[ad_1]

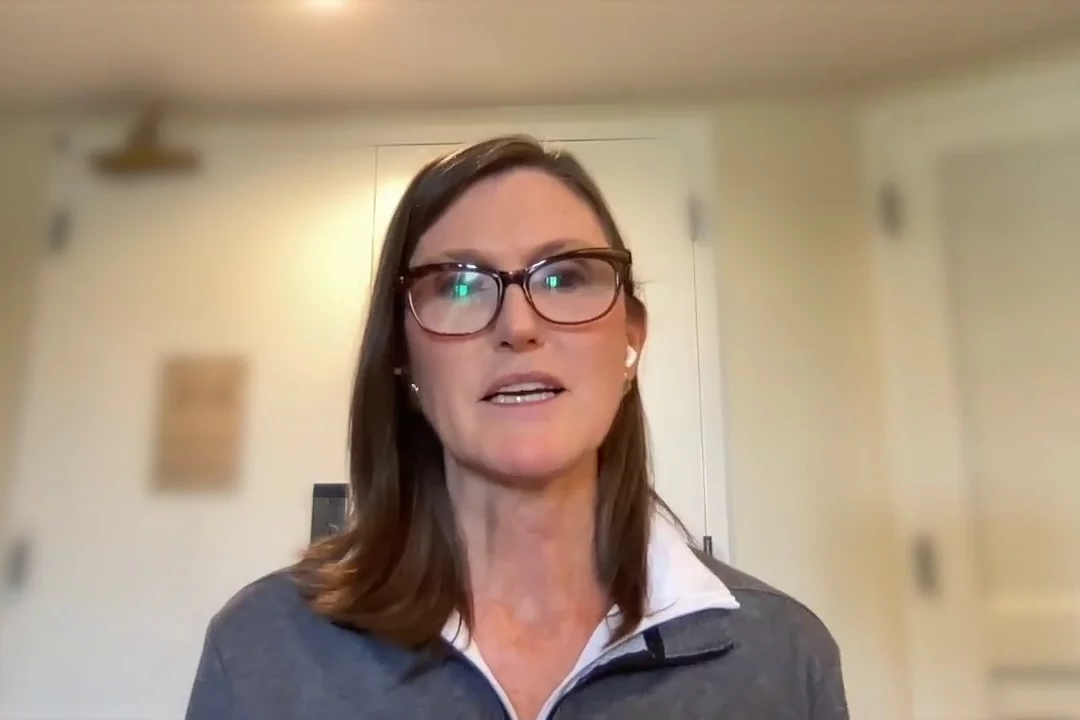

Ark Investment Management founder Cathie Wood, who has been highly critical of the Federal Reserve’s monetary policy stance, took to Twitter to offer her thoughts on Wednesday’s rate move.

What Happened: The Federal Reserve, under the chairmanship of Jerome Powell, on Wednesday raised the Fed funds rate by 75 basis points to 3-3.25%, in line with expectations, and signaled that it may not be done with the rate hikes yet.

“Most disappointing about the Fed’s decision today was its unanimity,” Wood said.

On Wednesday, all 12 voting members at the Federal Open Market Committee meeting backed the central bank’s rate-hike decision, an official statement showed.

Wood noted that none of the members was focused on the “significant deflation in the pipeline.”

The Ark founder has been sounding out warnings concerning potential deflation with evidence of falling prices for different items and commodities from their pre-COVID-19 levels.

“The Fed seems to be making decisions based on lagging indicators and analogies,” Wood said.

In the past, she has said the Fed is taking wrong cues from its former president Larry Summers’ team, which was forced to act aggressively following 15 years of inflation. The current inflationary environment is only two years old and was due to the supply-side shock engendered by the COVID-19 pandemic, Wood contended.

Backward Looking? Future Funds’ Gary Black said the central bank is looking backward as opposed to the market, which is forward-looking.

He noted that Powell himself admitted the Fed has based its decision on three-month, six-month, and 12-month trailing core inflation.

“The Fed has created the steepest yield curve inversion in 20 years, despite signs that core inflation peaked with COVID,” Black added.

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.