, as opposed to other firms who did exactly that and took reckless bets in order to juice the yield.

The second thing that impressed me was his staunch stance on overcollatersation:

The reason Nexo has stood the test of time in the volatile crypto market is our no-exceptions overcollateralized lending model. We don’t lend out funds without collateral even to our largest and most trusted partners. As such, we do not have any plans on changing this approach in the near future.

Nexo co-founder Antoni Trenchev

Then again, the detractors will argue that CEOs of many other firms talked a strong game, too. Former Celsius CEO Alex Mashinsky springs to mind, now reviled in the space but who was assuring everyone that funds in Celsius were safe right up until the company filed for bankruptcy.

Outwardly at least, a lot of these firms had similar business models to Nexo, too. Again, it comes back to the point above – reputation. Nexo is being tarnished by being in the crypto space, because now nobody is sure who is good for it, given so many others have misled previously.

And that brings us to the problem: nobody knows.

Transparency

I wrote above about where the yield comes from. Nexo do a hell of a lot more than most other firms in revealing where their yield comes from (evidenced by this thread here). Yet despite this, the word “transparent” simply cannot be used to describe what is happening here.

The below snapshot from their real audit says total assets exceed 100% of customer liabilities, which currently sit at $2.5 billion. But that is all that is given. It is impossible to take any sort of comfort in this statement.

There are no addresses given. There are no counterparties shown. Nor is it revealed what interest rates are being charged on respective loans. It just says assets total in excess of 100%. That could be 1000%, that could be 100,0001%. It is quite redundant, really.

A perfect example of this is what happened in the wake of the FTX crash. Nexo did everything right here, withdrawing hours before FTX crumbled. On-chain data shows that they were the largest entity to withdraw ETH, pulling $219 million from FTX at the 11th hour.

That $219 million is 9% of customer liabilities. Again, we have no idea how big the equity cushion is on Nexo’s balance sheet, beyond taking them for their word that assets are “in excess” of liabilities. But what if the equity cushion was less than 9%? This is also ETH alone, it is not clear if more funds were present.

It’s heresay. As I said, assets could be 10 times what liabilities are. But then again, they could not. Nexo could have been within a hair of totally collapsing. The reality is that nobody knows, it’s all speculation. Just like nobody knew for Celsius, BlockFi and all the others.

Market environment

What we do know is that DeFi yields have fallen to 1% in most places. On the other hand, the Federal Reserve has hiked rates like there is no tomorrow, currently sitting at 4% and expected to rise up closer to 5%.

These are the two most important benchmarks for anyone considering using Nexo as a “bank”. The first is that with the DeFi rate so low, it is harder to generate yield in excess of the 8% which Nexo pays out. The topline rate is 13.9%, but again, we don’t know how many customers pay this – there is also a rate of 0% advertised.

For the large institutional clients, there is likely OTC granularity here, too, and it is anyone’s guess what the breakdown in funds is. But for those who are wondering how Nexo’s rates have persisted while DeFi rates have cratered, this is a very fair question, to which I am not sure what the answer is.

But the most important question of all is this: if the risk-free yield is 4%, and soon to be 5%, then is holding your wealth in a platform like Nexo worth the 8%? Is the incremental 3%/4% worth the risks inherent above?

That question can’t be answered by anyone but each investor, of course. But it’s the question that every investor is obliged to ask themselves.

Native token

There is another wrinkle here. I have never really understood the benefit of platforms such as these having a native token.

The criticism of FTX’s token, FTT, is obviously damning: they were using it as collateral for loans, which given the sparse liquidity was never going to end well. Nexo insists that it does not do this. But again – and yes, I’m sick of saying this as well – there is no way to verify what is being given as collateral.

Overcollateralisation is great – but in looking at the wider environment, I wonder what the overcollatersation cushion is. There are countless parties in the space over the last year who instilled overcollaterisation rules and still fell by the wayside.

In an industry like crypto where assets print volatility numbers on a different planet to what would be conventionally accepted as collateral, that cushion better be fat. And maybe it is. But right now, there is no way to verify that.

The Nexo token allows users to recoup higher rewards. It can boost earnings up to 12% on stablecoins, and it is also how one can avail of borrowing at 0%. Despite this, Nexo have said it cannot be used as collateral, so the ins and outs are hard to ascertain. As said previously, certain large loans on Nexo are likely on an OTC basis, so it’s impossible to know.

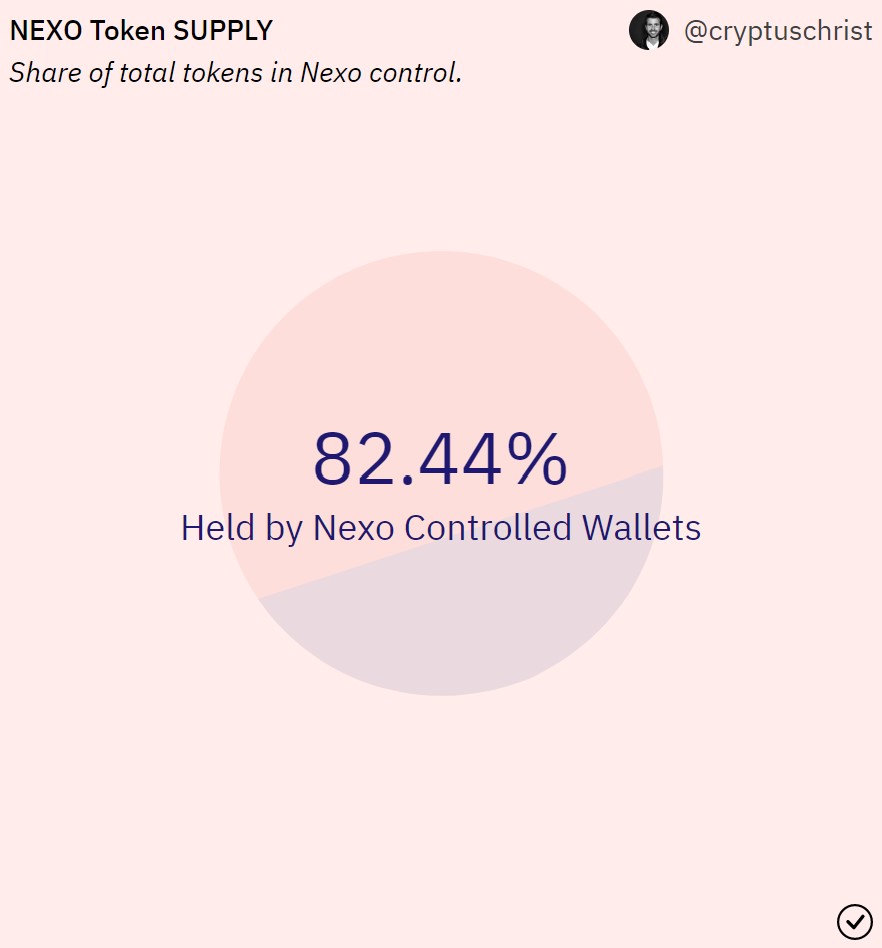

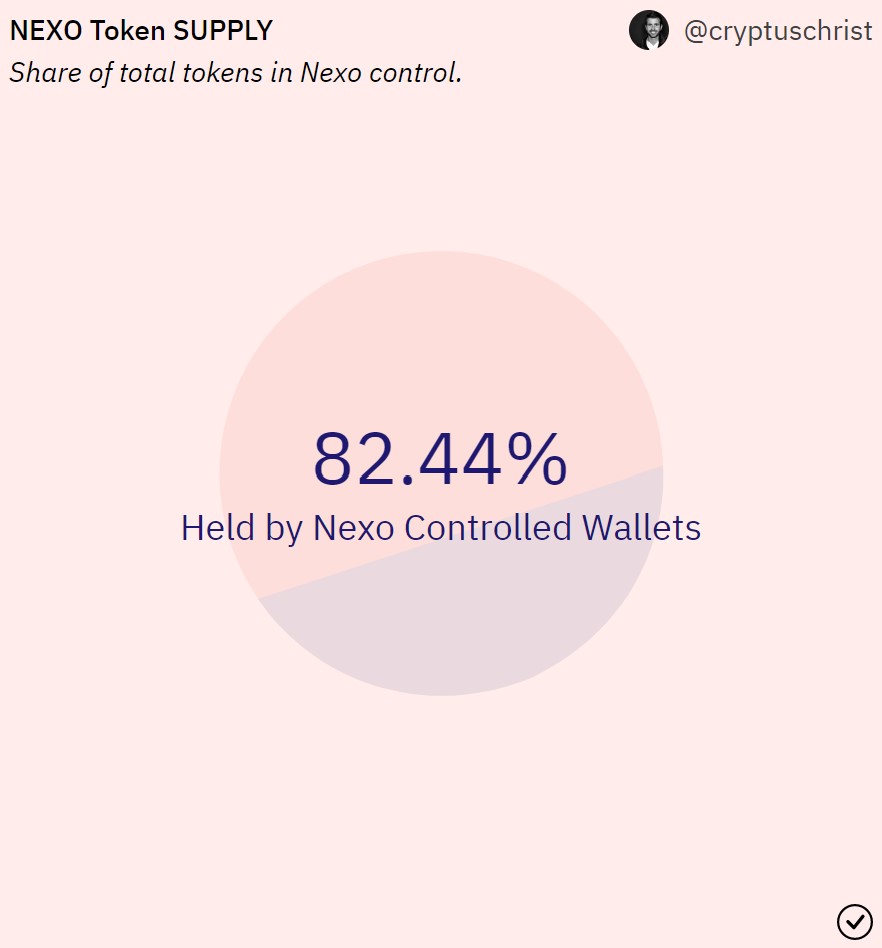

The vast majority of the Nexo token (80%+) is held on Nexo. This is a point that a lot of criticised, but to me it makes perfect sense, given the incentives customers have to hold it there. There is also minimal utility for Nexo outside of the platform, so would else would you expect?

But this is not an FTX situation, to be clear – the Treasury have confirmed that they hold only minimal amounts of the Nexo token. Which, if true, is comforting.

But I don’t really see the point of the Nexo token, as the lending model could work perfectly fine without a native token. The juiced yield and cheap borrowing rate that it also facilitates muddies the water.

However, as long as Nexo are not using it as collateral (which they claim they are not) then this should be fine, but it is something to monitor for investors.

Risk-reward ratio

All this really comes down to whether the ambiguity and lack of transparency here is worth the incremental yield that investors are gathering.

For Nexo, however, recent months have been absolutely crushing, despite it surviving to this point. They could well be healthy for all we know, yet they still have to be subject to pieces such as this examining their health.

But if there is nothing here to hide, then it should not be a problem. Increased transparency is something they have said they will move towards, so hopefully that is what we see. Looking at their audits, customer liabilities have fallen from $3.3 billion pre-FTX to where it currently sits at $2.52 billion, so there are evidently some customers who have decided the risk-reward is no longer there for them.

Then there is the matter of their announcement this week: a pulling out of the US market. While the timing is disconcerting, coming off the back of the FTX saga, the result is even worse for Nexo’s prospects as a company.

Raising a white flag to operating in the financial capital of the world is a heavy blow to the business, and I was surprised to see the native token not wick downward, given it should be correlated to the prospects of the business as a whole.

Final thoughts

Needless to say, if any of the above does not make perfect sense, then investors are best placed taking cover and avoiding Nexo or other platforms. That is true for any investment.

My opinion is not relevant, but for my portfolio, the risk/reward ratio is too far skewed. Right now, with the lack of verifiable information and the fragility of the market, it’s a negative asymmetric bet for me, with an upside of 3% yield and a downside of -100%. That is not +EV to me, a simple approach I like to take when assessing anything in my portfolio.

Until more transparency is provided around the role of the Nexo token, the counterparties, the amount of assets (numbers, not just “in excess of liabilities”), the APY charged on loans and the collaterisation ratio required, I will sit on the sidelines.

Of course, I’ve been wrong many times before, and I’ll be wrong again. A lot. And everybody’s portfolio is different.

But whatever you decide, be careful, people. Because Gordon Gecko was wrong when he said “greed is good”.

[ad_2]

Image and article originally from invezz.com. Read the original article here.