[ad_1]

Source: www.bls.gov/news.release/cpi.nr0.htm

Good afternoon, as the title of the post states, approximately 2/3 of consumer spending goes into services and as we will see below, inflation is still running rampant! Things like housing, healthcare, insurance, education, streaming services (for example HBO Max just raised their prices today effective immediately), etc. are all still on the rise.

CPI for services: jumped 0.6% month-to-month and 7.5% year-over-year:

fred.stlouisfed.org/series/CUSR0000SAS

Digging into housing and food deeper:

“Rent of primary residence” (accounts for 7.5% of total CPI) spiked by 0.8% month-to-month and by 8.3% year-over-year, the highest since 1982. It tracks actual rents paid:

fred.stlouisfed.org/series/CUUR0000SEHA

“Owner’s equivalent rent of residences” (what folks who own homes believe they can get in rent and accounts for 24.2% of total CPI) jumped by 0.8% month-to-month and by 7.5% year-over-year, the highest it has ever been in the data:

fred.stlouisfed.org/series/CUSR0000SEHC#0

“Food away from home” (think restaurants) jumped .4% for the month-to-month and 8.3% year-over-year:

fred.stlouisfed.org/series/CUUR0000SEFV#0

CPI for “food at home” (food from grocery stores): up .2% month-to-month and 11.8% year-over-year–the 10th month in a row of DOUBLE DIGIT year-over-year increases:

fred.stlouisfed.org/series/CUSR0000SAF11#0

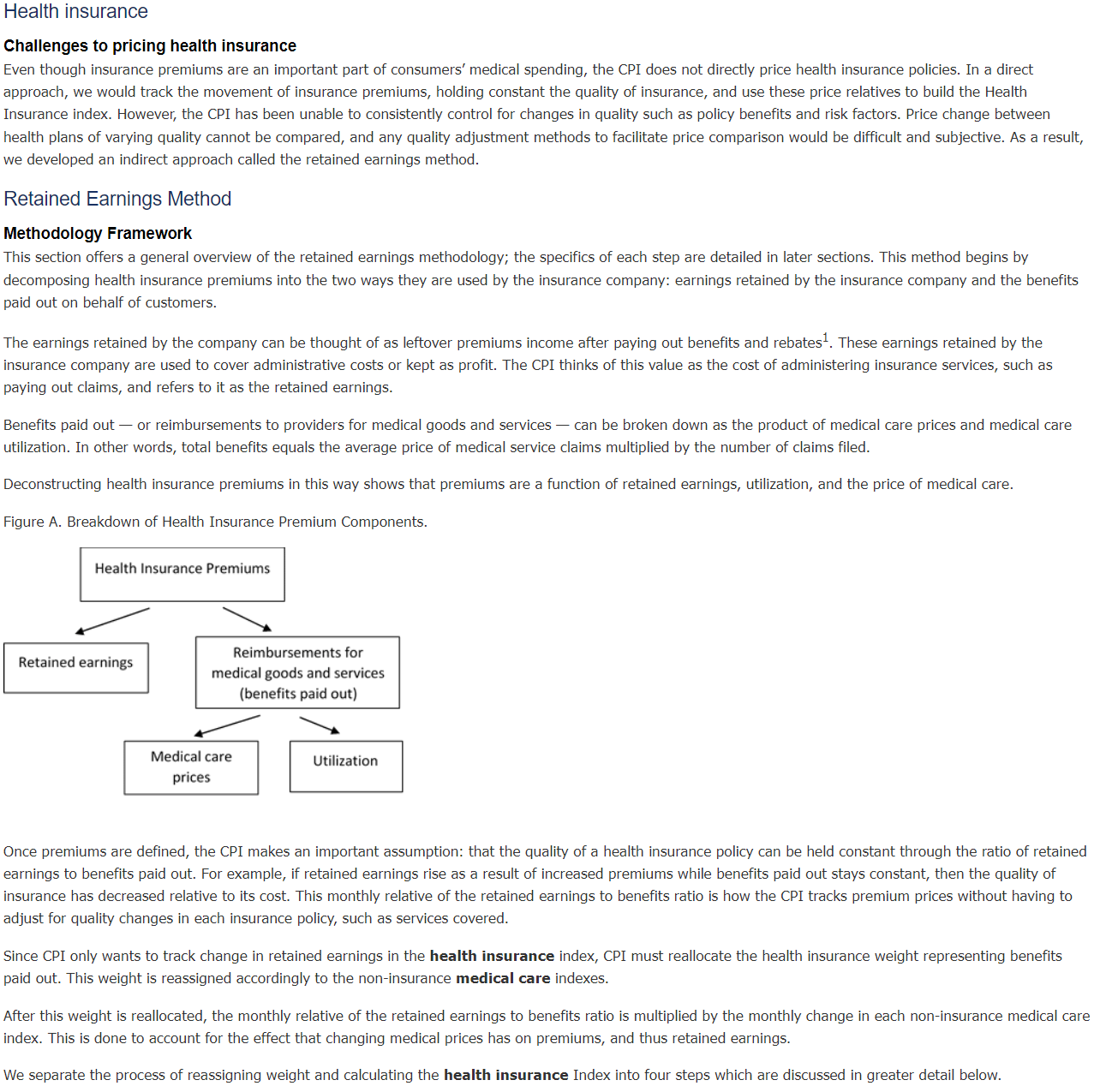

Due to this ‘adjustment’, CPI for health insurance ‘dropped’ by 3.4% month-to-month, with these adjustments reducing the year-over-year rate of health insurance CPI from 28% in September to 7.9% in December….

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.