[ad_1]

An investment policy statement (IPS) can be one of the most important documents for individual and institutional investors alike. Yet not all IPSs are of the same quality.

Which of these statements better describes your IPS?

A. The IPS is the backbone of our successful investment program.

B. I know there is an IPS around here somewhere.

If you answered B, you’re not alone. But you’re likely losing out on the benefits that a well-documented IPS can create for your investment program.

If you ran your IPS through a stress test, would it be strong enough to withstand the pressure?

Four considerations can help determine how robust an IPS is. The overarching theme among them is thoroughness: Thoroughness around the investment program’s governance, oversight, investment management, and monitoring / evaluation functions.

Current

Landscape

But before we address these four considerations, we need to level set the current IPS landscape.

Simply put, the “bad” investment policy statements outnumber the “good.” The IPS may be an investment program’s most important governance and oversight document and as such, should cover all details relevant to governing, executing, and monitoring the program and its portfolios. Implicit in this, in our view, is the critical difference between a “good” IPS and a “bad” IPS: again, thoroughness.

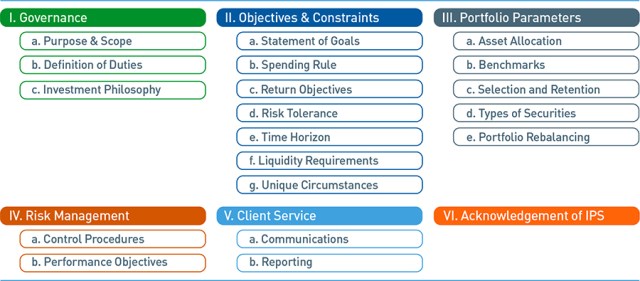

Common IPS Sections

A thorough IPS should contain as many of the sections listed above as are relevant to the given investment program. For example, a nonprofit organization may employ an investment program to sustain its mission. The IPS should document how that investment program will be constructed to support the mission and tie back to the overall goal for the assets, whether it’s to support a distribution, a budget, specific capital projects, etc.

The six key sections identified in the preceding chart cover a wide range of governance, portfolio execution, and monitoring and oversight responsibilities. These are relevant to board or investment committee members serving in a fiduciary capacity.

In our experience, this is where organizations with a “bad” IPS fall short. In some cases, they leave sections out, in others, they include them but not with enough specificity to drive the intended behavior, processes, and outcomes. These shortcomings tend to fall into one of our four consideration areas.

1. The Definition of Responsibilities

It may seem obvious, but the IPS should identify who does what. As an example, for board or investment committee members serving as fiduciaries for an institutional investor, there should be no ambiguity as to who is responsible for the various tasks associated with the investment program. The following assignments need to be made:

- Who is responsible for governance, oversight, and maintenance of the IPS?

- Who will set the investment and distribution objectives for the fund?

- Who will make asset allocation, manager selection, and other portfolio management decisions?

- Who will evaluate how well the investment program meets its objectives?

These responsibilities, among others, should be identified and assigned to specific owners, in writing, so that expectations are clear. These key owners may include the asset owners, board members, trustees, and investment committee members, in addition to such financial service providers as investment advisers, custodians, etc. Done right, this offers clarity on the responsibilities of each party, especially those with fiduciary duties, and accountability around the completion of those tasks.

2. Objectives and Constraints

When creating an investment portfolio, you must consider return objectives, risk tolerance, time horizon, taxes, liquidity, legal / regulatory requirements, responsible investing, and unique circumstances.

Spell out these factors and define and share them with the managers of the investment program. When considering these principal objectives and constraints, ask the following questions:

- Return Objective: What is the purpose of these funds? If the goal is to make a distribution while preserving purchasing power, does the return objective account for this?

- Risk Tolerance: What is an appropriate level of risk for the portfolio?

- Time Horizon: How long will these assets be invested? In perpetuity, or for a set period of time?

- Taxes: Are there any tax impacts or implications that should be considered as they relate to the investment portfolio?

- Liquidity: What are the portfolio’s cash flow needs (e.g., to fund distributions)?

- Legal or Regulatory Requirements: Are there any federal or state regulations that are applicable? What about other considerations?

- Responsible Investing: Does the portfolio’s construction and management require responsible investing factors be incorporated?

- Unique Circumstances: Are there any specific policies, such as special rules around approving alternative investments, that need to be integrated into the management of the portfolio?

An investment program should be built on these factors and should be designed to adapt as they evolve.

3. Benchmarking the Plan

Measuring progress is essential to successful investment program strategy. Specifically, gauging the performance of the investment program against defined benchmarks can help determine if it is on track to meet its objectives or if strategy adjustments might be required. Two steps are integral to this process:

- Define “success” in specific terms, through a relative or absolute benchmark.

- Measure the investment program’s performance relative to the definition of success on a periodic basis.

A relative benchmark applies an index or blend of indices to compare the performance of the investment program. For example, a relative benchmark might compare an investment portfolio against that of a 60%/40% blend of the S&P 500 and the Bloomberg Barclays Aggregate Bond Index.

An absolute benchmark, or hurdle rate, is an actual percentage return. For example, if the objective is to retain the principal and purchasing power of the portfolio against a 4% annual distribution, 2% inflation, and 0.5% in fees, a back-of-the-envelope calculation requires a 6.5% return. Investment returns below this benchmark suggest the program is not meeting its objective. Returns above it imply the objective is being achieved.

The second critical aspect of benchmarking is making sure that the benchmarks are actually used. Specifically, the performance of the investment program relative to the established benchmarks must be calculated on a regular basis.

We recommend that benchmarks be reviewed annually and in response to material changes in the investment portfolio or investment program objectives. This can help determine whether they remain appropriate for what the investment program is trying to achieve.

4. Portability

Over time, the circumstances, decision-makers, and financial services vendors associated with a policy may change. When the team in charge of the long-term objectives experiences turnover, how do you keep the investment program on track? An effective IPS can help.

With that in mind, will someone be able to pick up the IPS and understand the investment program without any other guidance? Some key factors to consider in answering this question include:

- Does the IPS include the common sections mentioned above?

- Have you defined responsibilities for key decision makers?

- Have you defined the objectives and constraints?

- Have you defined what success looks like (i.e., established benchmarking guidelines)?

- Have you defined how you are going to monitor the portfolio and with what frequency?

If the answer is “yes” to these questions, your IPS may be able to weather investing’s inherent uncertainties.

Conclusion

A strong IPS can provide a solid foundation for an investment program and give investors the discipline they need to persevere through challenging investment environments.

With theses considerations in mind, we recommend you work with your clients, decision makers, legal services firm, and investment managers to make certain your investment policy statements meet the thoroughness threshold.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

The material presented herein is of a general nature and does not constitute the provision by PNC of investment, legal, tax, or accounting advice to any person, or a recommendation to buy or sell any security or adopt any investment strategy. The information contained herein was obtained from sources deemed reliable. Such information is not guaranteed as to its accuracy, timeliness, or completeness by PNC. The information contained and the opinions expressed herein are subject to change without notice.

The PNC Financial Services Group, Inc. (“PNC”) uses the marketing name PNC Institutional Asset Management® for the various discretionary and non-discretionary institutional investment, trustee, custody, consulting, and related services provided by PNC Bank, National Association (“PNC Bank”), which is a Member FDIC, and investment management activities conducted by PNC Capital Advisors, LLC, an SEC-registered investment adviser and wholly-owned subsidiary of PNC Bank. PNC does not provide legal, tax, or accounting advice unless, with respect to tax advice, PNC Bank has entered into a written tax services agreement. PNC Bank is not registered as a municipal advisor under the Dodd-Frank Wall Street Reform and Consumer Protection Act.

“PNC Institutional Asset Management” is a registered mark of The PNC Financial Services Group, Inc.

Investments:

Not FDIC Insured. No Bank Guarantee. May Lose Value.

©2021

The PNC Financial Services Group, Inc. All rights reserved.

Image credit: Getty Images / PeopleImages

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.