[ad_1]

Investing in Artificial Intelligence (AI) vs. AI Investing

“AI will probably most likely lead to the end of the world, but in the meantime, there’ll be great companies.” — Sam Altman

If investors are looking for that one great AI company that will also end the world, then they should forget Alphabet or Amazon. I’d put my money on the Japanese firm Cyberdyne Inc. Why? Because it bears the same name as the company that created the Skynet AI in the Terminator films. Skynet fulfilled Altman’s prophecy before he made it, albeit on the silver screen, and wiped out human civilization.

The real Cyberdyne is naturally also in the business of creating robots. The stock hasn’t delivered great returns over the last few years, but if the company is anything like its fictional namesake, that is sure to change as its robots advance to Terminator level and work begins on Skynet.

Investors who want to harvest the benefits of AI without the risk of betting on a single company, even one with an alluring name, have a slew of exchange-traded funds (ETFs) to choose from that provide diversified exposure to AI, automation, and robotics companies.

But if investors want to go all in on this so-called fourth industrial revolution, they can forgo AI-focused companies altogether and have AIs directly manage their money.

So with all the buzz about AI, just how well have AI-focused companies and AI-managed ETFs performed?

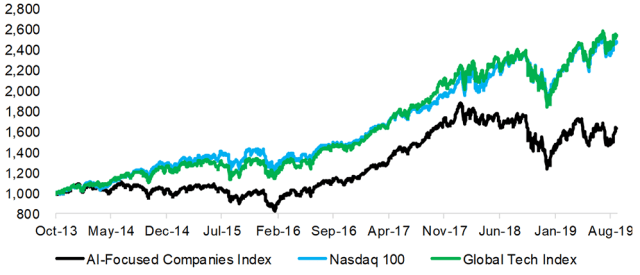

Benchmarking AI-Focused Companies

Despite all the hype about self-driving cars, the internet of things, virtual reality, robotics, and AI, investors have not allocated much capital specifically to these themes. AI and related ETFs in the United States have approximately $6 billion of assets under management (AUM), compared with the $3 trillion in US equity ETFs.

One reason for the lack of demand might be poor performance. An equal-weighted index of such thematic ETFs would have underperformed the NASDAQ and a global tech index by a considerable margin since 2013. And that’s before fees: These ETFs charge an average annual management fee of 78 basis points (bps) compared with 53 bps for all equity ETFs.

Investing into the Future: AI-Focused Companies

Sources: ETF.com, FactorResearch

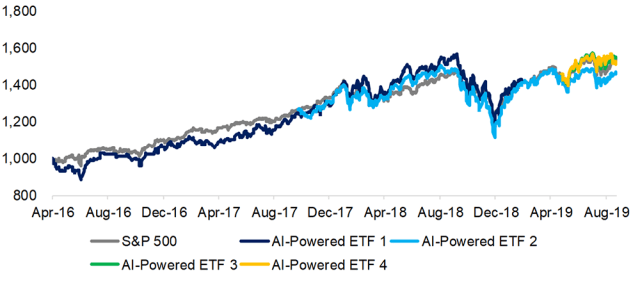

AI Investing

But maybe investors shouldn’t target AI-focused funds at all. Why not just let AI manage our money directly?

Unfortunately there are only a handful of ETFs in which investment decisions are executed by AI. The total AUM of this cohort? Just over $100 million. With an average yearly management fee of 0.77%, these AIs are surprisingly well-priced compared with human fund managers. We can only hope that they don’t notice.

But even with these low fees, investors have no more patience with AIs than with their human competitors and fire them just as easily. BUZ was the first ETF that used AI to gather sentiment data on US stocks. It closed down earlier this year, just three years after its launch, because of unsuccessful asset growth.

New AI-powered ETFs have launched in recent years, including one that uses IBM’s famous Watson AI. Most of these seek to beat US large-cap stocks. But it’s hard to find evidence that they are succeeding in this endeavor. It turns out it may be just as tough for an artificial intelligence to beat the market as it is for a human intelligence.

AI-Powered ETFs in the US Stock Market

Source:

FactorResearch

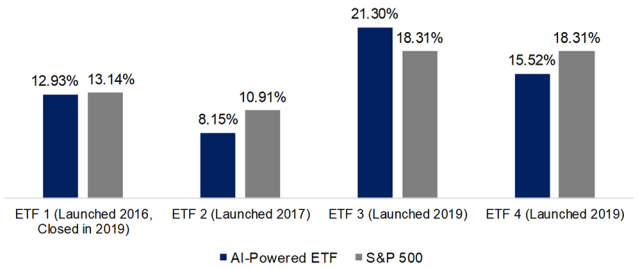

When benchmarked to the S&P 500, three out of four AI-powered ETFs underperformed.

Though two of these ETFs were launched this year and have a short trading history, it’s a stretch to assume that AIs would, like their human counterparts, require a full market cycle to generate outperformance.

Benchmarking AI Investment Skills: CAGRs

Source: FactorResearch

AI-Powered Hedge Funds

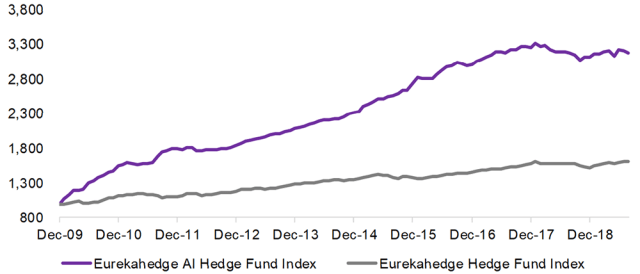

Perhaps the issue with AI-powered ETFs is that they are constrained to equities and long-only investing. AIs might need more flexibility to create value and unleash their full potential. And AI-powered hedge funds have significantly outperformed their benchmark since 2009, though they have underperformed this year.

AI-Powered Hedge Funds

Sources: Eurekahedge, FactorResearch

But caution is the watchword when it comes to hedge fund indices. They are prone to self-selection and backfilling: Only funds with enviable returns elect to become constituents. Some funds might generate negative returns once they are included in the index. When that happens, they tend to stop reporting.

The Eurekahedge AI Hedge Fund index currently has 14 members. Another 36 have been liquidated or refrain from further reporting. So successful fund selection is challenging, if possible at all.

In the case of AI-powered hedge funds, investors need to be even more cautious. The programmers and data scientists who create the AIs often don’t fully understand their behavior. So they remain black boxes, even to their creators, which is not a comforting feature to most investors.

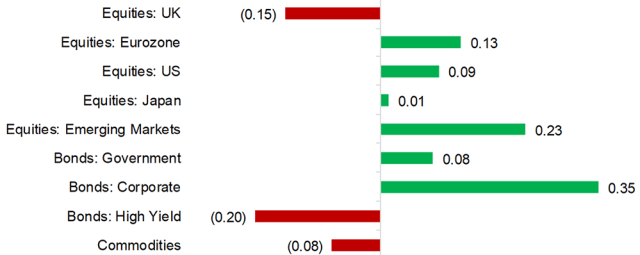

We can conduct a factor exposure analysis on the hedge fund portfolios. This demonstrates that AIs were recently bullish on eurozone and emerging market stocks, as well as corporate bonds, and bearish on UK stocks, high yield, and commodities.

Of course, this analysis can’t tell us why the AIs took these positions, and we can’t discuss their investment theses with them — at least not yet.

AI-Powered Hedge Funds: Factor Exposure Analysis

Source: FactorResearch

Further Thoughts

Across the globe, nearly every large investment firm has teams working on AI and machine learning technology. Many have already integrated these tools into their investment processes.

There have been successful applications of machine learning, say, to process big data in the form of billions of credit card transactions in order to spot trends in consumer spending. Such strategies might result in long and short positions in related companies.

Still, this hardly portends the revolution the AI proponents have predicted.

But maybe AI will transform the investment industry in a different way. Financial markets are noisy, and asset prices are influenced by many variables that interact in an open, complex system. This may prohibit prediction, regardless of the available computing power.

Since AIs are unlikely to develop egos anytime soon, it might make sense to relegate them to automating compliance and middle- and back-office functions that involve fewer variables.

It might be less exciting than actual investing, but it may also offer AIs more stable employment opportunities.

For more insights from Nicolas Rabener and the FactorResearch team, sign up for their email newsletter.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/ktsimage

Professional Learning for CFA Institute Members

Select articles are eligible for Professional Learning (PL) credit. Record credits easily using the CFA Institute Members App, available on iOS and Android.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.