[ad_1]

Italy’s bond yields touched the highest mark in more than two months as investors weighed political developments in the country’s economy.

Fundamental analysis: Early elections?

The Prime Minister Giussepe Conte is close to stepping down from his duty, but hopes to establish a new government that could rely on a broader majority.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

Media reported that Conte’s resignation could be expected as early as Tuesday, after which he would establish a new coalition that would include centrist and “responsible” members of parliament.

Italy’s ruling parties claimed snap elections are the single way out of the current political deadlock, additionally weighing on the country’s bonds.

UniCredit bank analysts said the selloff in the country’s bonds suggests that investors have been taking profits after a robust performance of the debt market and increased uncertainty about the future.

“Our baseline scenario remains that there will be no early elections,” analysts said.

Some fundamental data indicators are pointing towards a challenging start of the year for the bloc’s economy.

“2021 feels like a continuation of 2020, so the themes are the same. Last year was about Covid, on the negative side and 2021 seems like that again but more about the exit,” said David Arnaud, a senior fund manager at Canada Life Asset Management.

Technical analysis: Yields soar on political instability

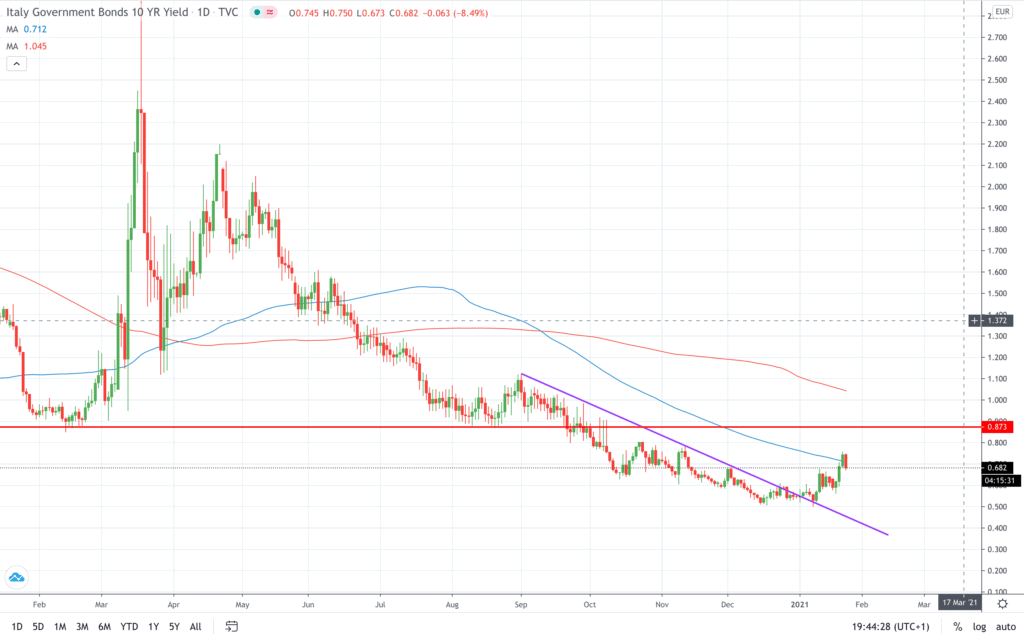

After touching new highs, the government’s 10-year yield fell today. The 10-year bond yield was last up 0.69%, around 10 bps higher than where it was last week. Friday’s high of 0.759 is the highest that a 10-year yield has traded since the mid-November.

On the other hand, broader eurozone yields stayed nearly unchanged, with Germany’s 10-year bond yield standing at -0.51%. Click here to learn more about bonds.

Summary

Italian bond yields hit two-and-a-half-month highs pressured by recent political developments in the country.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Capital.com, simple, easy to use and regulated. Register here >

*Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

[ad_2]

Image and article originally from invezz.com. Read the original article here.