[ad_1]

Wall Street’s three main indexes weakened last week even though the U.S. job market confirmed that the economy is on solid footing as the country reported that nonfarm payrolls rose more than expected in August.

The U.S. added 315,000 jobs in August, which surpassed economists’ estimate of 298,000 for the same month. The negative news is that the unemployment rate rose to 3.7% from 3.5%, while the participation rate increased to 62.4% from 62.1%. Rick Meckler, a partner at Cherry Lane Investments, said:

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

An uptick in the unemployment rate eased fears about aggressive interest rate hikes from the Federal Reserve. Investors are still rethinking the August jobs report and are probably leaning into the fact that there’s no clear end to the rate increases.

According to the CME FedWatch Tool, the market probability of a 75-basis-point increase eased to 56% from 75%, while Morgan Stanley Chief US Economist Ellen Zentner said that consumer price data due Sept. 13 would be key in determining the Fed’s decision.

On the other side, analysts from Commerzbank reported that the FED would likely raise rates by 75 basis points on Sept. 21 rather than by 50 basis points.

Investors will carefully watch Fed Chair Jerome Powell’s speech on Thursday as well as the U.S. consumer prices data next week for clues on the path of monetary policy.

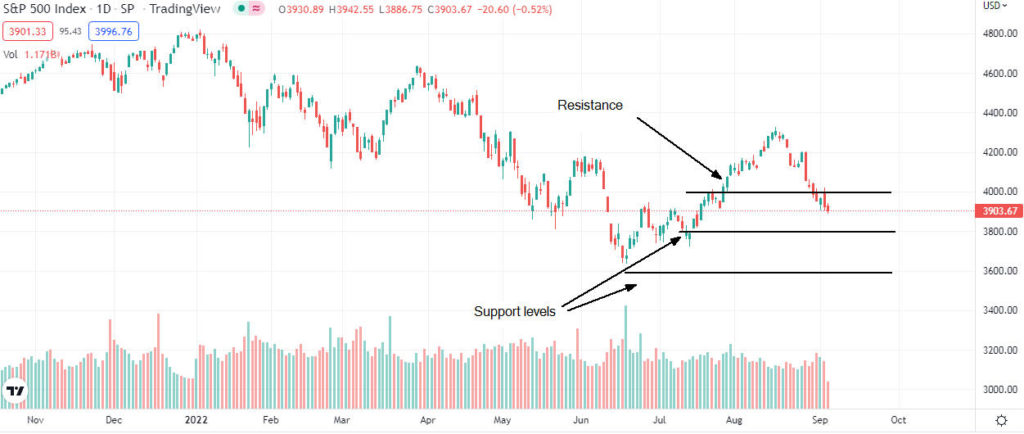

S&P 500 again below 4,000 points

S&P 500 (SPX) has weakened again below 4,000 points, and investors will pay close attention to Fed Chair Jerome Powell’s speech on Thursday.

The current support stands at 3,800 points, and if the price falls below this level, it would be a “sell” signal, and we have the open way to 3,700 points. The upside potential still remains limited, but if the price jumps above 4,000 points, the next target could be 4,200 points.

DJIA has a strong support level at 30,000 points

The Dow Jones Industrial Average (DJIA) weakened last week and closed in red in five of the last six sessions.

The strong support level stands at 30,000 points, and if the price falls below this level, it could be the beginning of a much stronger sell-off.

Nasdaq Composite down -3.3% on a weekly basis

Nasdaq Composite (COMP) lost more than 3% last trading week and closed at 11,630 points.

This marked Nasdaq’s sixth daily loss in a row, and if the price falls below 11,000 points, the next target could be 10,500 points.

Summary

The Dow Jones, the S&P 500, and the Nasdaq ended lower last week even though the U.S. job market confirmed that the economy is on solid footing as the country reported that nonfarm payrolls rose more than expected in August. Investors will carefully watch Fed Chair Jerome Powell’s speech on Thursday as well as the U.S. consumer prices data next week for clues on the path of monetary policy.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Capital.com, simple, easy to use and regulated. Register here >

*Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

[ad_2]

Image and article originally from invezz.com. Read the original article here.