[ad_1]

A new investment style has proliferated over the last decade or so: the copycat investor.

The basic idea is always the same. Look at the quarterly reports of prominent investment gurus and their holdings at the end of each quarter. Then simply invest in the same stocks they hold.

There are obvious problems with the copycat investment style. Holdings are disclosed only with a substantial time lag, and we don’t know which stocks an investor has bought and then sold again within each quarter. We can only see the holdings per each quarter’s end.

But if the investment guru is a long-term investor and holds mostly stocks and very little in terms of derivatives or private assets, the copycat strategy might just work.

These copycat strategies have been put into action in the United States via exchange-traded funds (ETF)s and now have a relatively long track record that — crucially — includes the 2020 bear market. To the best of my knowledge, there are three such copycat ETFs out there, all of which exclusively invest in US stocks and should thus be compared to the S&P 500:

- The Global X Guru Index ETF (GURU) has $74 million in assets under management (AUM) and tracks the positions of thousands of hedge fund managers.

- The AlphaClone Alternative Alpha ETF (ALFA) has $32 million in AUM and tracks the holdings of ~500 hedge funds.

- The Goldman Sachs Hedge Industry VIP ETF (GVIP) has $220 million in AUM and tracks the 50 stocks held most frequently by hedge fund managers.

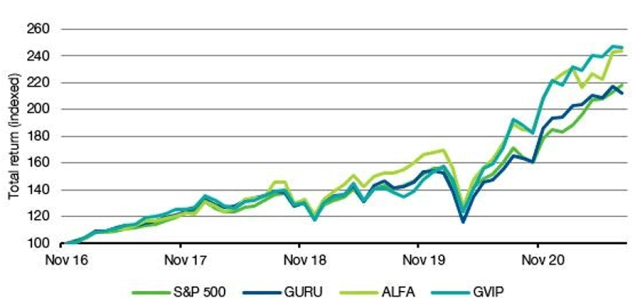

Since the 2016 launch of the GVIP ETF, two of these ETFs have materially outperformed the S&P 500. While GURU has underperformed the index by 0.5% per year in total returns, ALFA and GVIP have beaten the S&P 500 by 2.% and 2.6% per annum, respectively.

Copycat ETF Performance since 2016

Not bad, but that outperformance comes with higher volatility and greater drawdowns during a crisis. The maximum drawdown of the S&P 500 occurred during the height of the pandemic panic in March 2020. Back then, the index fell by 19.6%, while GVIP dropped 21.4% and ALFA 25.1%.

As the chart above indicates, that meant that the copycat ETFs either lost all the outperformance they created from 2016 to 2020 in one month, as in ALFA’s case, or underperformed the S&P 500 after previously matching its performance, as with GURU and GVIP.

It was only in the recovery since April last year that the copycat funds started to outperform.

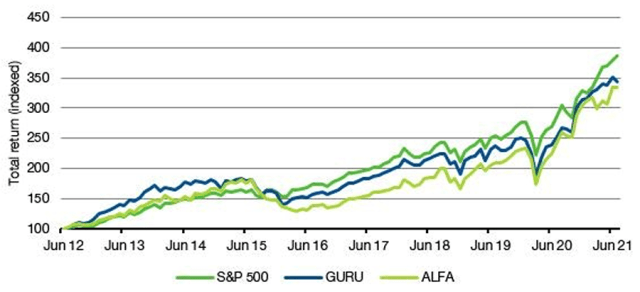

And while the GVIP ETF only exists since 2016, we can use the GURU and ALFA ETFs to go back even longer to mid-2012 when these two funds were launched.

Copycat ETF Performance since 2012

With almost 10 years of performance to look at, we can hardly conclude that these copycat funds add a lot of value. Both GURU and ALFA have underperformed by 1.3% and 1.6% per year, respectively, and had much higher volatility. The chart above shows that copycat funds fared well in the upswing from 2012 to 2015 and then lost all of that outperformance and more in the 2015–2016 correction.

These copycat funds very much resemble fair weather investments that don’t perform over an entire cycle. Indeed, copying from other investors misses one key ingredient for outperformance: creativity.

I will cover that ingredient in my next post.

For more from Joachim Klement, CFA, don’t miss 7 Mistakes Every Investor Makes (And How to Avoid Them), and Risk Profiling and Tolerance, and sign up for his Klement on Investing commentary.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Joas

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.