[ad_1]

It’s January and strategists and economists are busy announcing their forecasts for 2020. Like every year, there’ll be plenty of mainstream predictions telling us everything is going to be just fine. And there’ll be a few that are so outrageous in their optimism or pessimism that they really grab the headlines.

But for investors, being right matters more than grabbing headlines. And being right is much harder than being outrageous.

In my forthcoming book 7 Mistakes Every Investor Makes (And How to Avoid Them), I examine the S&P 500 return forecasts of investment professionals over the last 20 years. In 13 of those years, beginning-of-the-year predictions were off by more than 10 percentage points. Often, they didn’t even correctly call the stock market’s direction.

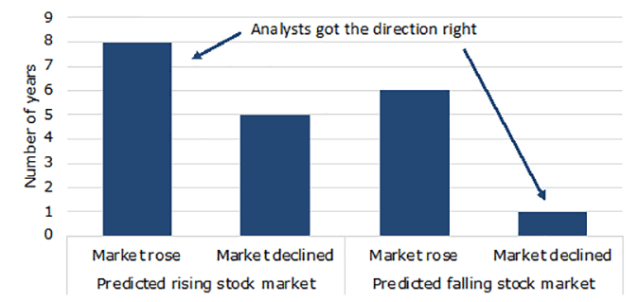

The following chart shows how often the annual consensus prediction anticipated the stock market would rise or fall and which way it actually went over the next 12 months. Only in nine of the 20 years did the consensus get it right.

Consensus Analyst Stock Market Predictions, 2000–2019

And that’s based on the consensus of analyst forecasts. New research by Ritong Qu, Allan Timmermann, and Yinchu Zhu shows that the consensus forecast of individual economists beats even that of the most skilled single economist. So investors should rely on the wisdom of the crowd and follow the expert consensus forecast rather than any individual prediction.

But I guess you knew that already, didn’t you? What you probably didn’t know, because the research was only published in German and hence never made the headlines in the English-speaking press, is that there is a simple way to outperform even the consensus forecast of a crowd of experts.

Oliver Hein and Markus Spiwoks analyzed more than 150,000 stock market, interest rate, and exchange-rate forecasts compiled by the German ZEW Institute between 1995 and 2004. These forecasts sought to predict six international stock markets and the interest rates in these markets, as well as the major exchange rates, for the next three and 12 months.

Here, again, the consensus typically beat almost all individual predictions. But Hein and Spiwoks found that the consensus correlated more with where stock markets and interest rates were at the time of the prediction than the time the prediction aimed to forecast. In a sense, the experts seem to start with the current situation and then try to guess in which direction the markets would move.

Isn’t It Ironic?

The ability of “expert” market forecasters is so poor that investors are better off assuming that nothing will change at all. In fact, predicting that stock markets or interest rates will be right where they are today a year from now not only tends to be more accurate than even the most-skilled individual forecast, but also more accurate than the consensus forecast.

So when it comes to end-of-year forecasts, economists and analysts should avoid making them and investors should avoid listening to them.

Nevertheless, it is January. So where will stock markets and interest rates be at year-end 2020? I’m guessing exactly where they are today. Chances are I’ll be less wrong than all the other expert forecasts, consensus or otherwise.

For more from Joachim Klement, CFA, don’t miss 7 Mistakes Every Investor Makes (And How to Avoid Them) and Risk Profiling and Tolerance, and sign up for his Klement on Investing commentary.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/wildpixel

Professional Learning for CFA Institute Members

Select articles are eligible for Professional Learning (PL) credit. Record credits easily using the CFA Institute Members App, available on iOS and Android.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.