[ad_1]

Sadly the world has for too long spent twenty pound ought and six with an income of only twenty pounds. Thus MISERY is coming without fail.

Contrary to what the wisest men and women in the land have told us, the world has been hit by the most vicious bout of inflation.

The “transitory” heads of the Fed and ECB clearly couldn’t recognise inflation until there was a scapegoat like Putin to blame it all on.

The fact that Powell, Lagarde and their predecessors had laid the perfect foundation not just for a small spell of price increases but for an unstoppable avalanche of global inflation, they were totally oblivious of.

NEITHER COVID NOR PUTIN IS THE CAUSE OF INFLATION

Let’s be very clear.

Covid didn’t create inflation.

Putin didn’t create inflation.

No, inflation is the result of governments’ and central banks’ irresponsible and totally irrational policy of believing that prosperity can be created out of thin air.

They don’t understand or at least choose not to understand that reckless creation of fake money that has zero value CREATES ZERO WEALTH.

Money in itself has ZERO value. Money is just a derivative that derives its value as a medium of exchange through the production of goods and services.

In simple terms, money that has derived value from anything but goods and services has ZERO value.

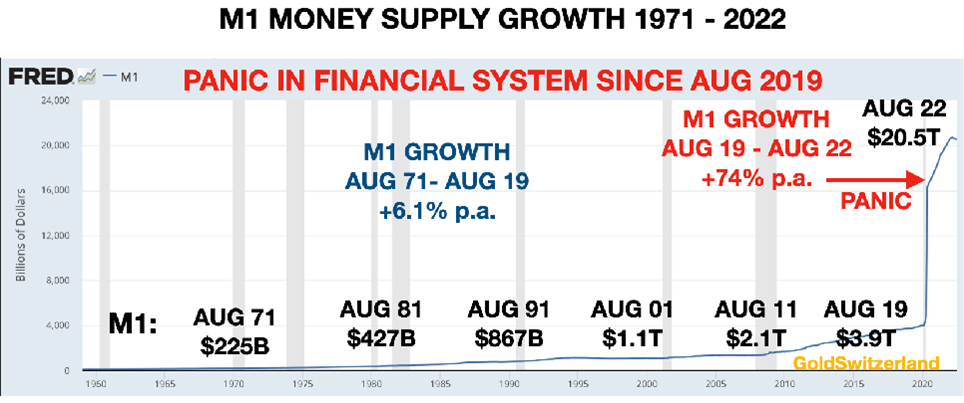

So the consequences of the rapid increase in credit since August 1971 (Nixon closed the gold window) and the exponential explosion in money supply since August 2019 are crystal clear.

GROWTH IN MONEY SUPPLY CREATES INFLATION

Between 1971 and 2019 M1 grew by 6.1% per annum. Contrary to what central bankers or ordinary people grasp, inflation doesn’t come from increases in prices but from the creation of credit (increase in money supply).

If total Money Supply is 100 and the central bank prints another 100 (with no good or service produced), prices for all goods will double and the value of money halve.

Between 1971 and 2019 (see chart below), a 6.1% annual growth in money supply led to prices doubling every 12 years.

But the 74% annual increase in M1 between 2019 and today has had catastrophic effects with the value of money halving every year.

And that is exactly what the world is starting to experience currently.

The world is now learning the hard way, the consequences of unlimited money printing and credit creation.

There had already been an epic price rise in asset prices such as stocks, bonds and property. But conveniently for governments, this type of inflation is excluded from the inflation figures.

So the arrival of a galloping and sustained inflation in consumer prices was 100% guaranteed whatever central bankers with forked tongues were telling us.

As I said above, it is not Putin or Covid who have caused the price increases but a catastrophic mismanagement of the economy by governments and central banks, spending money that they didn’t have.

“Everyone wants to live

at the expense of the

state. They forget

that the state wants

to live at the expense

of everyone.”

Frederic Bastiat

At the end of August 2019, the financial system could not cope with this eternal overspending and was on the verge of collapse. The whole problem was the overhang from the 2006-9 Great Financial Crisis when $10s of trillions were printed for a temporary rescue of a bankrupt financial system.

So on cue, the problems are back but this time of a magnitude that the world will not be able to cope with without considerable misery.

ENERGY IS THE KEY TO ECONOMIC GROWTH

Without energy the world cannot grow and what no government has understood is that the world has reached peak energy and this certainly cannot be rectified by 2030 (UN Agenda) or 2050 (Climate Change).

Neither Al gore nor Greta Thunberg are wizards that can reduce energy consumption. Their agenda is purely political and has zero understanding of the economic consequences of shutting down the energy systems needed to keep the world afloat for the next 30-75 years.

Carbon based fuels (oil, coal, natural gas) supply about 85% of the energy used in the world. The climate change advocates have managed to stop investments into fossil fuels decades before there are viable alternatives. Not only that, pipelines are closed down, nuclear plants shut and coal production banned in many countries.

Add to that the total imbalance in Europe with the very unwise and dangerous dependence on Russia and at the same time cutting off the hand that feeds them through sanctions etc.

What a mess!

So the Climate Change warriors believe they can limit the temperature increase to 1.5% by 2050. This is just a pipe dream with no scientific proof that makes sense. Although the programme itself could be seen as admirable, the consequences are not.

Actions always have consequences and erroneous actions will in the Climate Change case cause catastrophic consequences.

Firstly, the required stringent actions will not be taken by all the committed parties. Secondly, even if they were, they are unlikely to achieve the desired targets.

But much worse, closing down fossil fuel usage and production prematurely will lead to immeasurable damage to the world economy and therefore also to humanity. And this is likely to have much more serious consequences for the world than fossil fuels, especially in the next 30-75 years.

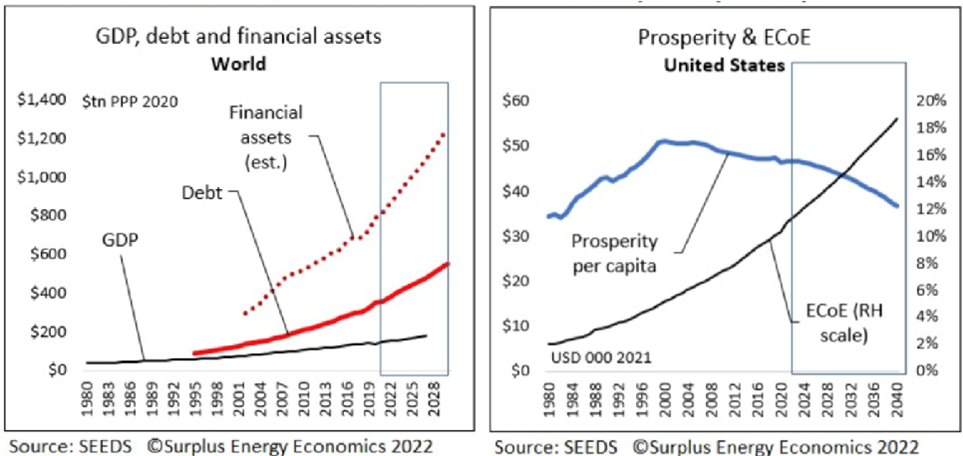

Tim Morgan of Surplus Energy Economics (Seeds) explains the dilemma of limited energy very clearly.

The basis of Seeds is that nothing can be produced without energy and thus the economy is an energy system. Also, the energy in the system is consumed to produce energy. That is called Energy Cost of Energy (ECoE).

As I mentioned above, money has no intrinsic value but is only a claim on the output of the material economy.

Most people think of the economy as a financial or monetary economy and this is a fallacy when it is really an energy based system for the production of goods and services.

The problem is that the Energy Cost of Energy today accounts for 80% energy use.

Thus we have a limited resource which today is in decline and we are trying to expand production infinitely without understanding that you can’t print energy.

Let me show a couple of graphs produced by SEEDS.

The chart on the left shows that global GPD growth could only be achieved with debt and financial assets growing exponentially.

The second chart shows that real prosperity per capita in the US peaked around the turn of the century. This graph also shows that the Economic Cost of Energy continues to grow until 2040 and beyond.

So the second graph shows a grim picture with projected declining prosperity due to the increase in the Economic Cost of Energy.

Thus scarce energy resources at an increasing cost does not bode well for the people’s prosperity.

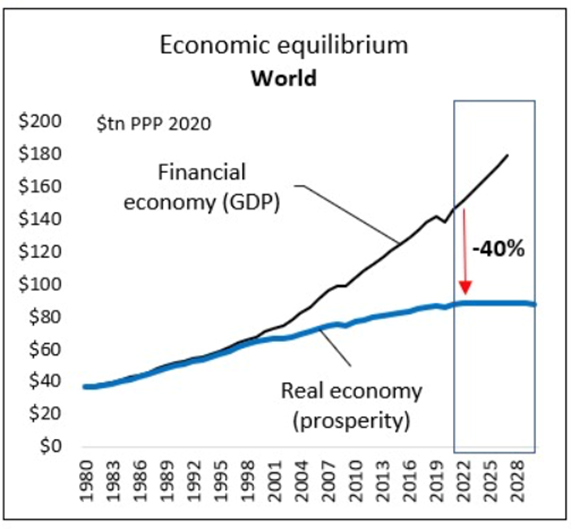

The final graph in this series shows the false Financial economy or GDP which needs printed and fake money to show growth (fake) compared to Real economy (prosperity).

As the graph shows, in 2022 the Financial economy need to implode by 40% to close the gap with the Real economy.

ASSETS WILL BE BOUGHT FOR A PENNY ON THE DOLLAR

As I have explained above, GDP or the financial economy is showing a fake growth due to the pricing of fake money with ZERO intrinsic value.

The coming RESET will involve the financial economy collapsing down to the level of the real economy to close the 40% gap.

As always is the case when bubbles burst, the fall will overshoot and crash considerably more than the 40% gap.

That will be the time to have REAL money or assets like gold and silver which will buy financial assets for a penny on the dollar.

GDP measured in gold

Another method to explain the real growth of GDP is to measure GDP in Gold which of over time reflects real terms.

First we see a period of a fixed gold price which ends in 1971. Thereafter gold rose substantially and then corrected until 2000 when gold say the next surge.

GDP measured in gold is now at the same level as in the mid 1970s. The gold price has not yet reflected the massive money creation in the last few years and I would expect GDP in Gold grams to reach the level of the 1930s at least.

CENTRAL BANKERS READING THE TEA LEAVES IN JACKSON HOLE

We have learnt that central bank chiefs know nothing or at least very little when it comes to managing the economy.

They keep interest rates at zero (Fed) or negative (ECB, BoJ etc) for around ten years and then print tens of trillions of dollars, euros, yen on top of that.

For a decade they don’t understand why there is no inflation in spite of this massive stimulus. They conveniently ignore the exponential price rises in stocks, bonds and property in their calculations.

And then abracadabra, almost overnight inflation goes from zero or negative to 5-6%. Well that can only be “transitory” they all say in a rehearsed unison. Our target is 2% and this is what inflation will soon reach, they said.

For ten years they couldn’t get it up to 2% and then when all of a sudden it jumps much higher they still believe they can get it back to the magic 2% quickly.

That 2% level is obviously plucked out of the air and has no economic relevance. In a sound economy, inflation should be zero with REAL growth of a couple of percent.

But Powell, Lagarde, Kuroda or any other CB head don’t know what a sound economy really means. For them “sound” means deficits, money printing, fake money, manipulation of stocks, interest rates, currencies and gold.

They have never experienced any other form of economy.

Now Powell is determined not to make a mistake again so he does what I have been predicting all along and thus the Fed is unlikely to “pause tightening soon”.

He also said that the Fed would “cool the economy for a sustained period”.

But an irrational market used to constant stimulus thought that one month’s fake inflation figure would be enough for a Fed reversal.

Any not too astute Fed observer should know that the Fed is always behind the curve and don’t understand that inflation is not transitory.

Take my word for it, inflation is here to stay and both inflation and interest rates will be much, much higher!

Traders forecasting reduction in rates in 2023 don’t understand what is happening.

MUCH WORSE THAN THE 1970s

I personally experienced high inflation and high rates in the UK for 10 years in the 1970s.

There was a Middle East Oil Crisis with oil surging, there was a coal miners strike and there was a 3 day working week as companies could only operate with electricity for 3 days.

Inflation peaked at 24% in 1975 and was above 10% for 8 years. My first mortgage reached 21%!

The circumstances now are considerably more dire than in the 1970s.

And the consequences will be exponentially worse.

Everything is more serious today, debts, deficits, size of asset bubbles in stocks, bonds and property.

And very importantly, this crisis is global. Virtually every single country in the world has the same problem. There is no one to bail out any country since every country in the world will need a bailout!

So rates will be high for years and so will inflation.

But conveniently no central banker mentions money printing but they soon will.

The world is definitely facing the crisis of a century and possibly of a millennium.

We know that governments’ and central banks’ coffers are empty. They have been for a few decades already.

ECONOMIES ON THE ROPES

We also know that the even before the crisis has started, the real economies in the US and Europe are already on the ropes.

In my last article I explained that the EU’s problems are of a magnitude that are beyond salvation . Italy and Greece are already basket cases and Germany is on the verge of becoming one.

And in the US, the real economy is crashing.

For example, House closings are the 2nd lowest ever and worst since 2007 (subprime crisis) and house sales are down 50% with evictions up 30%. More homeless, more misery.

Mortgage rates are 6% and increasing which is more than borrowers can afford.

Auto, home and student loan data are all horrible.

That means auto and housing lenders are in trouble and so are banks.

And as energy prices are surging, nobody can afford to pay their bills.

In Europe energy prices are up 10x in many areas – a tragedy in the making. Add to that food and car fuel inflation of 20% and more. Nobody can afford it.

In China the median house price is 36x median income. Nobody will repay their mortgage.

All this will of course lead to a major economic upheaval for the world as I discuss in this interview with Greg Hunter of USA Watchdog “The Era of Fake Money is Gone”.

So back to money printing:

Whilst the ECB and the Fed are committed to higher interest rates they are not saying that they won’t print money

But we must be prepared for the most massive money printing bonanza in history in a final but failed attempt to save the world.

All sectors of the economy, individuals, companies, banks, local governments etc will be in need of financial support of a magnitude never before seen in history.

But remember that what governments and central banks are doing will add ZERO intrinsic value to the economy. Instead they are creating more debt to get rid of a debt problem.

And don’t think that social security checks will be worth more than the paper they are written on. Don’t either believe that pensions will be worth anything.

Yes we are looking at a human disaster of proportions never seen before in history and that on a global scale.

STOCKS STARTING AN EPIC FALL

In my previous article I warned about a major stock market fall:

“Stock markets are now extremely near finishing the correction and will resume the downtrend in earnest. It is possible that the real falls in markets will wait until September but the risk is here now and very dangerous.”

Well the 1,000 point fall last Friday was right on cue.

The Dow can easily fall 10,000 points between now and October. But as I have stated many times, a bubble of this magnitude is likely to crash at least 75% and probably by 95% before it is finished.

INTEREST MARKETS TO CRASH

I doubt that central banks will be able to ever reduce rates in the coming cycle.

The combination of hyperinflation and defaults are likely to lead to lower bond prices and higher rates for many years.

And higher rates start another vicious cycle of more defaults and still higher rates that no now can afford to pay.

The risk of a total implosion of the system is at that point extremely high and quite likely.

GO FOR GOLD

Physical gold obviously won’t be the total remedy for the potential problems outlined above.

But as the monetary system makes its final move to ZERO, gold will most certainly be critical to hold as wealth preservation and insurance.

Still in a period of crisis, a circle of family and close friends is what will keep you alive and sound.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.