[ad_1]

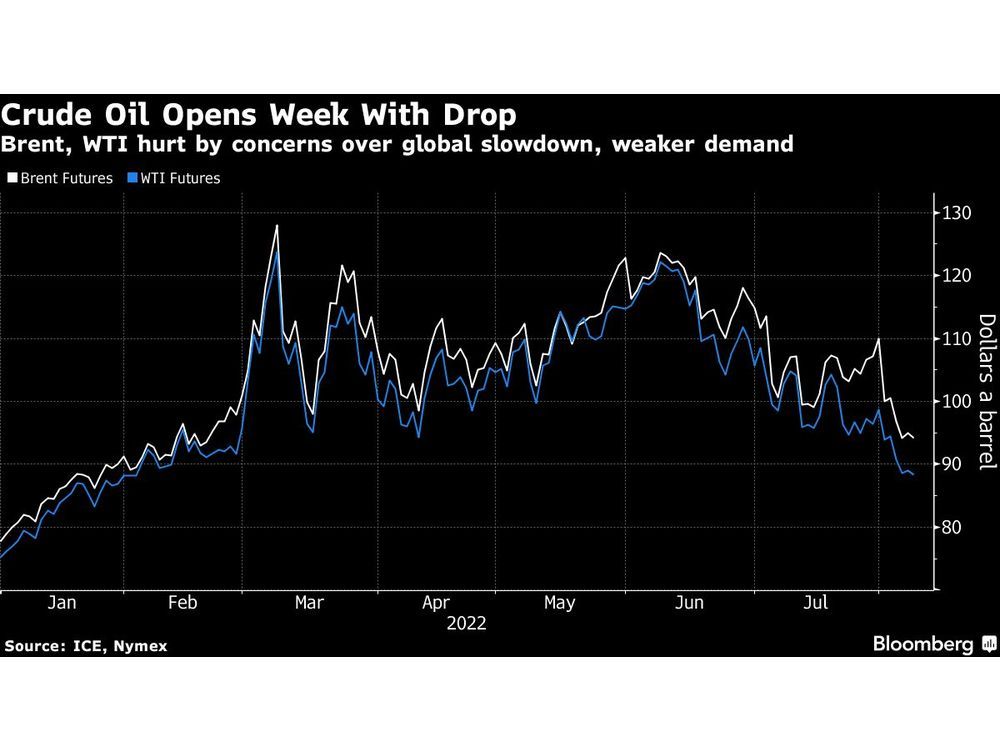

Oil fell as the week’s trading kicked off, extending the biggest weekly decline since April, amid persistent concern about weakening demand.

![601]5{gg}r19jg55rau060ao_media_dl_1.png](https://wealthstreetinvestor.com/wp-content/uploads/2022/08/Oil-Extends-10-Weekly-Drop-as-Demand-Concerns-Spur-Caution.jpg)

Article content

(Bloomberg) — Oil fell as the week’s trading kicked off, extending the biggest weekly decline since April, amid persistent concern about weakening demand.

Article content

West Texas Intermediate dropped toward $88 a barrel in early Asian trading after slumping by almost 10% last week on soft US gasoline consumption data. Investors have backed away from commodities in recent months as slowing growth feeds concern that energy usage will drop. That’s eroded liquidity.

Crude has had a roller-coaster ride in 2022, soaring in the opening months of the year following Russia’s invasion of Ukraine, then sinking from June onward as slowdown concerns gathered pace. Elevated inflation has prompted central banks including the Federal Reserve to jack up interest rates, with investors wagering that more hikes remain in store this half.

Oil is “down but not out,” Goldman Sachs Group Inc. analysts including Damien Courvalin said in an Aug. 7 note that both reduced the bank’s near-term price forecasts while making the case for a rebound. “We continue to expect that the oil market will remain in unsustainable deficits at current prices.”

Oil’s drop early Monday came despite data released at the weekend that showed China’s imports of crude rose in July from the lowest in four years as travel and transportation activity improved after Covid-19 curbs eased. Still, the country’s year-to-date total remains about 4% lower.

While oil markets remain in backwardation, a bullish pricing pattern, key differentials have narrowed in recent weeks, suggesting an easing of tightness. Brent’s prompt spread, the difference between its two nearest contracts was $1.69 a barrel on Monday, down from $3.56 a month ago.

[ad_2]

Image and article originally from financialpost.com. Read the original article here.