[ad_1]

A few months ago, the Gordon and Betty Moore Foundation and SRI-Connect approached my employer Liberum to write a report on how animal pandemics can affect the global food system and what kind of risks investors need to be aware of.

One thing we should have learned from the COVID-19 pandemic is that there are risks out there that are much more likely to materialize than we think. Ironically, pandemics that affect animals are among these risks and their likelihood has substantially increased in recent years. Of course, thanks to a human pandemic, we didn’t notice.

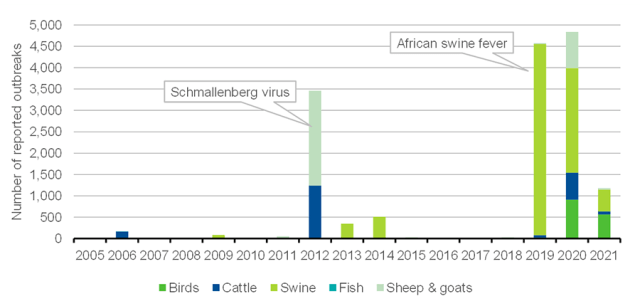

Most notably, thousands of outbreaks of African swine fever all over Asia and in parts of Europe over the last several years have severely affected the production of pork and — worst of all — bacon.

It is no accident that animal pandemics are becoming more common. As farming is increasingly industrialized, two trends contribute to the outbreak of pandemics in animals. First, deforestation and the growing sprawl of human settlements reduce natural habitats and bring people and farm animals into closer contact with wildlife. This makes the transmission of viruses from rats, bats, and other species to such domestic livestock as cows, swine, and chicken more likely.

Second, industrial farming is the world’s largest user of antibiotics, accounting for about two-thirds of the global total. This contributes to the emergence of antibiotic-resistant bacteria that can cause pandemic.

Reported Animal Pandemic Outbreaks

Since both of these trends are going to persist into the foreseeable future, it makes sense to investigate how such animal pandemics may disrupt the global food system. With that in mind, we looked at 266 global food companies, from food producers to food processors and retailers, and found some surprising results.

The full report is available to clients, but the big lesson is that when an animal pandemic hits, the results for investors are not pretty. Such pandemics easily reduce an affected company’s earnings by 10% to 20% and create share price declines of similar magnitude.

But the really fascinating insight was how these shocks reverberate through the global food system, from food producers to food retailers and restaurants. We found an outbreak of African swine fever creates higher prices for pork because much of the supply dies very suddenly. But if pork prices rise, how do consumers react? Do they shift to chicken or beef or pay more for plant-based protein?

It turns out that the substitution mechanism and thus the way the shock is transmitted through the food system depends heavily on the kind of animal affected by the pandemic. Because chicken is typically the cheapest form of meat, consumers do not have the financial means to switch from chicken to more expensive beef or fish when a pandemic hits. Instead, they have to trade down to plant-based proteins or switch to milk. This creates good times for producers of grains, rice, beans, etc., as well as milk. But meat producers and retailers and restaurants selling meat products suffer.

On the other hand, if pork prices rise, consumers tend to switch to beef. But because beef is slightly more expensive and pork prices rise as well, that cuts into their overall food budgets and they have to start saving in other areas. Most commonly, they reduce their consumption of fish and such “luxury” fruit and vegetables as coffee and cocoa. The end result is that in a swine pandemic, beef producers benefit while producers of these fruit and vegetables see their earnings and share prices decline.

To paraphrase George Orwell, Not all animals are created equal. Instead, investors can gain an advantage by being prepared for an outbreak of an animal pandemic and knowing how the shock may travel through the global food system.

As we learned last year, being prepared for a pandemic might not be of immediate importance, but it can make the difference between success and failure once an outbreak occurs.

For more from Joachim Klement, CFA, don’t miss Geo-Economics: The Interplay between Geopolitics, Economics, and Investments, 7 Mistakes Every Investor Makes (And How to Avoid Them), and Risk Profiling and Tolerance, and sign up for his Klement on Investing commentary.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / SeventyFour

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.