[ad_1]

Devotees of alternative investments have for many years claimed that alt-heavy investors perform better than stock-and-bond investors and enjoy “volatility-dampening,” to boot.

In a recent LinkedIn post, a senior CAIA Association executive reiterated this claim, saying:

“The endowments that have allocated larger chunks to Alts materially outperform a 60/40 in the LT. More importantly, they see significantly less volatility and draw down risk.”

No hedging there on the merits of alts — more return, less risk.

It so happens that I recently examined the performance of a group of large educational endowment funds during the 10 years ended 30 June 2018. I focused on endowments with assets in excess of $1 billion that had an average allocation to alternative investments of nearly 60% over the study period. I created a composite of returns for these investors using National Association of College and University Business Officers (NACUBO) data. Then I created an equivalent-risk benchmark for the composite using returns-based analysis. (The equivalent-risk passive benchmark actually turned out to be 72% stocks and 28% bonds.)

I found that the endowment composite underperformed the equivalent-risk passive portfolio by 1.6% per year. Underperformance of 1.6% a year over a decade ain’t hay.

In the course of that work, I also examined the proposition that alts dampen portfolio volatility relative to a 60/40 portfolio. In simplest terms, I found that the annualized standard deviation of the endowment composite returns was 11.7% compared with 9.4% for the 60/40 portfolio comprising the Russell 3000 and the Bloomberg Barclays Aggregate Bond Index. In other words, the alt-heavy portfolios were 24% more volatile than “60-40.”

So much for a central element of the raison d’etre for institutional investment in alts. Over a decade, the alts-heavy endowments were more, rather than less, volatile than “60-40.”

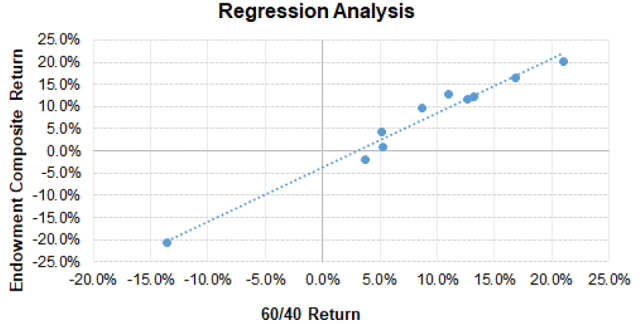

What about performance? The diagram below is a regression of the endowment composite against the 60/40 portfolio. The slope (beta) is 1.22. The intercept of the regression (alpha) is -3.7% per year (t-statistic of -4.0).

So much for the claim that alts-heavy endowments outperform “60/40.” The endowments underperformed by a wide margin on a risk-adjusted basis, with 22% greater market-related risk.

Bottom Line

My research reveals the much greater extent to which public market pricing is reflected in the returns of private market real estate, private equity, and hedge funds since the global financial crisis (GFC). Nowadays, alt returns are animated by returns observed in stock and bond markets.

Consequently, there is neither reason (logic) to expect alts to be “risk dampeners” nor evidence that they have been such since the GFC.

Caveat emptor!

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Baac3nes

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.