[ad_1]

“Some form of money or bonds has always had that hedge property — yet, over 3,000 years of history . . . nominal yields have always been positive until the last 12 or 13 years. Has the hedge property overtaken the investment property of fixed-income assets, suddenly, for the first time?” — Laurence B. Siegel

What happened to the correlation between stocks and bonds? Why has it flipped from positive to negative? And why did it go from negative to positive years before that?

These are among the questions Rob Arnott, Cliff Asness, Roger G. Ibbotson, Antti Ilmanen, Martin Leibowitz, Rajnish Mehra, Jeremy Siegel, and Laurence B. Siegel consider in this excerpt from their 21 October 2021 Equity Risk Premium Forum discussion.

Building on previous installments, the panel delves further into the underlying nature and dynamics of the ERP and explores such related issues as the structure of the real rate of return, the appeal of long volatility assets, and the role and influence of central bank policy.

What follows is a lightly edited transcript of their conversation.

Jeremy Siegel: Well, what is meant by the equity risk premium? I don’t think it matters whether the reference asset is long- or short-term bonds.

Martin Leibowitz: If bond returns are prospectively negative, shouldn’t the risk premium be measured against positive returns?

J. Siegel: No. It should always be the difference between whatever the real riskless return is, positive or negative, and the return on risky equity. Always.

Leibowitz: If someone is investing and they want to get a positive return, bonds would not be a consideration.

J. Siegel: Yes, they would. It’s their hedge. What do you mean, just because the return is negative, it doesn’t do anything?

Leibowitz: Negative returns are not an exciting hedge.

J. Siegel: They’re not exciting, but they’re absolutely a hedge. A lot of hedges have a negative expected return.

Roger G. Ibbotson: If you want to consume later instead of earlier, because we are planning for some future thing, you’ll get a negative real interest rate.

Rob Arnott: This whole discussion hinges on whether there is a zero-return alternative to the negative-return risk-free asset.

J. Siegel: There is not. If there were a storage technology, there would be.

Arnott: Stuff it under your mattress. The return on that will be zero in nominal terms. But a lot of governments around the world are trying to replace currency with something else.

J. Siegel: Paul Samuelson wrote that famous article about money having a zero nominal return. Remember? Long-term equilibrium with and without social contrivance of money, the forced equilibrium. But the truth is, as you’re saying, Rob, money gives you a zero nominal return in an inflationary environment. It is a negative real return, so you have no zero real return alternative.

Rajnish Mehra: Jeremy, let me just continue one second more and then we’re done with it. The real rate of return is going to be the sum of three terms. The first term will be the time preference, the rate at which we prefer to consume today rather than tomorrow. That’s about 1% per year.

The next term is the growth rate of consumption multiplied by the inverse of the elasticity of intertemporal substitution. In a growing economy, the consumption growth rate is positive (historically ~2%). The elasticity of intertemporal substitution is about a half or a third or something in that ballpark, implying a coefficient of relative risk aversion around 2 or 3.

The third term is –0.5 Υ2 σ2, where Υ (gamma) is the coefficient of risk aversion and σ2, the variance of the growth rate of consumption (~0.00123). Unless one becomes extremely risk averse with a risk aversion parameter of 45 or 50, this third term will be negligible, and the first two terms will dominate, so normally, the risk-free rate increases as your risk aversion goes up. It will start declining only if you become extremely risk averse, resulting in a negative real return even when the growth rate of consumption is positive.

This is Fischer Black’s solution to the equity premium puzzle, by the way. His solution, in private conversation, was that you have a risk aversion of 45. In such a case, you can solve everything. Why? Because the risk-free rate will become very small and may become negative.

Ibbotson: You have a preference to consume later instead of now.

Mehra: You can just use constant relative risk aversion. That’s not going to change. I could cook up an example, but that will be inconsistent with everything you know — the risk aversion will come out to be so high that you would not get out of your bed every day.

Nominal Fixed Income as a Hedge or Insurance

J. Siegel: There’s another reason why you might have negative equilibrium real rates. That is government reaction. If things collapse and prices go down as in a great depression, nominal assets are the best assets to hold. They become a negative-beta asset. That’s why I talked about the negative correlation between bonds and risky assets that will prevail if things go bad. That would cause people to hold more bonds. How much they hold has to do with the perception of whether those nominal assets are in fact effective risk hedges or not.

Laurence B. Siegel: They become an insurance asset.

J. Siegel: Yes. An insurance asset, as you know, will very often give you a negative return. When nominal assets are perceived as an insurance asset, which has happened at various times in history, one could ask why — maybe the concern is default by the government, money not being redeemed in gold properly.

When everything is priced in money and the concern is about another financial crisis or a pandemic crisis or whatever, prices of goods and services and real assets decline, and bonds do extremely well. Nominal fixed assets do extremely well. They take on a really negative beta, which I think gives them a tremendous hedging ability. I think trillions of dollars’ worth of demand are generated to hold that asset.

L. Siegel: Some form of money or bonds has always had that hedge property — yet, over 3,000 years of history, as you and Sidney Homer showed, Marty, nominal yields have always been positive until the last 12 or 13 years. Has the hedge property overtaken the investment property of fixed-income assets, suddenly, for the first time?

J. Siegel: Yes.

L. Siegel: Why?

Antti Ilmanen: It changed 20 years ago. Before that, there was rarely a negative correlation between stock and bond returns.

J. Siegel: Let me tell you an interesting story. A lot of people analyze the VIX equity volatility index. I was confused about why there was so much demand for VIX assets, and then someone told me, “We love VIX assets because they’re negatively correlated with the stock market.” And I said, “Yes, but do you know that if you hold them, they’re going to deteriorate by 5% to 10% a year every single year, all the time?” They didn’t really understand that.

So, I gave a lecture about government bonds being negative beta assets. One money manager came to me and said, “Jeremy, I had $3 billion in VIX products for the negative correlation. Why don’t I try to get a positive nominal return, even if it’s only 1%, by holding long-term nominal US government bonds instead?” And he did that. He said, correctly, “Forget about those VIX assets. Bonds are so much better, even though they give negative returns.”

Cliff Asness: Jeremy, I very much agree with you, but we should acknowledge that not everyone on earth agrees that long-volatility assets have a negative expected return. Our man, Antti Ilmanen, has gone quite a few rounds with Nassim Taleb on this very issue.

Antti, sorry to put you on the spot.

The Flip from Positive to Negative Stock/Bond Correlation

Ilmanen: I want to say something quickly on the stock/bond correlation. We have a nice story on why the sign flipped from positive to negative 20 years ago. Stocks and bonds tend to be driven by growth and inflation. When there is more growth uncertainty, stocks and bonds tend to move in opposite directions, so we’ve had negative stock/bond correlation for the last 20 years. Before that, there was, relatively speaking, more inflation uncertainty, and we tended to have positive stock/bond correlations. So, we are waiting to see if those relative uncertainties flip again.

L. Siegel: The stock/bond correlation was negative from the mid-1950s to the mid-1960s. I think there was growth uncertainty then, but relatively little inflation uncertainty. That supports your story, Antti.

J. Siegel: I think you’re right. The correlation flip is also related to the fact that when you have supply shocks, you will have a positive correlation between stock and bond returns. By the way, I’m not talking about the constrained supply situation that is happening right now; that is very specific to current news. I mean oil shocks and other more typical shocks — you’re going to have that positive correlation. The reason is that supply-shock inflation is bad for the economy, so stocks and bonds go down together. You get a positive beta on long bonds.

If the stocks are more demand-related, caused by financial crises or pandemics or something else like that, then you tend to get a more negative correlation. The difference, as I mentioned earlier, is enormous. Go through the math and see what that does to real yields. It depresses them tremendously. So, I agree with you; the correlation changed, and I think it had to do with supply shocks versus demand shocks in a macro system.

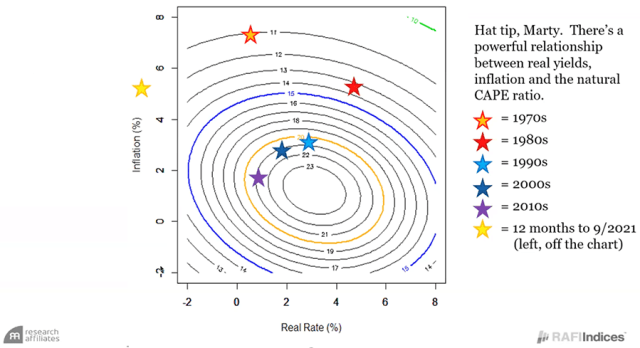

Leibowitz: Rob, does this observation relate to the P/E smile that we’ve talked about so much in the past?

Arnott: I think it does, but spell out to me with what you mean by the question.

Leibowitz: As real rates go up beyond a certain point, P/Es start to come down as the high real rates become a constraint on growth, first naturally and then Fed-induced. As real rates go lower, you find yourself in a situation where, beyond that tipping point, the prospects for equity growth or economic growth are sufficiently dour that the correlation goes in the other direction.

Arnott: I think that’s exactly right. The exhibit below ties into that. While you described it as a smile, it’s more of a frown.

Does MMT Pose a Threat to ERP? Only If the Fed Has No Exit Strategy

Leibowitz: Yes, it is a frown.

Arnott: The peak multiples are found at moderate levels of inflation — 1% to 2% — and moderate real rates, 2%, 3%, maybe even 4%. The multiples fall off pretty sharply from there. So, a lot of this variability in multiples hinges on central bank policy. And in an MMT world, I’m not sure the central bankers are likely to be pursuing policies of anything other than moderate to high inflation and negative real rates.

For more on this subject, check out Rethinking the Equity Risk Premium from the CFA Institute Research Foundation.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Copyright Dave Hitchborne and licensed for reuse under this Creative Commons Licence.

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.