[ad_1]

Inflation is perhaps the least understood phenomenon in all of economics. Once thought to be driven strictly by monetary factors, inflation today is seen as much more nuanced and complicated. Indeed, there is considerable debate as to its root causes and even how to appropriately measure it.

For the better part of a generation, economists were primarily concerned with inflation being too low, while the public at large had little interest one way or another. That has all changed in recent months, however; US voters now rank inflation as their top economic concern.

So, what happened, and what’s the outlook going forward?

In March, the personal consumption and expenditures (PCE) index registered an astonishing 6.59% year-over-year (YoY) increase. The less volatile Core PCE index rose 5.18%, just below the 40-year high set the previous month. The surge in inflation has raised the possibility of structurally higher prices and of inflation expectations becoming “unanchored,” even if their role in controlling the price level is far from settled.

To understand the current inflation outlook, we first need to assess how different parts of the economy are contributing and how that affects the risks going forward. To untangle this riddle, I examined the more than 200 categories of goods and services included in the Core PCE index to determine whether inflation is broadly distributed or confined to select categories that are exerting an outsized influence. The methodology is loosely based on research from the Federal Reserve Bank of San Francisco.

Methodology

To begin, I classified each category of goods and services based on its current inflation rate relative to what it was before the COVID-19 pandemic. To do that, I ran the following regression for the period from January 2010 through March 2022:

Πi,t = αi + βiDi,t +Ei,t

Where:

Πi,t = the YoY log-change in the price index for category “i” in month “t”

αi = regression intercept

Di,t = a dummy variable that takes a value of 1 at the start of the COVID-19 pandemic in February 2020 and 0 otherwise

βi = regression coefficient for dummy variable

Ei,t = regression error term

The regression intercept, αi, represents the average pre-pandemic inflation rate from January 2010 through January 2020. The coefficient βi is the differential intercept term and indicates the change in inflation during the pandemic period. If βi is positive and statistically significant, inflation for category i is higher today than before the pandemic and is thus classified as Above Trend. Conversely, if βi is negative and statistically significant, then inflation for category i is lower today than it was prior to COVID-19 and is thus Below Trend. Finally, if βi is not statistically significant, then there is no detectable difference between the two periods for category i, so it is At Trend.

Inflation Deep Dive

The table below summarizes the number of categories in each group and each group’s corresponding weight in the Core PCE calculation:

| Group | No. of Categories | Weight in Core PCE Index |

| Above Trend | 99 | 54.73% |

| At Trend | 78 | 32.46% |

| Below Trend | 32 | 12.80% |

The Above Trend group consists of 99 separate Goods and Services and accounts for ~55% of the weight of the Core PCE index. So, over half of all spending is currently running Above Trend, which puts substantial pressure on consumers’ wallets. In contrast, only 32 categories — just ~13% of spending — are below their pre-pandemic trend, which hasn’t been enough to offset rising prices elsewhere in the economy.

Finally, 78 categories are currently classified as At Trend, with inflation in line with what it was before the pandemic. At only 32% of spending, At Trend categories haven’t been able to rein in the upward movement in the general price level.

Goods or Services?

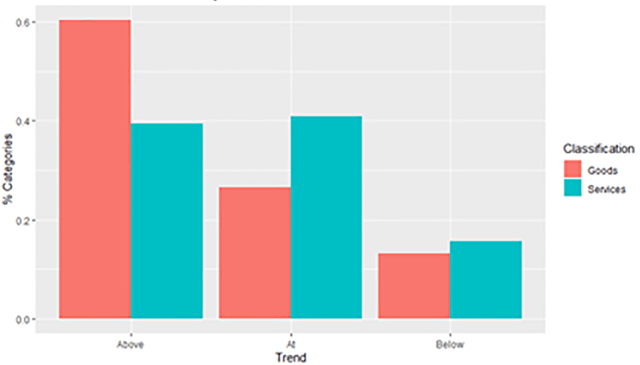

Core PCE can be broadly decomposed into 65 Goods and 144 Service categories. So, are Goods or Services contributing more to inflation? To find out, I broke down the trend groups by classification.

The plot below visualizes the percentage of all Goods and Services categories within each of the three trend buckets. Approximately 60% of all Goods and 40% of all Services are currently running at Above Trend inflation. The At Trend group is dominated by Services, while its Below Trend counterpart is evenly split.

Percentage of Goods and Services by Trend

Taken together, these figures imply that Goods account for much of the recent acceleration in inflation. There are potential upside risks if the At Trend Services categories inflect higher. A key determinant for keeping Services prices anchored will be a sustained recovery in the labor force in such service-related sectors as housing, transportation, food service, and child care, among others.

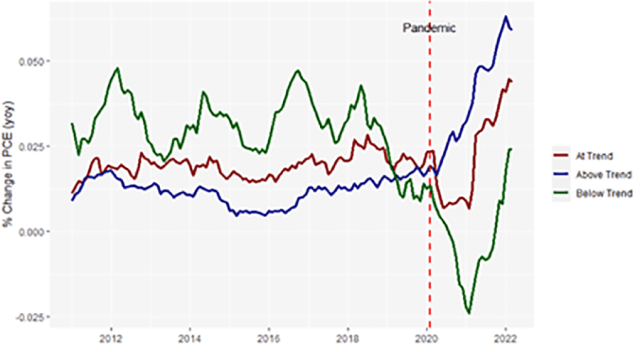

To understand where inflation may be headed, I reconstructed price indices for the Above Trend, At Trend, and Below Trend groupings. Even though 99 categories are Above Trend, the pace of acceleration may be cooling or rolling over. This would indicate some near-term abatement in headline numbers. Conversely, Below Trend figures could be inflecting higher and moving from a net negative to a net positive contribution. This would indicate that headline figures may deteriorate further.

The following chart depicts the percentage YoY change in PCE for each of the price indices. The results show broad acceleration across classifications. The Above Trend group started to climb higher at the onset of the pandemic and is currently clocking a ~5.90% YoY change. The Above Trend categories, by contrast, showed the most subdued inflation in the pre-COVID-19 period, at ~1% YoY for almost 10 years. This rapid spike may indicate significant damage to the supply chains of the underlying Goods.

PCE Inflation by Classification

The At Trend group experienced a steep decline at the pandemic’s outset and stayed low for most of 2020 but has surged back in 2021 and 2022. The 4.4% change in February is much higher than the changes the index experienced prior to COVID-19, which were in the 1% to 2.50% range. Indeed, the limited sample size may be all that’s keeping these At Trend. This could mean that At Trend Services categories may see higher inflation.

The Below Trend group’s trajectory may be the most intriguing of all three. Before the pandemic, Below Trend recorded higher inflation than At Trend or Above Trend, with a pre-pandemic range of roughly 2% to 4% amid considerably more volatility. At the onset of COVID-19, inflation declined precipitously in Below Trend and spent most of 2020 and part of 2021 in negative territory. Outright deflation in the Below Trend group helped keep the lid on inflation across the broader economy, at least for a while. But now the lid may have come off.

Of the three classes, Below Trend has experienced the most dramatic snapback, from –2.4% in February 2021 to 2.4% one year later. Yet it remains below the top end of its pre-pandemic range. This suggests near-term upside risk as Below Trend categories continue to recover.

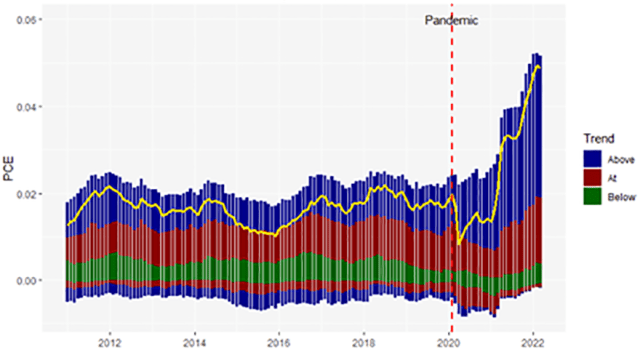

So, how will these trends influence headline Core PCE? The following chart plots the cumulative contribution of each of the three buckets to Core PCE: The dark blue section represents the Above Trend contribution post-pandemic, the dark red section the At Trend contribution, and the dark green section the Below Trend contribution. The headline Core PCE is overlaid in gold.

Contributions to Core PCE by Classification

The bucket classifications and their color schemes are based on post-pandemic results. A category running Above Trend today does not mean that its pre-pandemic contribution to Core PCE was necessarily positive. Indeed, many categories running Above Trend today were actually net detractors for most of the 2010s, which is indicated by the dark blue subzero region from 2011 to 2020. Today, some At Trend categories are still pulling inflation down, though there are fewer and fewer of them.

As of March, the Above Trend categories are contributing ~3.25% to Core PCE, At Trend is contributing 1.42%, and Below Trend ~0.30%. As expected, very few categories are now acting to offset inflation.

What’s Next?

Together, this data provides a developed and granular picture of where inflation is running hot and how the underlying trends are developing. They indicate that across almost all categories, inflation is positive and accelerating. The key near-term risk appears to be At Trend categories flipping to Above Trend in the coming months as the sample size broadens and the underlying pattern reveals itself.

On balance, this indicates that Core PCE is likely to remain high over the next few months. That will have significant implications for the direction of monetary policy.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Jeffrey Coolidge

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.