[ad_1]

by BoatSurfer600

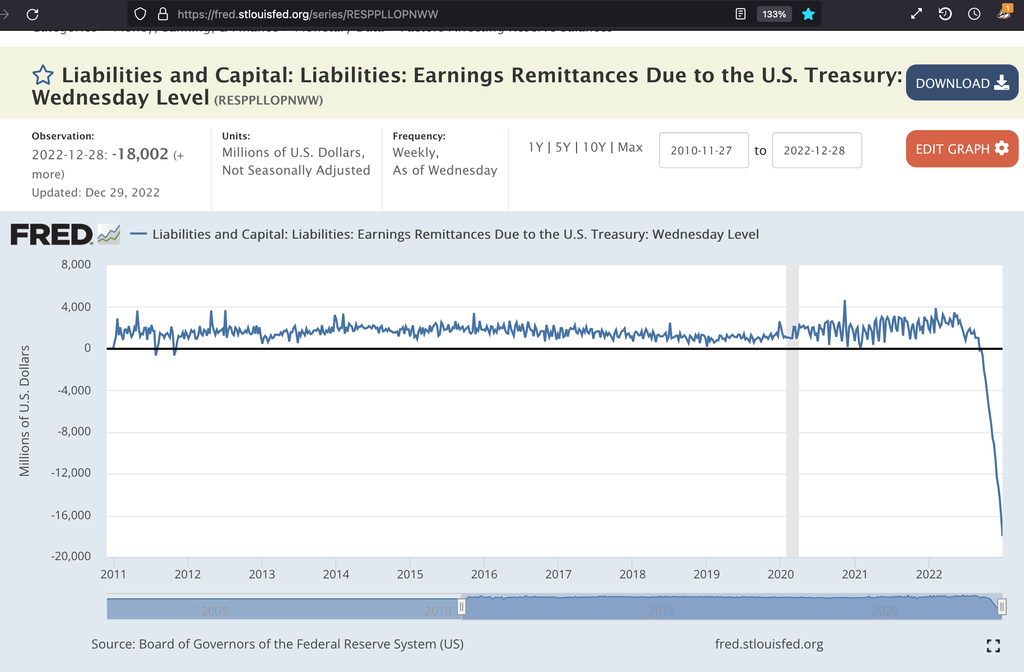

Federal Reserve remittances to the US Treasury keep falling. now -18.002 Billion per week.

The Fed is playing slight of hand here.

Storing losses on the balance sheet as an asset, rather than showing the loss on the income statement right away, is an old corporate accounting trick.

The Fed explains this in footnote:

“Positive amounts [from January to early September] represent the estimated weekly remittances due to U.S. Treasury.”

“Negative amounts [since early September] represent the cumulative deferred asset position, which is incurred during a period when earnings are not sufficient to provide for the cost of operations, payment of dividends, and maintaining surplus.

“The deferred asset is the amount of net earnings that the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume.”

In other words, each week going forward, the linked chart will show the Fed’s total losses starting from September 2022. The bigger the negative number, the bigger the accumulated loss.

So, ‘wut mean’? This number will get bigger to indicate the amount of money the Fed owes the treasury. The Fed gets to just sit on this negative balance and when it starts making money for treasury again (from money it makes on interest and fees, lowering its operating expenses, paying less on dividends), will see that negative number start to shrink (in theory).

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.