Bitcoin (BTC/USD) remains lodged near $20,000, a price level it has traded at or around for most of the past several months. But is the cryptocurrency showing signs of finally decoupling from US stocks?

HC Wainwright, a leading investment banking provider and equity research firm, notes that trading patterns suggest this could be the case.

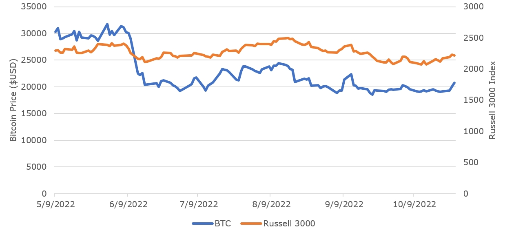

In particular, the company observes that Bitcoin depicted a close correlation to equities prior to the collapse of Terra (LUNA) and TerraUSD (UST) in May. After that, the benchmark cryptocurrency’s correlation to the stocks has decreased.

Bitcoin and Russell 3000 showing less correlation since LUNA break

Kevin Dede, CFA, the Managing Director of Equity Research at HC Wainwright, says Bitcoin has shown “atypical price stability,” pointing to the cryptocurrency’s trading action before and after the Terra collapse.

The distinct “patterns” and the static nature that’s characterised bitcoin price movement in the year contrasts with the norm – that BTC has traded in tandem with other volatile financial markets. (Here is a deep dive into the Bitcoin-stocks correlation over the years)

Writing in an update dubbed “Bitcoin Is Alive Well, Here and Abroad—Our Crypto Musings Post BTC 2022, Amsterdam” published Wednesday 2 November 2022, Dede noted:

“In looking at bitcoin and its relationship to other risk-on assets, primarily equities of all sizes and scope, we ran two correlation studies between bitcoin and the Russell 3000 index—a market cap weighted index tracking the performance of 3,000 of the largest U.S. equities—one pre and one post the UST-LUNA crash. Prior to the algorithmic break, bitcoin and equities daily trading action was almost perfectly correlated with a coefficient of 0.89 on 588 data pairs with the analysis shown in a p value in the 0.00001 range, where anything less than 0.05 validates the correlation.”

While the trading action for bitcoin and Russell 3000 showed there’s still some correlation, Dede says the coefficient has dropped from 0.89 to around 0.50. Bitcoin is thus showing less correlation to traditional risk-on assets now as compared to before the Terra breakdown.

Although less correlated over the last few months, HC Wainwright suggests, exogenous factors like inflation and interest rates, could still play a role in whether the decoupling widens further. Bitcoin could begin to enjoy more favour as an inflation hedge, or run wild alongside other risk-on assets if the Fed flips its monetary policy.

[ad_2]

Image and article originally from invezz.com. Read the original article here.