[ad_1]

by Boo_Randy

Peter Schiff calling out what the MSM touts & shills are trying desperately to conceal from you:

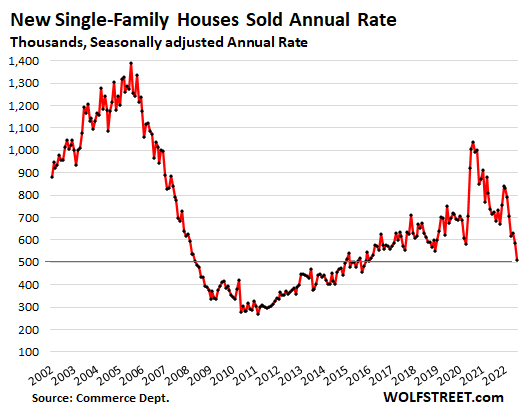

So the last time new homes were this unaffordable the nation had just experienced a financial crisis, the U.S. economy was in the worst recession since the Great Depression, and the S&P was at the bottom of a 48% bear market decline. Yet “experts” claim now the economy is strong.

— Peter Schiff (@PeterSchiff) August 23, 2022

The Numbers Don’t Lie; The Fed Won’t Win This Inflation Fight

The central bankers at the Federal Reserve continue to talk tough about fighting inflation. But is it a fight they can win?

The numbers say no.

After the CPI data cooled a bit in July, many observers expected the Fed to declare victory and begin pivoting away from tightening monetary policy. Instead, the central bankers doubled down on the tough talk. Minneapolis Federal Reserve Bank President Neel Kashkari said the Fed remains “far, far away from declaring victory” on inflation. He went on to say he hasn’t seen anything that changes the trajectory of the Fed’s inflation fight. Kaskari remained adamant that the central bank needs raise rates to 3.9% by the end of the year and to 4.4% by the end of 2023. He even insisted he won’t be deterred by a recession.

The markets seem to have faith in the Fed’s ability to bring inflation down to 2% and keep it there for most of the next 30 years. Peter Schiff said they are “living in fantasy land.”

There is no way the Fed is going to even come close to achieving that for 30 years. They’re not even going to achieve it for three years. Yet, investors are still operating under the delusion that the Federal Reserve can do what it claims it’s going to do.

Peter is right.

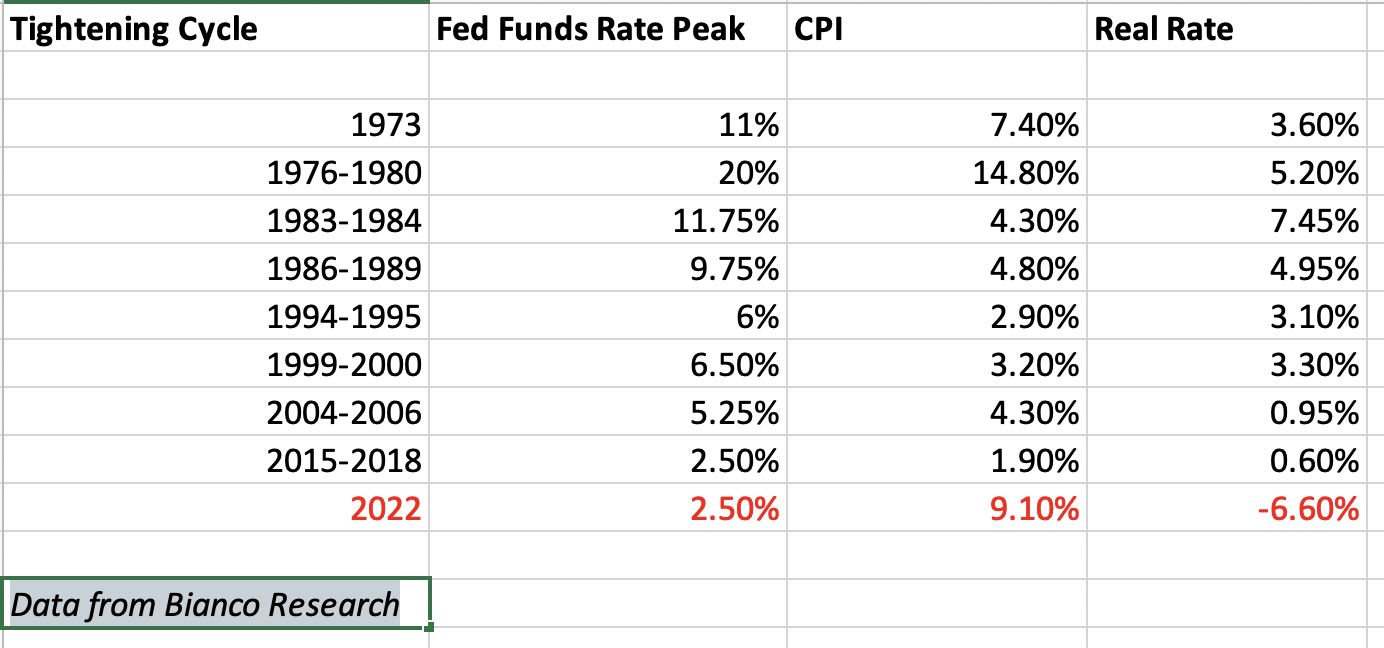

For all the tough talk about stopping inflation, the Fed’s plan isn’t enough. Pushing rates to 3 or 4 percent won’t tame 8.5% CPI.

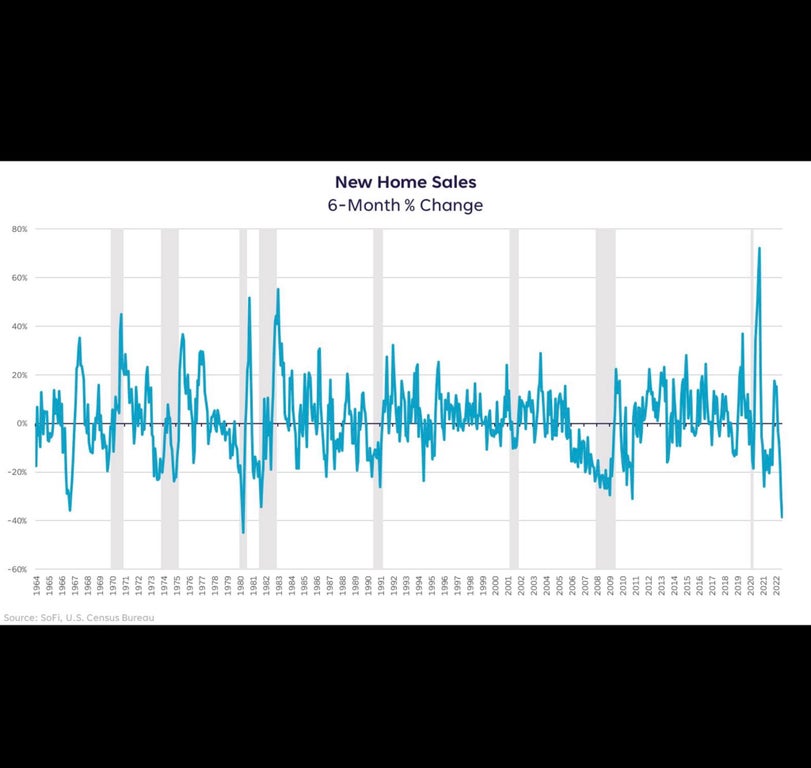

If you look at all of the Fed tightening cycles since 1973, the central bank has never stopped tightening before the Fed funds rate was higher than the CPI.

It’s clear from the chart that the Fed has a lot of tightening to do before it brings the real rate positive. It’s also clear that 3 or 4 percent isn’t going to get the job done.

Analyzing interest rates based on the Taylor Rule leads us to the same conclusion.

Economist John Taylor came up with a formula that links the Federal Reserve’s benchmark interest rate to levels of inflation and economic growth. Based on the Taylor Rule, the Fed fund rate needs to be 9.69% assuming 2% real neutral rates.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.