[ad_1]

Market indices have seen constant evolution in more than a century of history, but never more so than in the last year.

On 3 July 1884, the world’s first stock index, the Dow Jones Transportation Index, was published by Charles Dow. And every year since then, market indices have evolved and grown in scale and scope to meet the expanding needs of investors. Technology and better sourcing of input prices and data have led to much more accurate ways to reflect markets and subsectors. And that has never been more true than in 2020.

Indices were first used exclusively to measure markets. More recently, their applications have broadened and they have come to serve as the basis for a wide range of investment products. Innovation continues to drive their expanded use.

While indices comprise a well-established industry spanning 136 years, the 2020 benchmark survey from the Index Industry Association (IIA) shows a sector unafraid of constructive transformation. It demonstrates IIA members responded quickly to change, to the compression and uncertainty that have marked this year’s markets and investor preferences.

How have they done this? By developing new types of indices, particularly in environmental, social, and governance (ESG) and fixed income. Indeed, survey data shows index providers are competing and innovating most rapidly in these two areas, offering new sophistication for investors in a market that demands it.

Eye-Opening Results

So what is the Index Industry Association and what is the purpose of our benchmark survey?

Founded in 2012, the IIA represents the global index industry by working with market participants, regulators, and other key stakeholders to promote sound practices in the sector while serving investors. Our primary focus is promoting index industry best practices and communicating the value of market indices to the public. Our survey is an annual “report card” of sorts for our sector. It is how we measure the total number of indices and identify notable trends over the past year and beyond. Prior to our first survey four years ago, no systematic study of the industry had been conducted to determine how many indices there were.

Our first survey was eye-opening: It revealed that our members administer approximately three million indices. This ubiquity speaks to the utility of indices for measuring markets, benchmarking, performance attribution, risk analytics, and sometimes providing a universe for investment composition. Many investors only think of the investment products based on the indices, when in fact indices have a much broader scope and a wide range of use cases.

As we began compiling this year’s data, we knew immediately that the results were compelling. They reflect an industry on the cutting edge, investing in research, data, and operational capabilities. Due to the regulatory and capital changes driven by the Great Recession, many of the research functions previously performed by The Street are now being conducted by index providers.

ESG nets record growth.

The most surprising result of this year’s survey? The unprecedented growth in ESG indices. To call this a trend would be an understatement: It is a paradigm shift. The number of indices measuring ESG criteria grew by more than 40% in the past year. This represents the largest single year-on-year increase among any single major index type in our survey’s history.

While a significant jump, it maybe shouldn’t come as such a shock given ESG investing’s expanding popularity. New regulations, particularly in Europe, increasing environmental concerns across the globe, and long-term socio-economic and demographic changes have all propelled investors toward sustainable strategies.

ESG performance hasn’t hurt either: During periods of peak pandemic volatility over the last year, ESG proved its mettle and outperformed in many markets. Research reports on ESG companies have shown many “asset light” firms have done very well throughout the pandemic.

To be sure, more work is needed to improve the quality of ESG data. Comparable emission data, for example, among other inputs, are necessary to make apples-to-apples comparisons. Nevertheless, the data will continue to improve and indices will continue to become more precise. And investors should eventually coalesce around common ESG definitions to reflect their social preferences.

Large institutional funds have started to embrace more ESG-friendly mandates, driving large asset flows into the space. And this growing focus among the institutional segment has spread to retail investors. Index providers have responded to increased demand for ESG indices by developing more product and methodology innovations. The old days of ESG management by simple exclusionary screens are over. There are now more sophisticated ESG factor-based index screening and weighting processes.

Fixed income gets dynamic.

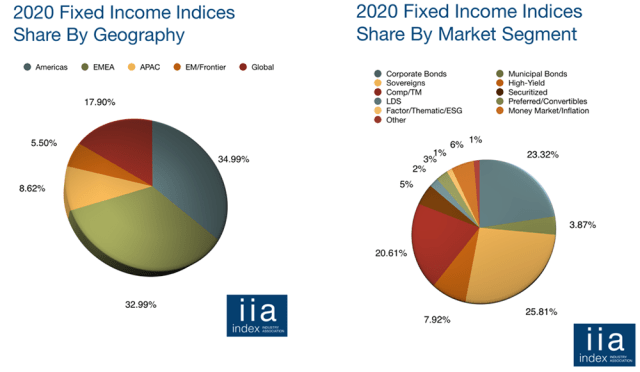

The fixed-income space has likewise seen expansive growth. Our survey found the number of indices covering fixed-income markets grew 7.1% in the past year and nearly 15% over the last two.

Fixed income is often considered “more difficult to measure” because of the complex and opaque nature of bond markets. But index providers have innovated and developed new indices that have given investors access to previously unavailable areas of the fixed-income sector

Our survey revealed that the largest percentage of fixed-income indices are in the Americas. This is not the case for equities. What explains the discrepancy? The diversity of the fixed-income markets in the Americas. For example, the United States has many more types of municipal bonds and very extensive securitization markets compared to other countries.

Trends in Equities

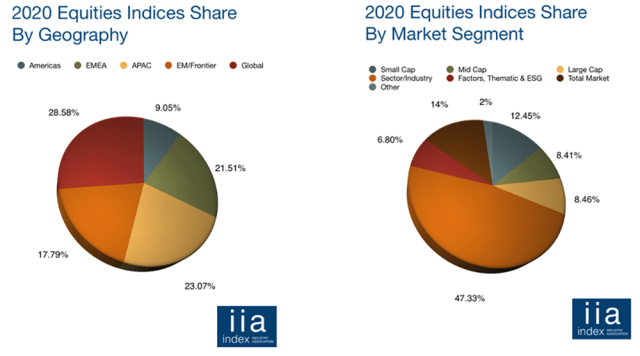

Industry and sector indices account for almost half of equity indices, according to our survey, and there is movement towards more global indices. In 2020 there was a decline in cap-weighted indices relative to such newer areas as ESG and thematic indices. That the Americas have such a small percentage of equity indices may come as a surprise to some, but Europe, the Middle East, and Asia have many countries with their own stock markets driving the results. Our survey also shows a rising percentage of emerging and frontier equity markets indices.

A Revealing Year

While ESG and fixed income experienced the most development and investment in the index industry in 2020, they also reflect a broader shift. The index industry has seen more innovation in the last decade than in any of the 13 preceding it. As investor needs have grown and evolved, the index industry has had do adapt to keep pace.

New participants continue to enter a competitive space. ETFGI, an ETF industry consulting and research firm, follows 255 index providers, while Morningstar has 199 index providers in their database. There is no shortage of firms trying to come up with new and “better” ideas. ETFGI recently reported that after accelerating growth in recent years, global assets invested in index-based ETFs and ETPs surpassed US$7 trillion at the end of August.

So what has fueled this growth? Cost reduction is the prime culprit and investors have benefited enormously. The Committee for Economic Development (CED), in a 2019 study, estimated the cost savings for investors to be between $12 billion and $15 billion per year. Add that to the reduction in fees across all types of funds and in transactions costs, and the center estimated cost savings to be in the range of $40 billion to $50 billion annually.

The year 2020 has posed a tremendous challenge for global financial markets, for the index industry, and for the world. Indices were battle-tested in real time and index providers demonstrated their consistency and preparedness.

Our survey results throw the future of the industry and the markets into stark relief: This future will be shaped by new investment criteria, greater informational demands, and products that more directly — and inexpensively — address investor needs across a wider set of asset classes.

This is the third installment of a series from the Index Industry Association (IIA).

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Paolo Carnassale

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.