[ad_1]

by mark000

Looking very likely…

Default insurance (CDS) on Credit Suisse is approaching same level as during the collapse of Lehman Brothers… $CS pic.twitter.com/nbHKYcuwxx

— Wall Street Silver (@WallStreetSilv) September 25, 2022

What just happened to dollar ? pic.twitter.com/PiMnoDn2CA

— Michael J. Kramer (@MichaelMOTTCM) September 26, 2022

“Once inflation is above 5% in advanced economies, it takes on average 10 years to drop to 2%” – BofA pic.twitter.com/L2ngztKJup

— Sam Ro 📈 (@SamRo) September 26, 2022

What’s worse: the US is in a recession or GDP is negative at maximum employment

— zerohedge (@zerohedge) September 25, 2022

‘If the bond market does not function, then no other market functions, really,’ say Ben Emons of Medley Global Advisors

Global government-bond markets are stuck in what BofA Securities analysts are calling one of the greatest bear markets ever and this is in turn threatening the ease with which investors will be able to exit from the world’s most-crowded trades, if needed.Those trades include positions in the dollar, U.S. technology companies and private equity, said BofA strategists Michael Hartnett, Elyas Galou, and Myung-Jee Jung. Bonds are generally regarded as one of the most liquid asset classes available to investors. If liquidity dries up in that market, it’s bad news for just about every other form of investment, other analysts said.Financial markets have yet to price in the worst-case outcomes for inflation, interest rates, and the economy around the world, despite tumbling global equities along with a selloff of bonds in the U.S. and the U.K. On Friday, the Dow industrials sank almost 500 points and flirted with a fall into bear-market territory, while the S&P 500 index stopped short of ending the New York session below its June closing low.

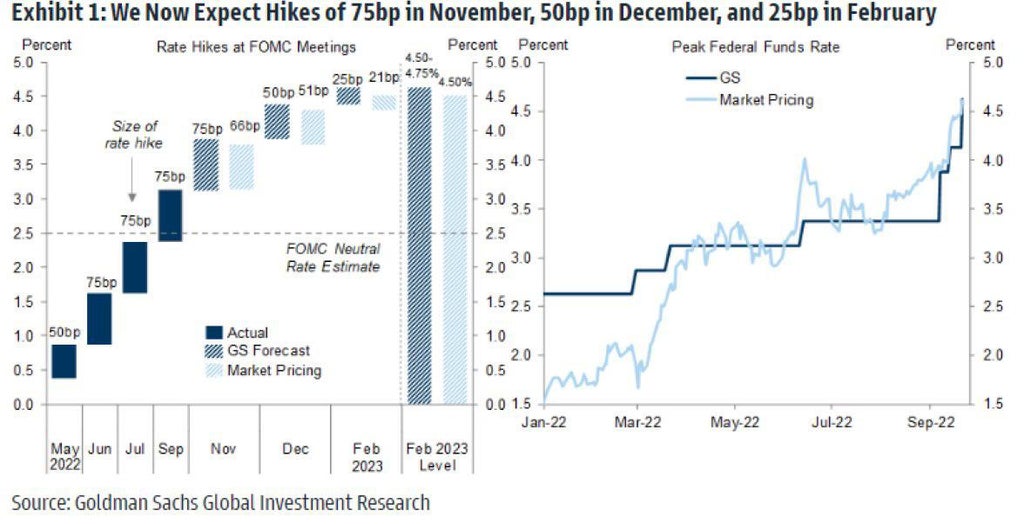

GS now predicting another 75 bps hike by Fed in early November… 50 bps in December… and 25 bps in February…bringing Feds funds rate to 4.75%… this is a higher rate outlook than priced in by the market… Fed raising rates hard into a recession and a rapidly weakening housing market… fasten seatbelts…

Snider: Rapid dollar tightening continues to wreck currencies and economies around the world.

EMEs are facing a rapid tightening of external financial conditions, capital outflows, currency depreciations and reserve losses simultaneously

This Bad.

Dr. Doom predicted the 2008 recession, and says a ‘long and ugly recession’ is coming this year

#SPX, weekly

2008 vs 2022

Even the weekly TSI is showing the SAME pattern.

So, if 2022 is to continue mimicking the 2008 analog, the market might actually make a new low next week and then stage another multi-week rally, which will eventually fail. pic.twitter.com/cQzjwQNjPw

— Yuriy Matso (@yuriymatso) September 24, 2022

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.