Wall Street icon Carl Icahn has a warning for his fellow investors: “The worst is yet to come.”

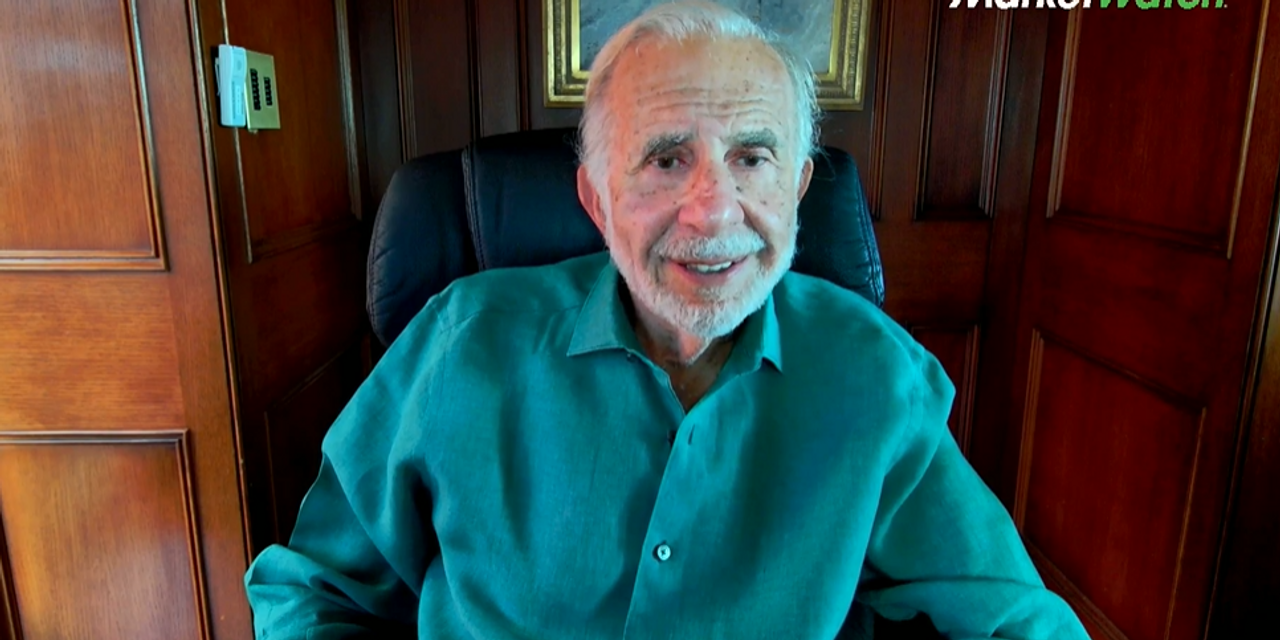

Speaking on Wednesday at MarketWatch’s Best New Ideas in Money Festival via a remote feed, the 86-year-old Icahn delivered that grim assessment of the economy, but also spoke of areas of opportunity for investors.

It’s not hard to see why the billionaire investor could offer such a pessimistic view: The stock market saw its worst first half of the year since 1970. But Icahn, whose career in finance goes back to 1961 and who has made his mark as an activist shareholder, has had a robust 2022 by contrast: The net asset value of his Icahn Enterprises increased by 30% in the first six months of 2022.

Icahn said that hedging strategies were key to his success. And he stressed that investors can still find stocks to buy.

“I think a lot of things are cheap, and they’re going to get cheaper,” he said, later pointing to companies in the oil-refining and fertilizer businesses — he mentioned CVR Energy

CVI,

in particular — as ones to watch.

Not surprisingly, Icahn said inflation was playing a significant role in the market’s downturn. “Inflation is a terrible thing,” he said, observing that it led to the downfall of the Roman Empire. “You can’t cure it.”

Icahn blamed federal outlays for the country’s current fiscal woes. “We printed up too much money, and just thought the party would never end. And the party’s over,” he said.

Icahn said he supported the Federal Reserve’s move on Wednesday to increase interest rates by 75 basis points in its ongoing bid to curb inflation. But he also thought the Fed could have been more aggressive, saying he would have supported a 100-point hike.

As for the recently approved Inflation Reduction Act and its aim to reduce carbon emissions, Icahn said he understood the need to curb carbon, but thought the legislation went too far. He likened it to a sick patient who is prescribed too much medication. If you “take 100 pills at once, you’ll die,” he said.

Still very much the activist shareholder, Icahn hammered home the idea that today’s companies need to be better run. “There’s no holding management accountable,” he said.

Joseph Adinolfi contributed to this story.

Get insights on investing and managing your finances. Speakers include investors Josh Brown and Vivek Ramaswamy; plus, topics such as ESG investing, EVs, space and fintech. The Best New Ideas in Money Festival continues Thursday. Register to attend in person or virtually.