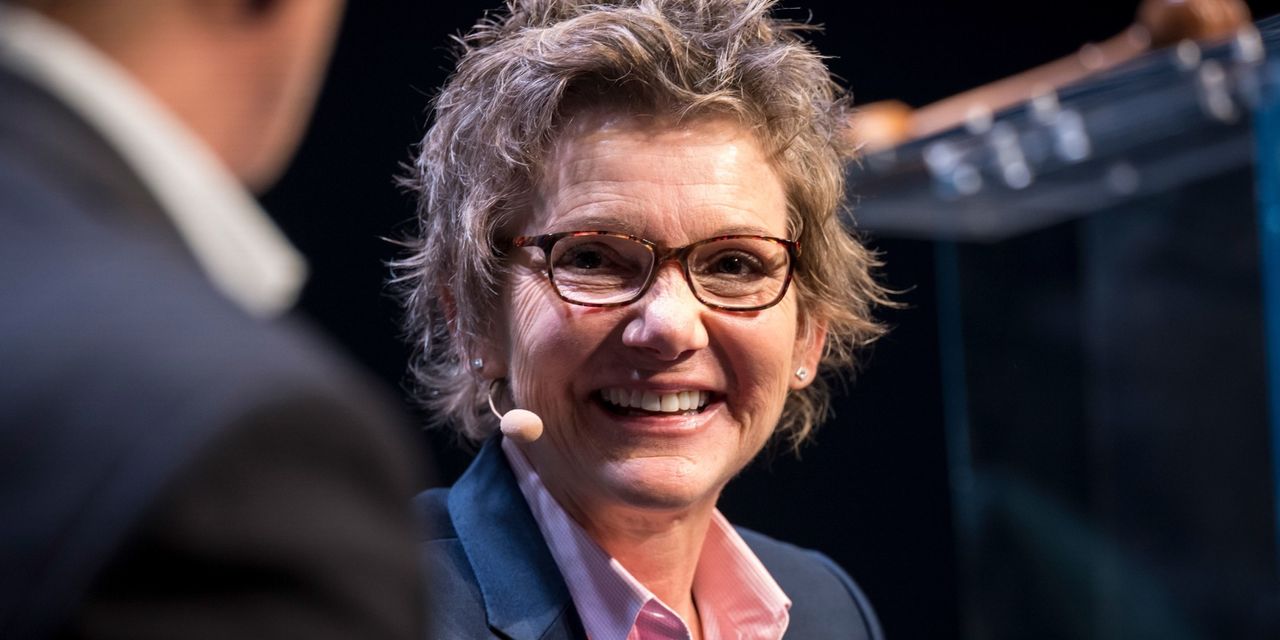

There are signs that the U.S. labor market is starting to cool off a bit, San Francisco Federal Reserve President Mary Daly said Tuesday.

“I think…some of the churn that’s been going on in the labor market might be settling and that’s better ultimately for sustainability,” Daly said, in a conversation about the outlook sponsored by the Council on Foreign Relations in New York.

Higher wages over the past year — often to workers who find new jobs and to others in service jobs who are in public-facing positions — has been a key driver of inflation.

The Labor Department said wages increased at a 5.7% annual rate in the second quarter, the latest measure of wage growth as part of the employment cost index.

Former Boston Fed President Eric Rosengren estimated that if the Fed wants to get inflation back to its 2% target, it will need to see wages and salaries slow to a range of 3.5%.

In her talk, Daly said that in discussions with business contacts in her region, she is hearing more stories that workers are not quitting their jobs at such a fast pace.

She said one executive told her that his conversations with staff has shifted from workers asking for raises to conversations with workers who go out of their way to say they are satisfied and not looking around. Some of the workers who left are also asking to return.

“So I think that is an indication that people are finding their footing to stay in a place and some of the churn might be settling,” she said.

Daly said that she is also hearing that firms are planning for a lower rate of wage increases in the coming year – back to 3%-4% down from 4.5%-5.5%.

A lot of the outside wage growth was to new hires and firms are turning to equity adjustments to make existing workers happy, she said.

The yield on the 10-year Treasury note

TMUBMUSD10Y,

slipped to 3.6% on Tuesday after briefly touching 4% last week as investors hope the Fed might not have to continue aggressive interest rate hikes into next year.