[ad_1]

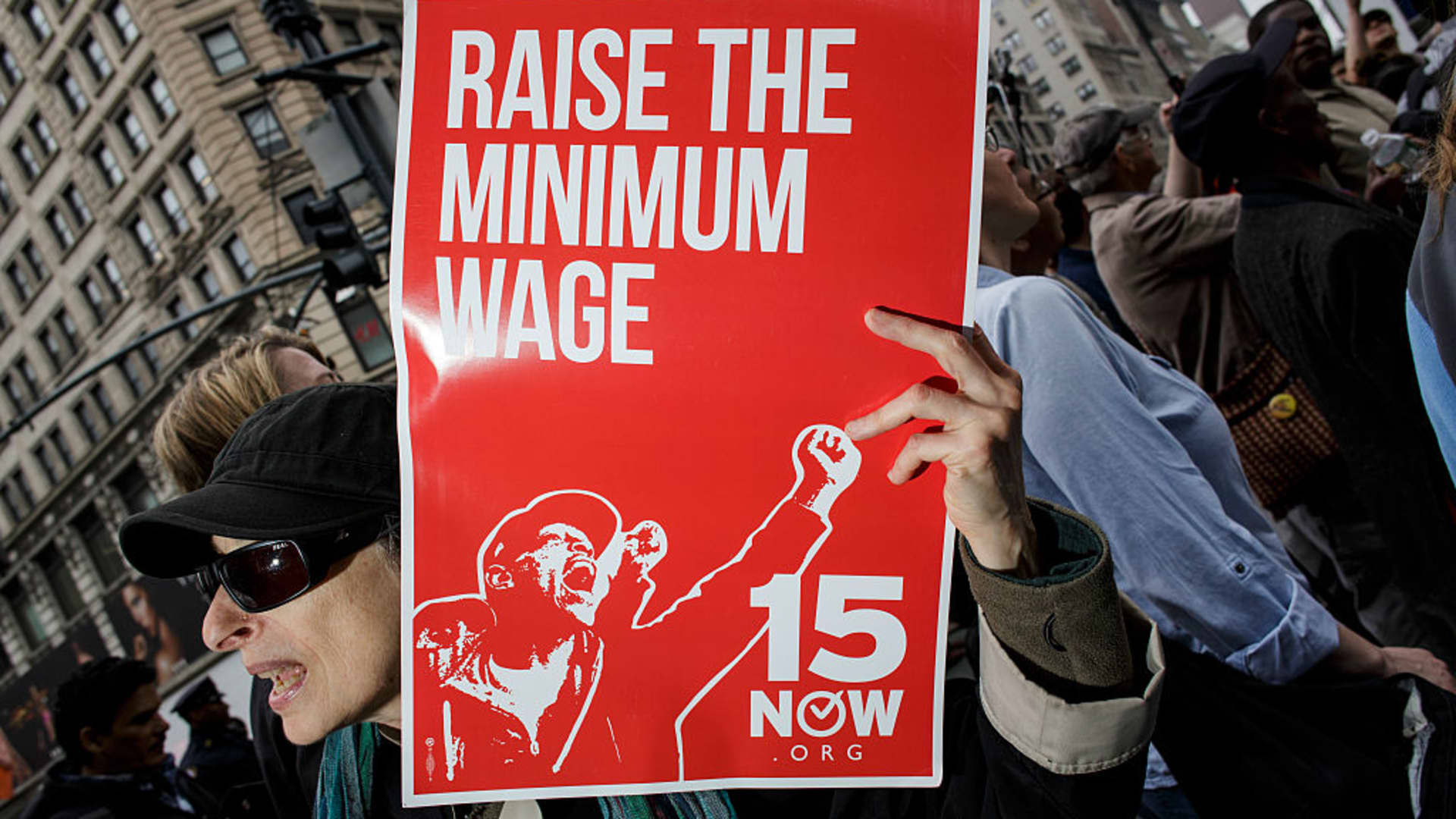

Fast-food workers and supporters fight to raise the minimum wage to $15 an hour.

James Leynse | Corbis Historical | Getty Images

The Biden administration seems to have pegged a student loan policy announced Wednesday to its broader push for a national $15-an-hour minimum wage.

The White House detailed a long-awaited plan to forgive up to $20,000 in federal student debt for borrowers, and extended a payment pause through the end of 2022.

But tucked into the broader package of policy measures were tweaks to “income-driven repayment plans.” These plans help make monthly payments more affordable for low-income borrowers.

The administration linked one of those tweaks — specifically, one relative to a definition of “non-discretionary” income — to a $15 minimum wage.

How student debt ties to a $15 minimum wage

“Non-discretionary” income is basically the income a household funnels into essentials like rent, mortgage payments and food.

For borrowers in income-driven plans, the government protects their non-discretionary income by exempting it from repayment. The amount is based on household annual income relative to the federal poverty line.

Under current rules, a borrower with income of less than 150% of the federal poverty level qualifies for a $0 monthly loan payment. In 2022, that equates to roughly $20,385 before tax for a single individual — about $9.80 an hour for a full-time worker.

President Biden proposed raising that threshold to 225% of the federal poverty level — about $30,577.50 of annual income, or $14.70 an hour.

The policy guarantees that “no borrower earning under 225% of the federal poverty level — about the annual equivalent of a $15 minimum wage for a single borrower — will have to make a monthly payment,” according to the U.S. Department of Education.

The policy — which applies to undergraduate student loans — means more borrowers in income-driven plans would qualify for a $0 monthly payment or owe a smaller monthly bill, according to student loan experts.

“These changes make things more affordable for borrowers and allow borrowers to avoid default,” according to Whitney Barkley-Denney, senior policy counsel at the Center for Responsible Lending.

Other changes to income-driven repayment plans

The administration also simultaneously announced other reforms to income-driven plans.

None of the measures are final yet. The Education Department is proposing regulations “in the coming days,” the agency said Wednesday. The public will have a 30-day window in which it can comment on the proposal, and then the Department would then use those comments to craft a final rule, which could differ from the proposal.

In addition to the higher “non-discretionary” income threshold, monthly payments for borrowers would be capped at 5% of income; that’d be half the current 10% cap.

It’s another way of continuing to push the idea that $15 should be the minimum wage.

Abigail Seldin

CEO of the Seldin/Haring-Smith Foundation

Barkley-Denney offered an example of how this would work for a one-person household:

Let’s say a borrower has an income of $60,000 in 2022. As noted above, the first $30,577.50 would be considered “non-discretionary” and therefore protected from repayment. The remaining $29,422.50 would be “discretionary” and used to calculate the borrower’s monthly payment.

The new rules would cap those payments at 5% of discretionary income — roughly $123 a month versus $245 a month under the current 10% maximum.

In addition, borrowers with original loan balances of $12,000 or less would have their debt erased after 10 years of consistent payments (even if that payment is $0 a month). That timeline is currently 20 years.

And interest won’t accrue on loans if borrowers make consistent monthly payments — meaning their balances won’t grow, unlike the dynamic with current income-driven repayment plans.

If these proposals survive as written, the reforms would be significant since they’d be a permanent fixture of the student-loan system, experts said.

“This is a systemic change,” Seldin said. “Debt forgiveness might be a one-time move.”

[ad_2]

Image and article originally from www.cnbc.com. Read the original article here.