[ad_1]

Economic theory holds that absent monopoly powers and barriers to entry, every firm’s competitive advantage in an industry will diminish and its profits fall to zero over time.

While this is just economic theory, it raises some interesting questions: Does a firm’s competitive advantage tend to endure longer in some sectors than others? And if so, in which industries does competitive advantage tend to have the greatest staying power?

To answer these questions, we examined all initial public offerings (IPOs) on the NYSE and NASDAQ over the past 30 years and tracked how each firm performed following its IPO. We tracked how a particular company’s profitability shifted up to a decade after its IPO by looking at its margins: earnings-before-taxes (EBT), operating, net, and gross.

We calculated how a firm’s margins change over time by measuring the difference between those in a particular year and in the firm’s IPO year. We used the median difference in the industry to represent the sector as a whole.

Though margins and profitability are not perfect proxies for competitive advantage, they do offer a glimpse into how a firm’s standing in its sector shifts and evolves. When a new entrant to an industry has a singular in-demand product driven by unique intellectual property, it will likely generate high profits and margins upon its IPO. As other firms attempt to catch up and replicate or improve upon its product, the new entrant’s margins will decline as its competitive advantage in the sector diminishes.

The first striking takeaway from our analysis is the heterogeneity of firm profitability changes by sector. For instance, the median aerospace and defense industry firm experienced a 0.04 percentage point drop in EBT margin from Year 0, or its IPO year, to Year 9. But the median biotechnology company’s EBT margin fell 2.95 percentage points over the same interval.

Nine Years Post-IPO: What’s Changed?

| EBT Margin | Gross Margin | Net Margin | Operating Margin | |

| Aerospace and Defense | -0.04% | 0.45% | 0.49% | 0.10% |

| Agriculture | -2.07% | -2.60% | -0.69% | -1.75% |

| Apparel Manufacturing | -1.28% | 2.61% | -1.08% | -1.87% |

| Apparel Retail | 2.10% | 1.02% | 1.31% | -1.21% |

| Asset Management | -0.74% | -0.29% | 0.32% | -3.05% |

| Biotechnology | -2.95% | -7.99% | -1.10% | -4.11% |

| Beverages | -0.02% | 5.46% | -1.31% | 1.30% |

| Building Materials | -0.85% | 0.91% | -0.20% | 0.23% |

| Chemicals | 0.36% | 4.13% | 1.88% | 2.32% |

| Communication Equipment | -1.05% | 0.86% | 0.75% | -2.41% |

| Computer Hardware | -7.63% | -2.45% | -1.32% | -8.50% |

| Drug Manufacturers | 0.90% | 6.03% | 1.60% | 1.18% |

| Electronic Components | -1.20% | -0.37% | -0.41% | -3.83% |

| Engineering and Construction | -1.16% | -5.43% | -1.08% | -1.71% |

| Entertainment | 3.40% | 1.19% | 5.87% | 5.87% |

| Farming | -1.80% | -0.83% | -0.90% | -0.17% |

| Information Technology | 0.23% | -3.55% | 2.04% | -1.30% |

| Leisure | -1.74% | -2.49% | -1.34% | -3.98% |

| Medical Care | -0.16% | -3.92% | 3.55% | -0.43% |

| Medical Devices | 0.71% | 5.72% | 2.79% | 0.48% |

| Oil and Gas | -0.26% | -2.14% | 2.47% | 0.17% |

| Package Foods | 1.26% | 2.73% | 0.88% | 1.11% |

| Restaurants | -0.18% | -2.51% | 0.05% | -0.44% |

| Semiconductors | -4.56% | -1.07% | 0.82% | -2.10% |

| Software | 0.23% | 5.66% | 4.29% | 4.14% |

| Telecommunications | -2.93% | -4.55% | 2.55% | 0.44% |

| Utilities | -6.22% | -5.21% | 0.06% | 0.02% |

In fact, the two industries with the sharpest median drops in competitive advantage using all four margin measures are computer hardware and biotechnology. The gross margin of the median computer hardware firm fell 2.45 percentage points in the nine years post-IPO. That of the median biotechnology company plummeted 7.99 percentage points during the same period.

The computer hardware sector’s performance is particularly surprising given how well Apple has maintained its high margins over the years: Apple’s gross margins have expanded considerably and its net margins have more than doubled, from 10% in 2005 to 21% in 2020.

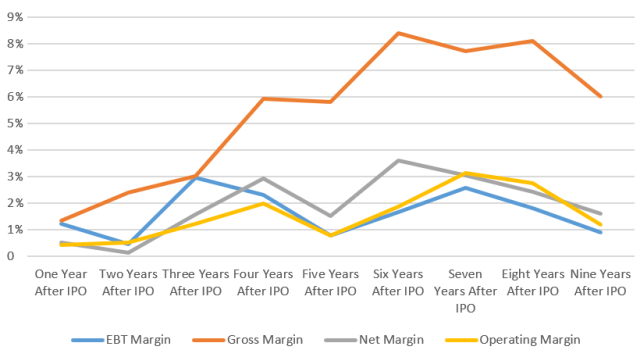

On the other end of the spectrum, drug manufacturers and entertainment are the two sectors with the largest gains in competitive advantage post-IPO. The median pharmaceutical firm’s gross margins expanded 6.03 percentage points in the nine post-IPO years, while the median entertainment company’s margins grew 1.19 percentage points.

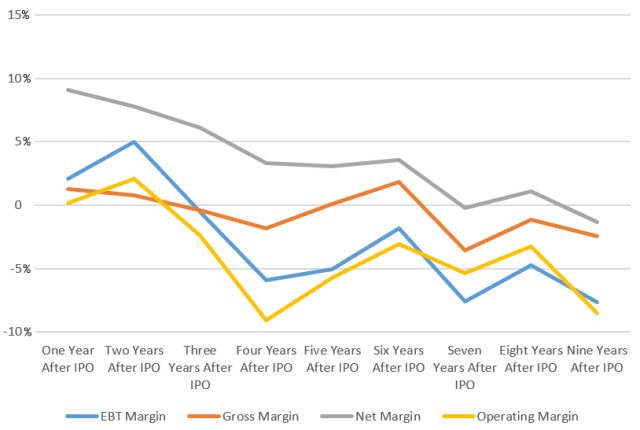

For further insight into how these margins develop post-IPO, we focused in on two of the more extreme industries — computer hardware and drug manufacturing — and how their median firm’s margin changed post-IPO.

Median Computer Hardware Firm Performance Post-IPO

Median Drug Manufacturer Firm Performance Post-IPO

Taken together, our results suggest that most firms experience a one percentage point drop in margins in the nine years following their IPO. But in some sectors — software, entertainment, and drug manufacturing, for example — the median firm actually improves its margins as the years advance.

What explains this “getting better with age” phenomenon? It could be the result of cost-costing, regulatory lobbying, the strength of a firm’s intellectual property, some combination, or something else entirely. Determining which is something to be investigated further.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Ryan McVay

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.