[ad_1]

Activism: An Escape Hatch for Active Managers?

Active fund managers today are like deer caught in the headlights of oncoming traffic.

The exchange-traded fund (ETF) industry is expanding its product range to all investment strategies and grabbing more and more market share from the mutual fund sector. In an important milestone, in August 2019, passive US equity funds surpassed their active counterparts in assets under management (AUM).

Active fund managers know they can’t compete with ETFs on cost. And achieving alpha in an increasingly competitive industry through fundamental analysis and other traditional tools is a prospect that grows dimmer with each passing day.

But active fund managers hold one trump card over the index funds, quants, and artificial intelligence (AI): They know company and industry fundamentals better than anyone. And that’s especially true of the sector specialists who have spent years debating strategy with management, touring company assets, learning about customers, and studying supply chains.

This knowledge may not be that useful in forecasting asset prices, but what if these managers applied it as activist investors?

To be sure, not every fund manager can transform themselves into an activist investor. But some may possess the requisite skillsets to make the leap. And whatever the odds, it beats watching ETFs continually erode their market share.

Of course, activist investing isn’t a new phenomenon, so fund managers may want to explore its track record before embarking on this path.

Trends in Shareholder Activism

Carl Icahn, Bill Ackman, Paul Singer, and other activist investors have become almost household names. The battles Ackman fought against Herbalife (and Icahn) or Singer against Argentina are the stuff of legend. Finance doesn’t get any more colorful than a company compiling secret dossiers on an activist investor or a hedge fund “seizing” a warship off the African coast after a court ruling.

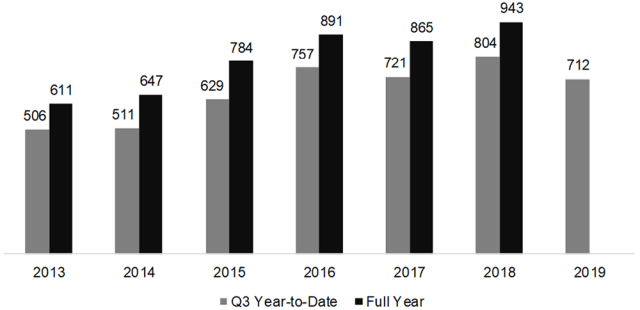

Such incidents aside, the number of companies targeted by activist campaigns has remained flat over the last four years. Although Japan, among other nations, has grown more shareholder-friendly, the environment for activist campaigns in most countries is distinctly unwelcoming. Therefore activist investing is largely confined to the United States.

Public Companies Targeted by Activist Investors across the Globe

As assets have flooded into passive, the structure of ETFs and index funds have made it more difficult for institutional investors to challenge company management. That’s where activist investors ought to come in: They are useful tools for policing stock markets.

Yet, just as the number of firms targeted by activists has remained flat, so too has the AUM of activist hedge funds: Despite the growth in ETFs and increased need for oversight of corporate management, these funds manage slightly fewer assets today than they did in 2014, according to data from Hedge Fund Research (HFR).

Long-Only Activist Investing

What explains the stagnation in AUM? Perhaps active investing’s all-around poor performance has tainted activist funds despite their otherwise laudable efforts to improve public companies.

But let’s take a closer look.

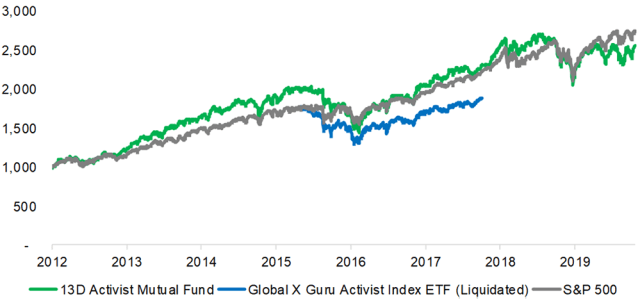

Launched in 2012, the 13D Activist Fund is a mutual fund that holds a concentrated portfolio of around 30 stocks targeted by activist investors. The Global X Guru Activist Index ETF was composed of 50 positions that well-known investors, such as Icahn or Ackman, had taken.

The 13D Activist Fund’s performed more or less in line with the S&P 500, while the ETF underperformed and was liquidated less than three years after its launch. Despite the activists’ efforts to force change on companies, these proxies for activist funds failed to outpace the market.

But these strategies entered positions based on public filings — after the activist campaign began — and therefore came to the game too late to benefit.

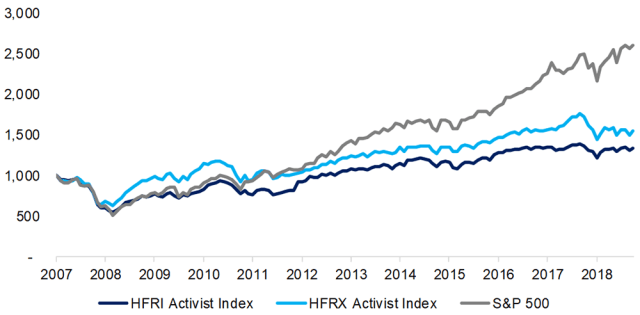

Activist Strategies vs. The S&P 500

Activist Hedge Funds

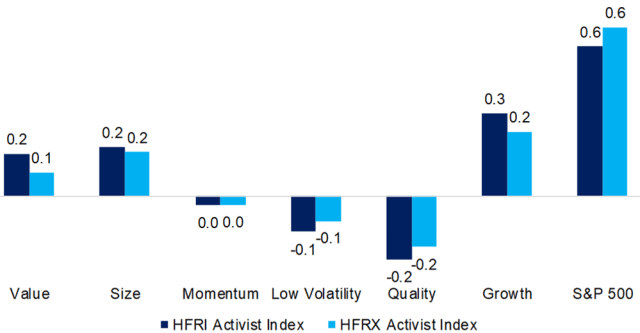

To understand the drivers of activist hedge fund performance, we conducted a simple factor exposure analysis on two benchmark indices from HFR. Most of the performance can be explained by stock market exposure. There is also meaningful exposure to value, size, quality, and growth factors.

That activist investors focus on cheap, small, and poor-quality stocks is intuitive. These companies are ripe for change, just like those that private equity investors target.

The exposure to the growth factor was more of a surprise. It indicates activists also pursue firms with strong sales and earnings growth. In these cases, strategy rather than restructuring would be the focus of discussion between the activist and management teams.

On the whole, activist investors target a wide range of firms. They don’t have any one particular type.

Activist Hedge Funds: Factor Exposure Analysis, Factor Betas, 2007–2019

In general, hedge funds should not be benchmarked against stock market indices like the S&P 500 since they might provide a hedge or invest in different asset classes. But with activist hedge funds, as per our factor exposure analysis, most returns are derived from the stock market. The global financial crisis (GFC) in 2008 to 2009 also demonstrates the lack of hedging: Activist hedge funds performed similarly to the S&P 500.

But how have activist hedge funds measured up in the long post-GFC bull market? Since 2009, they’ve underwhelmed, even on a risk-adjusted basis. Investors can live with hedge funds that generate lower returns than the stock market if risk is reduced as measured by volatility and drawdowns. But that was not the case for activist hedge funds. Moreover, due to a variety of biases, hedge fund indices have a tendency to overstate returns, which means their realized returns for allocators are likely to be even lower on average.

Activist Hedge Funds vs. The S&P 500

Further Thoughts

The market should reward activist investors for their efforts to improve public companies. But life is not fair and markets are tough to beat. The track records of activist investors make this clear. Why aren’t activists creating more shareholder value? That’s a challenging question for which we haven’t an answer.

Still, the overall message is clear. Mutual fund managers who don’t want to be run over by the ETF industry might think about applying their company and industry expertise as activist investors.

But it won’t be an easy path and may just mean exchanging one set of oncoming headlights for another.

For more insights from Nicolas Rabener and the FactorResearch team, sign up for their email newsletter.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/SCIEPRO/SCIENCE PHOTO LIBRARY

Professional Learning for CFA Institute Members

Select articles are eligible for Professional Learning (PL) credit. Record credits easily using the CFA Institute Members App, available on iOS and Android.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.