[ad_1]

US inflation has risen rapidly amid pandemic-related lockdowns, supply chain difficulties, and speculation. This jump should ease out gradually as these disruptions diminish over time.

Nevertheless, this reduced inflation may still be too high to shield those consumers who have been adversely affected by coronavirus-inspired economic disruptions.

Pre-Pandemic Inflation

Before COVID-19, in 2019, inflation held steady at around 2%. Though the consumer showed signs of weakness, the US Federal Reserve offset inflation’s negative impacts through monetary stimulus.

The consumer weakness manifested itself in the strong price growth of essential items relative to their discretionary counterparts. In the five years ending December 2019, prices for such staples as food, rent, and medical care, for example, tended to rise faster than those for luxury items like clothing, recreation, and autos.

Monetary policy contributed to rising housing costs by increasing the ownership concentration of housing assets. This, in turn, weakened the consumer’s purchasing power: As the costs of essentials rose, it left less for discretionary items.

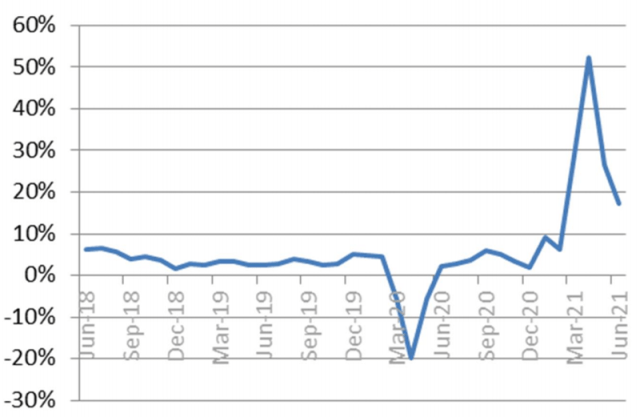

US Consumer Price Index (CPI), 12-Month Percentage Change

Inflation’s COVID-19-Fueled Rise

Inflation jumped across all categories amid the pandemic. Supply chain disruptions and the lockdown effect were the initial culprits, but as the various waves of infections burned out, pent-up demand, strains on production and distribution, and higher, speculation-driven commodity prices pushed inflation ever upward.

US Inflation Pre-and Post COVID-19

| Dec. 2019 (YoY) | Five-Year Cumulative to Dec. 2019 |

Dec. 2020 (YoY) | Jan. 2020 to July 2021 | |

| Headline Inflation | 2.3% | 9% | 1.3% | 5.4% |

| Essentials | ||||

| Food and Beverage | 1.7% | 6% | 3.9% | 6.6% |

| Rent of Primary Residence | 3.7% | 20% | 2.3% | 3.6% |

| Medical Care | 4.6% | 16% | 1.8% | 2.7% |

| Discretionary | ||||

| Apparel | -1.2% | -3% | -4.1% | -0.7 |

| Recreation | 1.5% | 5% | 0.9% | 3.3% |

| New Cars | 0.1% | 0% | 1.9% | 7.4% |

| Used Cars | -0.7% | -5% | 10% | 42.1% |

| Household Furnishings | 1% | 1% | 3.2% | 5.4% |

Source: US Bureau of Labor Statistics

Gradual Normalization?

Currently the US headline inflation rate has risen to 5.3% year over year. Inflation should fall back toward its long-term average of 2% as excess demand eases, the distribution network adapts to the new normal, and ongoing consumer weakness exerts its influence on prices.

After all, pent-up demand is temporary by nature. As the economy reopens, lockdowns end, and the need for work-from-home (WFH)-related items falls as workers return to the office or settle into their remote arrangements, it will alleviate the upward pressure on inflation.

In fact, data suggests consumer demand growth may have already peaked. Retail sales growth looks to have summitted in April 2021. After spiking in mid-2020, auto sales growth seems to have normalized as well.

Retail and Food Service Sales (YoY)

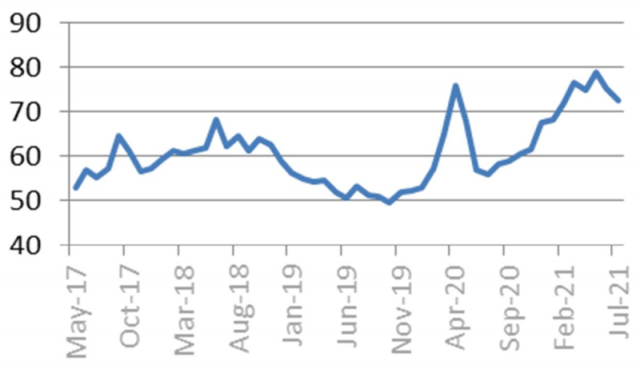

Supply chains are also becoming fully functional again. Such ISM Manufacturing PMI sub-indices as supplier delivery time and order backlog appear to have reached their high-water mark as raw material inventory has bottomed out. Thus, the stress on supply chains is decreasing.

Moreover, since the consumer on the whole has not emerged from the pandemic financially stronger, consumer demand should stay weak. That should constitute an additional drag on inflation.

Supplier Deliveries, Slowness (Indexes)

Based on these factors, we can expect the surge in US inflation to subside.

Similar trends are playing out elsewhere, in Canada, Germany, the United Kingdom, and Japan, for example. A sudden surge in COVID-19-related inflation is now moderating and returning back to the long-term trend line in most categories. There are exceptions, to be sure, notably oil and housing in some markets, as a result of easy monetary policies and speculation.

The Inflation Outlook

In sum, consumer demand and low interest rates will continue to be the primary inflation drivers. Ongoing consumer weakness should push inflation lower and necessitate further Fed support. The influence of other, event-specific inflation drivers will likely diminish as economies adjust to the new reality.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / RBFried

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.