[ad_1]

China’s central bank launched its first variable bond named “DR” in an effort to reinforce the pricing mechanism for financial markets.

Fundamental analysis: New product launched

Following the phasing out of the London Interbank Offered Rate (Libor), China decided to reform its benchmark rate framework, joining other global leaders.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

China’s central bank said its Depository-Institutions Repo Rate (DR) represents a key reference for monetary policy changes and market price-fixing.

Export-Import Bank of China placed a 3-billion-yuan ($458.94 million) bond with floating rates pinned to seven-day DR on auction. According to traders, the rate of the six-month bond was estimated at 2.6%, 44 basis higher compared to the benchmark.

Products like this are likely to enhance China’s benchmark interest rate system and improve monetary policy transmission, analysts said.

Furthermore, floating-rate bonds will likely help investors and issuers avoid volatility-induced risks, however, these instruments represent only 1% of China’s bond market as the majority uses Shibor as the benchmark.

Shibor is computed through banks’ price quotations whereas the DR is predicated on daily repo trading averaging 1.8 trillion yuan, and represents the most common “barometer” of the country’s banking system liquidity, the central bank said a few months ago.

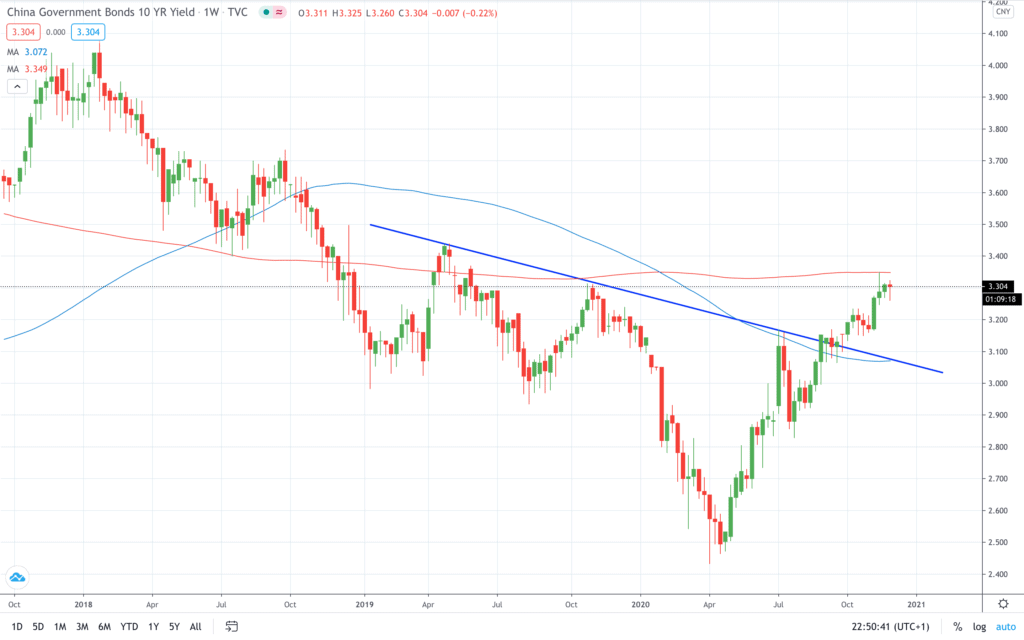

Technical analysis: 10-year heading higher

China 10-year yield has been in a continuous upward move since April. Last month, the price action hit 3.35%, the highest level recorded since May 2019.

A move above 3.15% also facilitated a break of the descending trend line that connects the lower highs. As seen in the chart above, the price action hit the 200-WMA, which is now acting as resistance.

Summary

China rolled out its first variable interest rate based on a key benchmark named “DR” as a part of the central bank’s effort to improve the pricing mechanism for financial markets.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Capital.com, simple, easy to use and regulated. Register here >

*Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

[ad_2]

Image and article originally from invezz.com. Read the original article here.