Article content

(Bloomberg) —

[ad_1]

Europe is again on edge about potential gas supply disruptions from Russia, even after the restart of the crucial Nord Stream pipeline following maintenance this week.

Author of the article:

Bloomberg News

Anna Shiryaevskaya and Vanessa Dezem

(Bloomberg) —

This advertisement has not loaded yet, but your article continues below.

Europe is again on edge about potential gas supply disruptions from Russia, even after the restart of the crucial Nord Stream pipeline following maintenance this week.

A turbine that helps pump gas into the link is held up in transit in Germany after first being stranded in Canada due to sanctions. President Vladimir Putin has warned that shipments through Nord Stream — Russia’s biggest pipeline to the continent — could dwindle if the part isn’t returned to Russia in the coming days.

Throughout the European Union, politicians and business are bracing for the possibility that Russia could cut gas supplies further, or halt them completely. EU nations are racing to build their stockpiles as they navigate a historic energy crisis, stoked by Russia’s war in Ukraine, that risks inflicting severe economic damage as it ripples across the continent.

This advertisement has not loaded yet, but your article continues below.

“Further disruptions are expected as Russia seeks to increase political and economic pressure on Europe as winter approaches,” said Penny Leake, research analyst for Europe gas and LNG at Wood Mackenzie Ltd. “It remains unclear what Russia will do.”

Since it returned from maintenance on Thursday, Nord Stream has been running at about 40% of its capacity, roughly the flow rate before the works.

That level could drop to 20% as soon as next week if the turbine delays aren’t resolved, according to Putin. Only two turbines at a compressor station in Russia are currently operating, and one of them needs to go for maintenance this month, he said earlier this week. Unless the replacement component sent from Canada arrives in Russia soon, flows will drop, he added.

This advertisement has not loaded yet, but your article continues below.

Turbine Saga

The status of the part wasn’t immediately clear. As of Friday, the replacement turbine was stranded at undisclosed location in Germany because Russia hadn’t provided the necessary paperwork to enable shipment, according to a person familiar with the matter.

But Russia’s Gazprom PJSC said that it hasn’t received requested documents from turbine manufacturer Siemens, and noted that it has no additional obligations to the German company in order to receive the component.

“Russia plays a strategic game on gas supplies to Europe,” said Simone Tagliapietra, a senior fellow at think tank Bruegel. “Keeping low flows going is better than cut-off. It decreases Europe’s resolve to reduce gas demand. Europe must not fall into this trap and go crisis mode anyhow.”

This advertisement has not loaded yet, but your article continues below.

European officials including German Foreign Secretary Annalena Baerbock have accused Russia of using energy as a weapon — a claim the Kremlin categorically rejects.

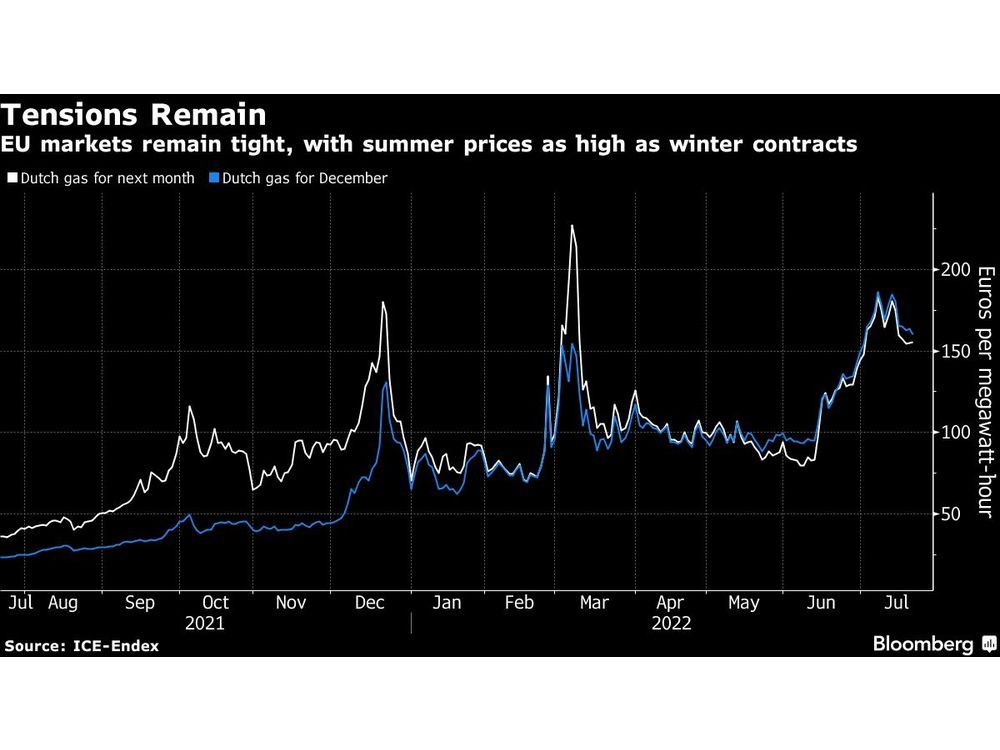

Dutch gas futures, the European benchmark, rose for a third consecutive session on Friday as the supply uncertainty continues.

Russian Storage

While the EU builds its gas stockpiles, Moscow is also preparing for one of its notoriously harsh winters. Russian Energy Minister Nikolai Shulginov told Putin on Thursday that the nation’s gas storage levels are already 81% of what’s needed to withstand peak demand during the cold months.

“We are preparing for this difficult period with full understanding that our partners in unfriendly states, for example, are expecting the very complicated season nervously,” he said during a meeting broadcast on state television. “We, on the other hand, are working normally, based on our plans and timelines.”

This advertisement has not loaded yet, but your article continues below.

It remains to be seen how Russia’s gas output may be affected after its own domestic storage is full, if there are limited export outlets for its fuel. Data from Gazprom showed its production is down about 10% year-on-year year as of mid-July.

Russia is already limiting gas flows to Europe via Ukraine, with no indication that it will boost supplies. At a monthly auction earlier this week, Gazprom opted not to book extra capacity to ship fuel along the route in August.

Russian gas-export curtailments are being split between domestic storage injections and production shut-ins, according to Goldman Sachs Group Inc.

Moscow had the option to re-route flows via Ukraine and chose not to do so, Samantha Dart, the bank’s head of natural gas research, said in an interview with Bloomberg TV earlier this week.

This advertisement has not loaded yet, but your article continues below.

LNG Relief

Russia’s imposition of conditions to get flows fully on track suggests “that this is more than just about a turbine,” she said. “This is likely a political and economic decision as much as a technical one.”

While uncertainty remains over pipeline shipments to Europe, the continent has seen some relief via imports of liquefied natural gas, which has been flowing at record volumes this year.

That’s partly due to Asian demand being subdued as a result of sufficient inventories and Covid-related lockdowns in China, which even re-sold some cargoes in the spot market.

“The moment Chinese activity picks up, we may see this quickly change and, as a result, fewer cargoes available for Europe,” said Dart.

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.