[ad_1]

Private equity and private funds more generally have become a go-to investing spot. And not just for institutional and sophisticated investors, or the so-called “smart money.” The retail crowd is also getting into the game. Regulators, too, recognize the risk diversification and return enhancements these instruments can bring to investment portfolios.

Still, while private equity’s appeal may be obvious, its potential benefits intuitive, measuring and explaining private equity performance is an ongoing challenge. As the asset class is increasingly integrated into portfolios, the ambiguity and complexity of current performance standards will be felt more intensely by the market and improvements to those standards will be framed by new regulatory activity.

So why do the current private equity performance standards have benchmarking limitations and what might a potential solution look like?

The IRR Puzzle

The internal rate of return (IRR) still poses communication and comprehension issues. The “2018 Yale Endowment Report,” a global standard for private investments, examining the performance of its venture capital (VC) portfolio, states: “Over the past twenty years, the venture capital program has earned an outstanding 165.9% per annum.”

The comment continues, and though VC-focused, the analysis is applicable to other private assets: “[It] is inappropriate to compound the 165.9% return over the twenty-year time horizon. For reference, the twenty-year time weighted return of Yale’s venture capital portfolio is 24.6%.” This hardly solves the IRR performance comprehension conundrum.

In fact, there is still one inconsistent notation: “per annum” after 165.9%. That should not be used along with an IRR. IRRs are money-weighted measures that by definition can’t have a temporal qualification. Moreover, IRRs don’t feature any information about the underlying investment amounts to allow compounding.

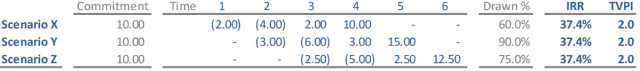

So just how ambiguous is the performance information of IRRs and such multiples as the total value to paid-in (TVPI) capital ratio? To find out, we compare money-weighted returns for three scenarios that could each represent the deployment and reimbursement patterns of a fund’s capital and gains. These scenarios assume the identical commitment of 10 units of capital but with different timing and capital call amounts, with negative figures in parentheses.

The scenarios that deliver identical IRRs and TVPIs are indeed artificial and simplified, but they demonstrate how standard private equity performance metrics fall short. Given all the information, Scenario Y, in which the fund deploys the most capital, should be the best option.

But that’s not what the performance metrics indicate.

New Rules and Regulations

The EU Benchmark Regulation (BMR) regulatory framework may help close the circle on measuring private equity performance. The BMR introduces “a regime for benchmark administrators that ensures the accuracy and integrity of benchmarks [to] protect consumers and investors through greater transparency and adequate rights of redress.” When it comes into full force in January 2021, it will apply to any benchmark used in the EU by EU or non-EU entities.

In early 2019, the UK Financial Conduct Authority (FCA) implemented new, follow-on rules to the BMR. These call for all types of funds to cut down on jargon and offer more transparency into their objectives and performance. The FCA said it wanted investors to “to get improved information to explain what a fund does, how it does it and how to evaluate how well it is doing.”

The BMR requires EU “supervised entities,” such as financial institutions, pension funds, fund managers, and alternative fund managers, etc., that reference a financial index to apply a regulated benchmark for four purposes:

- To ascertain the amount payable under a financial instrument or contract, or determine a financial instrument’s value.

- To measure an investment fund’s performance in order to track the return of that index.

- To define a portfolio’s asset allocation.

- To calculate performance fees.

Private Funds: The Benchmarking Challenge

A family of benchmarking tools, dubbed public market equivalent (PME), has been developed for private funds. But these metrics also likely fail to measure up to the BMR’s requirements.

The various versions of PME gauge the eventual performance of a fund relative to the relevant public market. They first simulate the fund’s cash flow outcomes under listed market performance constraints and then compare the resulting capital amounts. They are fund-specific and do not provide a definitive answer to which of the three above scenarios is optimal.

In the context of the new regulatory environment, the PME resembles the jargon that regulators want to eliminate. The BMR sets a higher bar for indices in all asset classes — with particularly stringent requirements for private funds.

Benchmarking implies that generalized comparisons can be made. A comparable performance metric synthesizes the growth of the notional capital over a given period of time. Proper benchmarks should have simple but robust characteristics and have practical applications in a multi-asset, multi-period capital market and, hence, time-weighted, framework. That includes basic additivity and averaging. Instead, PME, like IRR, can’t identify the true median fund or the average fund.

Restoring IRR’s Role

So how should we reevaluate the purpose of IRR?

To return to the basics, IRR equals the net present value (NPV) of the stream of cash flows of a transaction to zero. If IRR is above a certain required threshold, the project is considered viable. This is the perfect use case from the fund manager or general partner’s operational perspective. It is a deal level measure and a spot number that requires no averaging and relates to no generalized benchmark or relative value consideration.

A Way Forward?

But for the fund investor, IRR leaves out critical data: how much capital is used, when it is deployed, and for how long it stays at work relative to the targeted investment horizon and the allocation/commitment made.

When capital is not deployed all at once, the expected investment timing is forward, not spot as with IRR. Dry powder, or the money committed but not yet invested by a fund, and distributions carry investment and reinvestment risk — and only can produce cash returns. The reinvestment assumption of the IRR does not exist in real life.

While the term private equity suggests long-term equity dynamics and structural illiquidity, the reality is private equity funds tend to be not at all times fully funded, and, above all, self-liquidating.

These characteristics suggest that their performance should be measured by taking advantage of fixed-income instruments, in particular duration, to account for cash flows timing and amount dynamics.

The impact of duration, or the average time at which capital — and how much of it — is at work, could explain the reduction of Yale’s stated VC IRRs to the time-weighted number.

In that example, what’s difficult to assess is the eventual presence of an over-commitment strategy that prevents the calculated performance from being qualified as unlevered — as it should be. The answer is to build duration-based, time-weighted metrics and benchmarks that are investable and fully represent the physical fund allocations.

This way investors could assess both the ability of the manager relative to how much and when the capital is invested through the actual yield extracted from private equity over time.

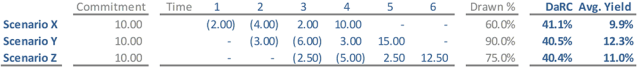

Recalculating the above scenarios while taking duration into account reveals which scenario would generate the best returns, or receive the tradable/investable actual average time-weighted yield over the six-period targeted time horizon.

Scenario Y best meets the investor’s allocation objective. The duration-based yield calculated would be comparable and exchangeable to any other asset class return: That 12.3% yield at the end of Period 6 would add up to 20.07 = 10 *[(1+12.3%)^6]. That’s the total return and includes the effect of dilution for delayed investment and the reinvestment risk for earlier liquidation.

If instead investors identified the highest-performing scenario in relation to the deployed capital rather than the notional, dilution and reinvestment risk would be neutralized to calculate the duration-adjusted return on capital (DaRC), or the time-weighted return on the invested capital. Putting the IRR in the context of time, they would favor the fastest turnover rather than the most money.

As private equity and private funds take on ever great prominence in investment portfolios, developing accurate, transparent, and readily applicable metrics is essential. Duration-based tools can address this need and help solve the private equity performance puzzle.

For more insights from Massimiliano Saccone, CFA, and the XTAL Strategies PE Benchmarks, sign up for the email newsletter.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/oonal

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.