Berkshire Hathaway Inc. added positions in materials manufacturer Louisiana-Pacific Corp., investment bank Jefferies Financial Group and chip manufacturer Taiwan Semiconductor Manufacturing Co. Ltd. during the third quarter, according to a filing released after Monday’s closing bell.

The company’s latest 13-F filing revealed a new position in Louisiana-Pacific

LPX,

amounting to nearly 5.8 million shares, along with a new position in Jefferies

JEF,

of 433,558 shares.

Louisiana-Pacific shares were up more than 9% in after-hours trading Wednesday, while shares of Jefferies were up more than 4%.

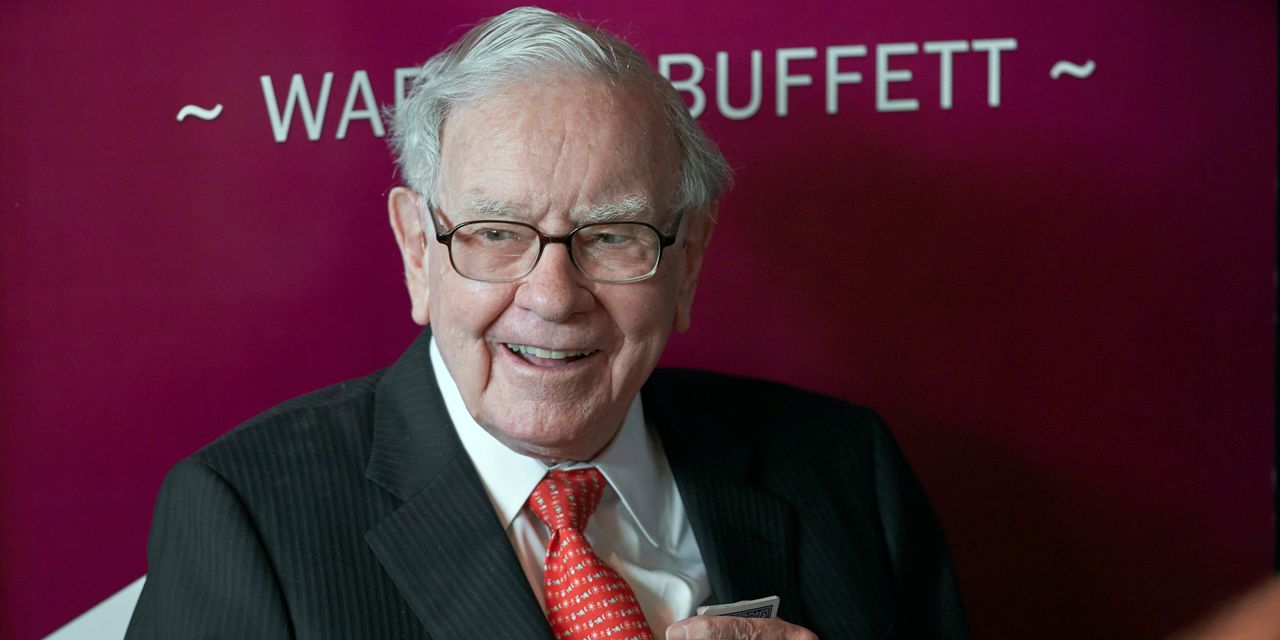

The Warren Buffett-led company also took a stake in TSMC

TSM,

during the third quarter. That amounted to just over 60 million shares of TSMC’s American depositary shares.

TSMC shares rose 6% in Monday’s aftermarket action, while its Taiwan-listed stock

2330,

surged more than 7% overnight.

The 13-F also showed that Berkshire

BRK.B,

BRK.A,

boosted its position in Paramount Global Inc.

PARA,

The company owned about 91 million shares of Paramount as of the third quarter, up from about 78 million shares as of the second quarter. Paramount’s stock rose more than 3% in after-hours trading.

Berkshire exited its position in Bank of New York Mellon Corp.

BK,

which had amounted to more than 72 million shares as of the second-quarter filing. Shares of the bank were off 1.3% in after-hours trading.

The company also trimmed positions in a number of names, including Activision Blizzard Inc.

ATVI,

and General Motors Co.

GM,