[ad_1]

by VotingIsForLosers

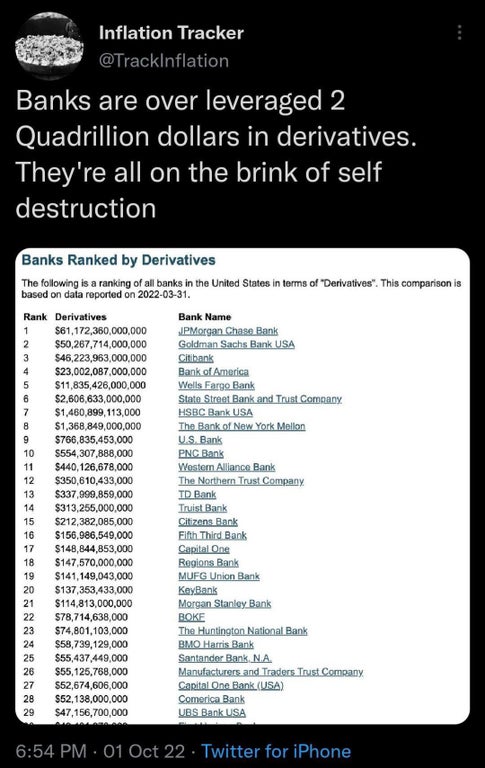

A derivative is a contract that derives its value and risk from a particular security (like a stock or commodity)—hence the name derivative. Derivatives are sometimes called secondary securities because they only exist as a result of primary securities like stocks, bonds, and commodities.

The four major types of derivative contracts are options, forwards, futures and swaps.

Banks use derivatives to hedge, to reduce the risks involved in the bank’s operations. For example, a bank’s financial profile might make it vulnerable to losses from changes in interest rates. The bank could purchase interest rate futures to protect itself.

Derivatives are a high-risk instrument. The volatile nature of derivatives can lead to huge losses. Moreover, the contracts are designed in such a way that it becomes very complicated for the investors to valuate them.

Both Credit Suisse and Deutsche Bank are rumoured to be on the brink of collapse.

They have 2.7 trillion in assets under management between them.

This could be our “Lehman” moment when shit REALLY breaks.

— Lark Davis (@TheCryptoLark) October 2, 2022

$600 Billion: What Lehman Brothers held in assets when they crashed and took the economy with them.

$2800 Billion: What Credit Suisse and Deutsche Bank control in AUM. 4.6x more.

Credit Suisse is at a ‘Critical Moment’ now, says the CEO.

What lies in store for the world?🧵 pic.twitter.com/VIaMU7dSLX

— Graham Stephan (@GrahamStephan) October 2, 2022

Famed investor Michael Burry delivered arguably his most dire warning about the current US economy to date late Thursday – suggesting he is concerned the ongoing downturn could be worse than the Great Recession.

Burry, the boss of Scion Asset Management, noted that one of his market analysts said his comments were “spooky” because he voiced his concerns on Sept. 29 – the anniversary of a 777.68-point drop in the Dow Jones Industrial Average in 2008 that ranked at the time as the largest single-day plunge in history.

“Today I wondered aloud if this could be worse than 2008,” Burry said in a now-deleted tweet. “What interest rates are doing, exchange rates globally, central banks seem reactionary and in [cover your a–] mode.”

The big crash is here. Mr. Bear Sterns is fine 2008, Jim Cramer says Credit Suisse is a great franchise as it goes down in flames.

Credit Suisse the current bagholder of Archego’s GME short positions is on the verge of collapse. 48 billion in shorts they owe they can’t close out.

Cramer said the same thing about Bear Stearns pic.twitter.com/8sI394Ds0c

— Wolf of My Street🏡 (@Ryan__Rigg) October 3, 2022

Home Prices Crash At Fastest Pace Since Lehman Bankruptcy

Global debt is going to implode if we continue to follow this path

Liquidity crunch on the way pic.twitter.com/vMdiktBZZK

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) October 3, 2022

If you think this crisis will be CS and DB driven you are a fucking doughnut. The AUM of the financial system is basically 60/40. The Stock-Bond Correlation Crisis that has been building for over 40 years is finally here. This recession will take years and destroy many lives.

— Wifey (@WifeyAlpha) October 3, 2022

Credit Suisse credit default swaps are far exceeding the highs seen during the Great Financial Crisis. pic.twitter.com/hF46dR6GtY

— Markets & Mayhem (@Mayhem4Markets) October 4, 2022

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.