Advanced Micro Devices Inc. shares fell in the extended session Thursday after the chip maker cut its already conservative forecast because a drop in PC sales after two years of pandemic-driven sales appears worse than feared.

AMD

AMD,

shares fell as much as 4% after hours, following a 0.1% decline in the regular session to close at $67.85.

Late Thursday, the company forecast third-quarter revenue of about $5.6 billion with adjusted gross margin of 50%.

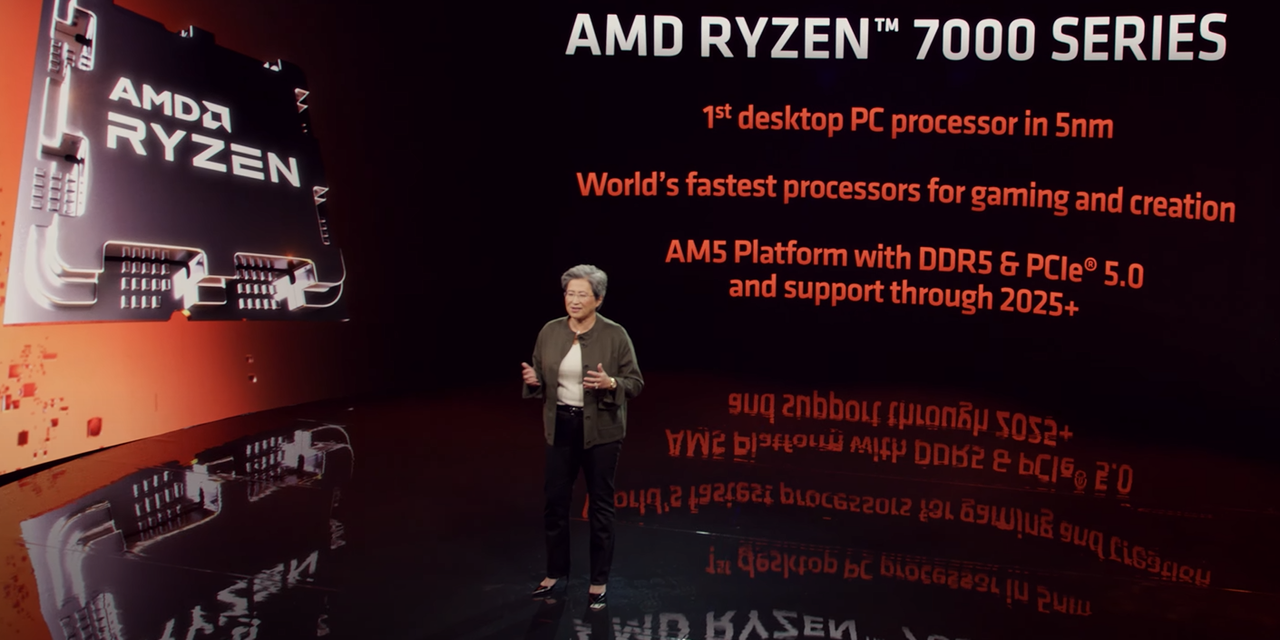

“The PC market weakened significantly in the quarter,” said Lisa Su, AMD’s chair and chief executive, in a statement. “While our product portfolio remains very strong, macroeconomic conditions drove lower-than-expected PC demand and a significant inventory correction across the PC supply chain.”

AMD expects a 40% drop in client sales to about $1 billion, compared with Wall Street’s consensus estimate of $2.04 billion.

In early August, AMD held firm on its revenue forecast of $26 billion to $26.6 billion for the year, and forecast third-quarter revenue of $6.5 billion to $6.9 billion, which at the time fell below the Wall Street consensus, and gross margins of 54%.

Analysts polled by FactSet currently forecast third-quarter revenue of $6.71 billion, and annual sales of $26.13 billion. AMD is scheduled to report quarterly earnings on Nov. 1.

“The gross-margin shortfall to expectations was primarily due to lower revenue driven by lower client processor unit shipments and average selling price,” AMD said. “In addition, the third-quarter results are expected to include approximately $160 million of charges primarily for inventory, pricing and related reserves in the graphics and client businesses.”

Last week, after Micron Technology Inc.

MU,

reported an “unprecedented” oversupply problem, analysts debated whether this supply glut was worse than the one in 2019 that the industry has tried to avoid this time around, following two-years of COVID-19-related demand and supply-chain difficulties.