Article content

(Bloomberg) —

[ad_1]

The pound just can’t catch a break as the UK’s bleak economic outlook eclipses any benefit the currency stands to receive from rapidly rising interest rates.

Author of the article:

Bloomberg News

Alice Gledhill and Libby Cherry

Publishing date:

Aug 20, 2022 • 30 minutes ago • 4 minute read • Join the conversation

(Bloomberg) —

This advertisement has not loaded yet, but your article continues below.

The pound just can’t catch a break as the UK’s bleak economic outlook eclipses any benefit the currency stands to receive from rapidly rising interest rates.

Another record inflation readout this week spurred money-market traders to bet the Bank of England will more than double its key rate to 3.75% by March from 1.75% currently.

Rather than buy sterling though, investors sold it, while options traders stayed resolutely bearish on the currency versus the US dollar. They also piled into hedges against higher consumer prices, betting the worst is still to come.

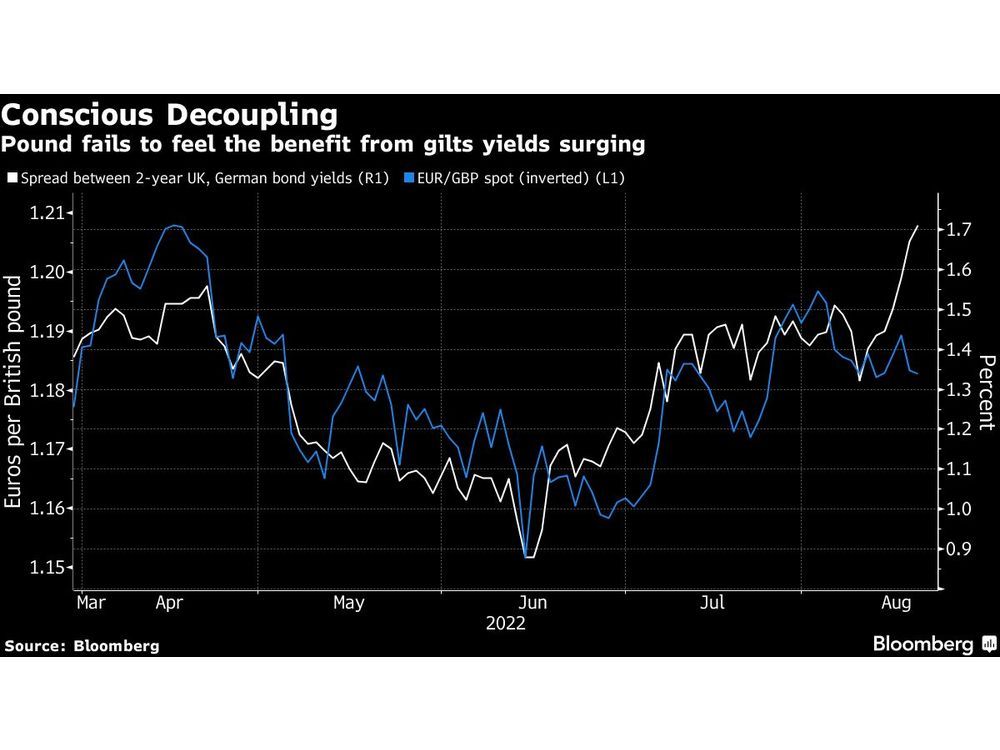

In theory, raising rates should act as a tailwind for currencies and a headwind for bonds. But in the UK the poor growth outlook, price pressures and uncertainty over the path of policy under a new leader are denting demand for the pound and bonds at the same time. Sterling has dropped against both the euro and the dollar so far this month, even as the rise in UK bond yields outstrips other markets.

This advertisement has not loaded yet, but your article continues below.

“If this trend persists then it could be truly alarming,” said Mike Riddell, portfolio manager at Allianz Global Investors. Global investors probably “don’t like the UK’s double-digit inflation combined with the inflammatory prospect of the likely next prime minister throwing fiscal stimulus on top,” he said.

It’s a dynamic that Adam Cole, currency strategist at RBC Capital Markets, has also spotted. This kind of breakdown in the correlation between currency and yield shifts is typically associated with emerging-market currencies, suggesting investors are questioning the credibility of UK policy, he said.

Cable was trading around $1.18 on Friday, on track for its worst weekly performance since September 2020. The fear-greed indicator, a gauge of momentum that compares buying to selling strength, implies sellers are now controlling prices once again. The UK currency has also dropped to its lowest level against the euro in almost a month.

This advertisement has not loaded yet, but your article continues below.

Read more: Sterling Bearish Boxes All Ticked: It Won’t Get Any Better Soon

Part of the issue is that the UK’s cost of living crisis may restrict the extent to which the BOE can hike despite soaring inflation. Protests and strikes are already widespread as workers push for higher wages.

One-year inflation swaps, which indicate traders’ bets on the level of the retail price index over the next year, surged past 11.5% after jumping 295 basis points since Tuesday’s close, prior to July’s inflation print. Trading volumes also jumped: one and two-year gross notional volumes were about six and nine times higher than usual, respectively, according to data compiled by Barclays Plc.

Data published Friday showed UK consumer confidence fell to the lowest since records started with a recession akin to the early 1990s looming. Meanwhile, government borrowing came in higher than forecast in the first four months of the fiscal year after debt costs soared, raising questions about tax cuts being promised by the two prime ministerial candidates.

This advertisement has not loaded yet, but your article continues below.

UK Tory Leadership Rivals Attacked Over Unfunded Tax Cuts

Not Enough

Such elevated price pressures also mean the UK’s real policy rates may stay negative, according to Bank of America strategists.

Their calculations, based on market pricing and their own inflation forecasts, showed the UK will have the most deeply negative real terminal rate of all the G-10 countries. The euro area is in a similar position.

“The ECB and the BOE have the most negative real rates and may have to do more, but it is not a given that they will,” the BofA strategists wrote. “In practice, we think the ECB and the BOE may not do enough, which would be negative for their currencies.” They recommend buying euro-sterling volatility.

Over the longer-term, some analysts are also beginning to re-think the currency’s valuation in light of the UK’s large deficits. RBC sees it “quite likely” that the UK’s current-account deficit will stabilize at around 6-7% of GDP.

This advertisement has not loaded yet, but your article continues below.

“The further we look into the future, the more confidence we have that a weaker exchange rate will play a key role in keeping the UK deficits fundable,” RBC’s Cole wrote in a note, as a falling currency boosts the performance of UK equities and reduces the relative price of UK assets.

There are some glimpses of light.

HSBC Bank Plc points to signs that the weakening economic cycle may be starting to exert less upward pressure on prices. The Confederation of British Industry’s measure of expected selling prices dropped to its lowest since September 2021, for example, a good lead indicator for inflation in the past.

Still, the balance of risks remains to the downside for sterling, said Dominic Bunning, HSBC’s senior FX strategist. The bank has a forecast of $1.16 for the first quarter of 2023.

This advertisement has not loaded yet, but your article continues below.

The flight to haven assets such as the dollar has been one of the biggest influences on moves in cable this year, according to HSBC. While the impact of rates has jumped, the outlook remains grim given the stronger economic picture in the US may allow the Fed to hike further than the BOE.

“If the rates story dominates, the dollar will do better,” Bunning said. “But if the risk appetite story dominates, sterling will under-perform anyway.”

Next Week

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.