[ad_1]

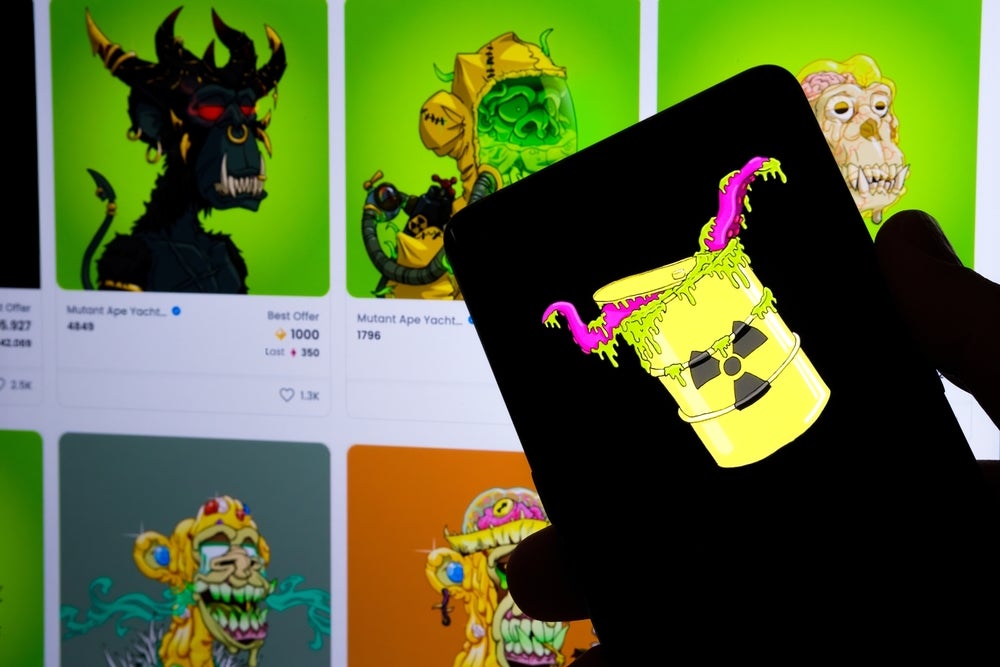

A Brooklyn-based federal court indicted Aurelien Michel for allegedly swindling users of the “Mutant Ape Planet” non-fungible token (NFT) project of $2.9 million.

What Happened: Michel is accused of assuring purchasers that their NFTs would gain greater worth, plus incentive rewards for holding them. In reality, it appears Michel misused the $2.9 million in user funds for his own benefit.

During subsequent talks with customers on social media, Michel confessed to “rugging” — an expression used when a programmer raises finances for a venture and then disappears with those assets — but insisted that it was caused by the divisive NFT community.

“We never intended to rug but the community went way too toxic,” Michel was quoted as saying according to a Department of Justice release.

See More: Best Crypto Day Trading Strategies

According to a Department of Justice statement, Ivan J. Arvelo, a Homeland Security special agent, declared that Michel has been badly accused of conducting a “rug pull” scheme, resulting in the deception of roughly $3 million from investors that he kept for himself.

People who bought Mutant Ape Planet NFTs believed they were investing in a trendsetting collectible item, yet they had been tricked and did not gain any of the anticipated benefits.

Michel, who is of French origin and hails from the United Arab Emirates, was apprehended at John F. Kennedy International Airport in New York.

Mutant Ape Planet is a collection of 7,000 non-fungible tokens which was launched on the Ethereum ETH/USD blockchain. At the time of launch in June 2022, the floor price was 0.05 ETH and has since fallen over 80% to 0.01 ETH.

Price Action: At the time of writing, ETH was trading at $1,253, down 0.11% in the last 24 hours.

Read Next: Genesis Billionaire-Backed Crypto Lender Axes 30% Of Jobs Months After Laying Off 20% Of Staff

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.