[ad_1]

In this episode of NewsBTC’s all-new daily technical analysis videos, we are looking at the Bitcoin price monthly chart and the DXY Dollar Currency Index ahead of the monthly close.

Take a look at the video below.

VIDEO: Bitcoin Price Analysis (BTCUSD): August 30, 2022

We are coming down to the wire here in the month of August, with less than 48 hours remaining until the monthly candle close. The month is especially critical for a number of pivotal reasons of which we’ll review in the video and in the text and charts below.

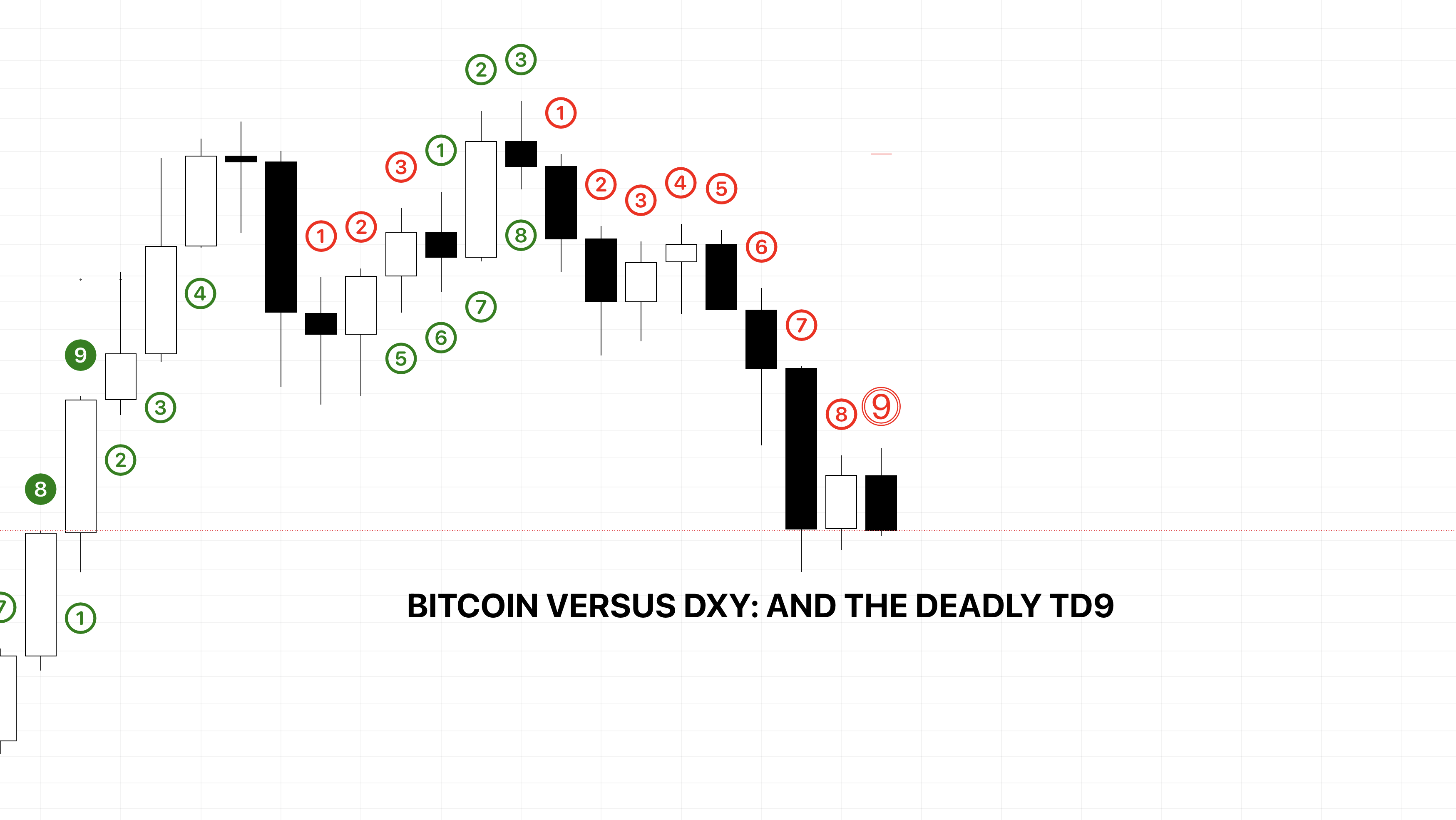

The Terrifying TD9 Buy Setup On Monthly Timeframes

The first and most important factor weighing over the next couple of days in the crypto market, is a looming TD9 buy setup. The TD Sequential is a market timing indicator. Simply reaching a 9-count is enough for a buy setup. However, the signal is much stronger when the series is perfected.

This can only happen with a sweep of the current low below around $17,500. It would also require a breakdown of all-time high resistance turned support and a breakdown of a decade-long monthly trend line.

A perfected TD9 setup would result in losing this trend line | Source: BTCUSD on TradingView.com

Could A Hidden Bullish Divergence Save The Day?

Bitcoin price continues to rest on the lower Bollinger Band – a first for the first ever cryptocurrency on the high timeframe chart. What we don’t want to see is price action close outside the lower band, which could lead to an explosive down-move.

Despite this risk, there are several signs that a bottom could also be in. The monthly momentum on the LMACD histogram and Relative Strength Index could be signaling a hidden bullish divergence. Stochastic is also nearing a turning point after reaching oversold conditions – another recurring bottom setup, especially when combined with a breakout of a downtrend resistance line.

Is this enough for a bottom? | Source: LTCBTC on TradingView.com

Or Will The DXY Defeat BTC Bulls Yet Again?

Remember, one half of the BTCUSD trading pair is the dollar. This means that when the dollar is strong, the BTC side of the trading pair takes a beating.

The best way to gauge the strength of the dollar is through the DXY – the dollar currency index – which is a weighted basket of top world currencies trading against the dollar. Much like Bitcoin price action is reaching oversold conditions with a possible hidden bullish divergence, the DXY is overbought and potentially forming a bearish divergence on each of the same indicators: RSI, LMACD, and Stoch.

Are dollar bears waiting for a chance to strike? | Source: LTCETH on TradingView.com

Comparing Currencies: Bitcoin Versus The Dollar

The similarities to the 2014 and 2015 bear market versus the most recent bear market in 2018, appear to be due to the dollar strength. The last time the DXY was this overbought was during what’s known as crypto’s worst bear market ever.

Plotting BTCUSD behind the DXY we can take a closer look at the possible correlation – or anti-correlation. The last extended up-move in the DXY is what led to such a lengthy bear phase in crypto. Interestingly, the Bitcoin plot at some points appears to be acting as dynamic support and resistance for the DXY, perhaps showing off an anti-correlated relationship through the trading pair.

Bitcoin has bottomed each time the DXY pushed above the BTCUSD plot line. Bear markets arrive during DXY upmoves, and Bitcoin performs well when DXY moves sideways, and the best when DXY is falling. With the DXY potentially at oversold conditions on the monthly timeframe, a pullback could be near or even a complete trend change that ultimately lifts Bitcoin out of its bear market.

Bitcoin has worked as dynamic support and resistance for the DXY chart | Source: BTCUSD on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading Course. Click here to access the free educational program.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

[ad_2]

Image and article originally from www.newsbtc.com. Read the original article here.