[ad_1]

Now that the midterm elections are over (except for counting of million of mail-in ballots, a massive moral hazard risk), President Biden has proclaimed that he isn’t changing any of his horrid policies. And apparently, neither is The Federal Reserve.

Despite the headlines that The Federal Reserve is rapidly downsizing its massive balance sheet of assets, The Fed is just letting their enormous holdings of mortgage-backed securities (MBS) run off. That is, just letting MBS mature. So, The Fed’s System Open Market Holdings of Agency MBS has barely declined.

Here is the table of MBS run-off. The mass of MBS doesn’t start to mature until … 2039. It is Treasuries that are maturing.

So, The Fed is raising its target rate rapidly, although that is likely to reverse course in the first half of 2022.

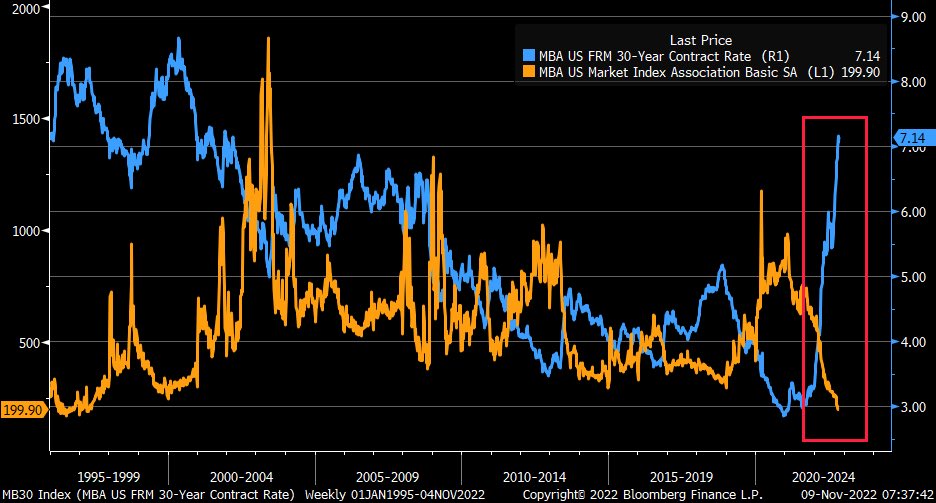

Meanwhile, mortgage applications fall to lowest level since 1997 with Fed tightening.

“So Mr Bond…let me tell you my plan for global domination.”

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.