[ad_1]

Introduction

Much of the crypto world is, by definition, cryptic and difficult to understand. But two crypto trends are crystal clear: Both talent and money are flooding into the digital currency market. Almost every day brings a fresh announcement of software developers from Google or financiers from JPMorgan joining crypto start-ups that are about to revolutionize something.

Indeed, while the total market capitalization of cryptocurrencies has fallen from its previous heights, it is still above the $2 trillion threshold. That’s the equivalent in value of the entire German stock market, which includes such blue-chip companies as Siemens, BMW, and Volkswagen.

It is as easy to invest in crypto today as it is in equities, but what is actually being bought is not as clear. When investors purchase Shiba Inu — a token with a $15 billion market capitalization and a Shiba Inu hunting dog mascot — SHIB tokens are deposited into their digital wallets. But what do they really own? And what drives SHIB’s performance?

Theoretically, the more popular the token, the higher the price. But does that relationship hold up in practice? Let’s investigate.

Tokens vs. Coins

Before diving in, we first need to define some basic crypto terminology: A token is a smart contract based on a blockchain, and a crypto coin is the native token of a particular blockchain. For example, ETH is the coin of the Ethereum blockchain, but SHIB is a token based on Ethereum. While all coins are tokens, not all tokens are coins.

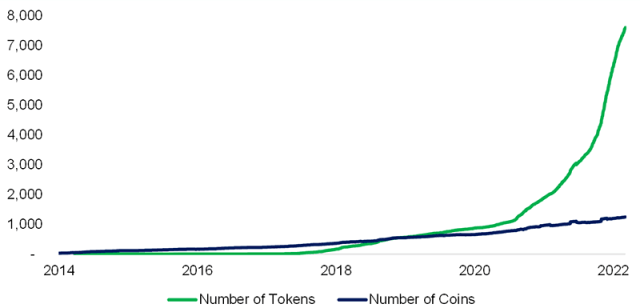

The number of tokens has exploded over the last couple of years, and tokens now outnumber coins by a factor of eight. Ethereum and Binance Smart Chain account for a combined 85% or so of the market share of the blockchain infrastructure layer where tokens are bought and sold. This raises the question of whether all of the 1,000 or so coins currently available are necessary. Over the long term, they probably aren’t.

Cryptocurrencies: Number of Tokens and Coins

Token Financing

Crypto start-ups are financed through equity and tokens. Raising capital via equity means issuing shares that are privately held by angel investors, venture capitalists, and the like. These shares represent an ownership stake that entitles the recipients to dividends and proceeds when the company is sold.

Token financing is very different: It gives investors no legal claim to the underlying business. As a consequence, token and equity investing are not really comparable.

Naturally, start-ups pursuing token financing need to convince investors there is value to be gained by participating in the token sale. The typical pitch is that the start-up’s product requires the use of tokens. This can create rather complex ecosystems that resemble small economies with their assorted stakeholders: The start-up is the equivalent of the government, the product a stand-in for goods, the users for consumers, and the token for the currency or medium of exchange.

Since each token represents a currency, demand and supply should determine its price. Token and coin issuers can influence supply: Bitcoin, for example, limits the total number of tokens to 21 million, and Ethereum has bought back ETH tokens and “burned” them. Since the tokens represent cryptocurrencies, their demand should be influenced by their popularity.

What’s the Correlation between Token Price and Token Volume?

The relationship between the product of the start-up and the underlying token is not straightforward, however, and is thus hard to evaluate. Stockholders would love to own shares in a booming, revenue-generating business. But token investors have no claim on such cash flows.

Worse, token investors face an information deficit since start-ups release little to no financial data on the underlying business. This puts them at a major disadvantage relative to equity investors.

The best way for token investors to understand the value of their holding is to interpret the change in token volume as a proxy for the demand of the associated product. The more popular the product, the higher the demand for the token, which should reflect an increasing volume of the token on the exchange.

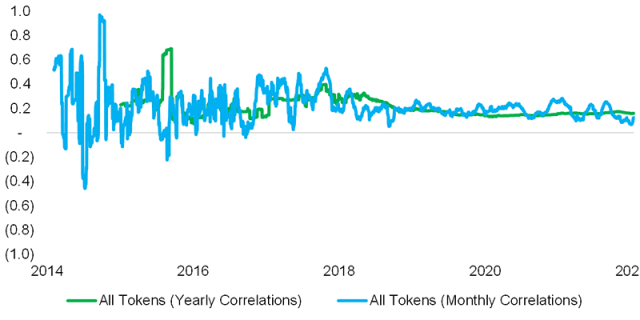

But that relationship doesn’t hold up under scrutiny. The rolling correlation between changes in token volume and token price across all tokens between 2014 and 2022, on both a monthly and annual basis, is close to zero. This indicates that there is no positive relationship between the business of the start-up and the price of its token.

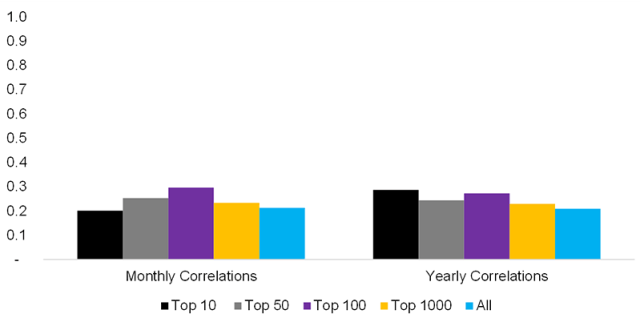

Token Price to Token Volume Correlations

But what about the correlation between token volume and the price for all tokens? The crypto space has its share of bad actors, and some token issuers may be more interested in fleecing underinformed investors than in building long-term businesses.

So, what if we limit our universe to only the most successful tokens by market capitalization: the top 1,000, the top 100, the top 50, and the top 10? The last of these categories has a combined market cap of approximately $100 billion and includes Chainlink and Uniswap. These tokens are associated with products that have some of the largest user bases in the crypto community. If they were normal companies, their equity would be quite valuable.

Again, the correlation between volume and price is negligible no matter how it’s measured. So, perhaps product and token have no bearing on one another in the crypto space.

But if product utility doesn’t drive token performance, what does? The obvious answer is speculation.

In cases like Shiba Inu, this is pretty obvious. SHIB is a meme token with no underlying product. At best, it is a gamble on other investors piling in and driving up the price. This represents speculation in its purest form. Investors are simply playing a game of musical chairs and betting that they will find a seat before the music stops.

Top Tokens Price and Volume Correlations, 2017 to 2022

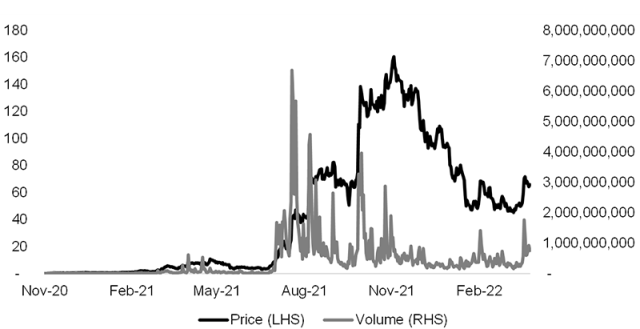

Axie Infinity provides a good case study of how this dynamic plays out. An online game in which players battle each other to earn tokens called Axie Infinity Shards (AXS), Axie Infinity became popular in 2021 as a source of income in such emerging markets as the Philippines and Venezuela. The token system, based on the Ethereum blockchain, was designed so that players must purchase digital pets called Axies with AXS in order to compete.

The price of an AXS token increased from $5 in May 2021 to a high of $160 in November 2021, before declining to around $47 as of this writing. The volume rose significantly when prices spiked in July 2021 but not during the AXS bull market in the six months thereafter. There were periods when the price and volume moved in tandem, but on average, the correlation was only moderately positive at 0.5.

Axie Infinity Shard (AXS) Price vs. Volume

Coin Price and Volume Correlations

But tokens are only one side of the crypto equation. What about coins? Do they exhibit the same dynamic? Theoretically, the price of both tokens and coins should be driven by their utilization. With tokens, the price should be determined by the business. But as we’ve seen, that relationship is hard to verify.

The price of coins, on the other hand, ought to depend on the number of transactions occurring on their associated blockchains. The more start-ups launch their tokens on Ethereum, presumably the greater the demand and the higher the prices for ETH coins.

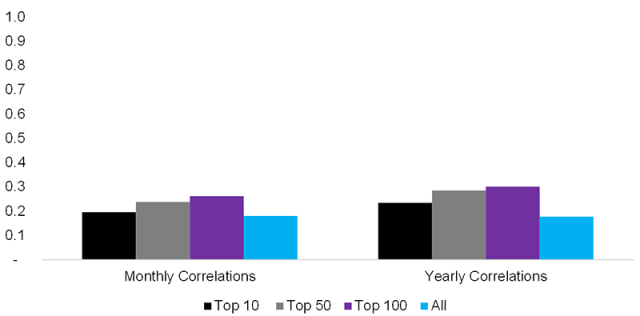

But again, the correlation between coin volume and price was just as low as it was for tokens. This suggests the utility of coins does not have a significant bearing on their prices either.

Coin Price and Coin Volume Correlations, 2014 to 2022

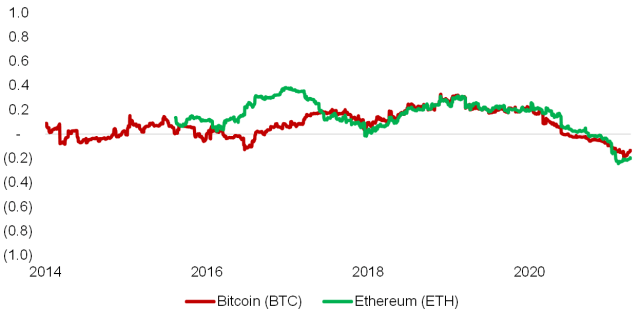

Maybe there’s no relationship between coins and their utilization via bitcoin (BTC) and Ethereum (ETH), the two coins with the largest market capitalizations of $900 billion and $400 billion, respectively. The correlations did not exceed 0.5 for either of these over the last six years.

Bitcoin and Ethereum: Price and Volume Correlations

Further Thoughts

Of course, the correlation between stock price and trading volume is also quite low, so the premise of this analysis is easy to challenge. Plenty of bear markets over the decades have seen the stock prices of companies with great fundamentals fall. Both tokens and stocks at times benefit and suffer from investor greed and fear.

So, what’s the difference between crypto and equity investing? The key distinction is that great companies can distribute earnings as dividends to shareholders regardless of the market environment. There is no parallel in cryptocurrency investing. There is also no equivalent of the buyout when equity investors are paid a premium for their shares.

Even worse, currency investing is a zero-sum game. For every investor who profits from a USD or BTC position, another loses the equivalent amount.

Fortunately for crypto investors, fiat currencies have been on the losing side of this trade for a while now. But that trend is unlikely to last long unless blockchains start providing more utility and become more than mere vehicles for speculation.

For more insights from Nicolas Rabener and the FactorResearch team, sign up for their email newsletter.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / TERADAT SANTIVIVUT

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.