[ad_1]

Barbara’s first Rich Thinking® white paper on women and finance, based in part on a quantitative survey of 1,000 Canadian women, was self-published 10 years ago. For the next nine years, her research methodology was primarily interview based — she conducted more than 800 of them, in fact — and qualitative. From that dataset, she distilled the top three findings in November 2019.

Although 800 interviews collectively make up a robust and statistically useful data source, they span 10 years and the questions differ each year. So partly in honor of the first Rich Thinking paper and also to ask some more sweeping questions, Barbara and Duncan conducted a quantitative online survey designed by Çiğdem Penn of XSIGHTS.

The survey ran from 25 November 2019 to 31 December 2019, and we collected responses from over 200 women across 24 countries. About half of these women were aged 35–54, more than a quarter were 18–34, and 20% were 55 and up. The sample skewed educated: Only 5% had not completed some post-secondary education. About 30% had personal annual income of less than US$75K, 43% made US$125K or more, and just over a quarter were in between.

When Barbara started doing this research a decade ago, she wanted to bust several myths: that women didn’t invest because they were not confident/independent enough, that they were afraid of risk, and that they needed to be “educated” on how to invest. Her hunch at the time? That all three of these generalizations were not just slightly off, but totally backwards. And her interviews have since borne this out.

Sisters are doin’ it for themselves.

Just under two thirds of respondents said they make their investment decisions either entirely by themselves (26%) or mainly by themselves with some input from others (39%). Those numbers were even higher for non-investment financial decisions such as banking, loans, and mortgages: 50% of women make those decisions on their own, and 26% say they make them mainly on their own. That adds up to a combined three quarters of women!

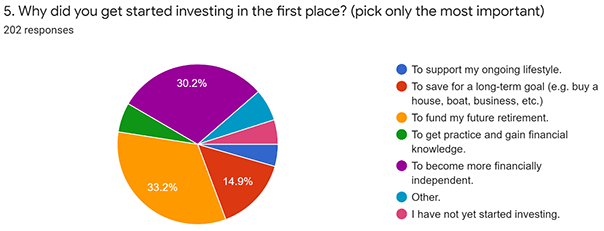

Our survey asked women to pick the top reason they began investing. The most common answer, chosen by one in three, was hardly a surprise: to fund their future retirement. But the second-place answer, selected by over 30%, was to become more financially independent. As Barbara pointed out in the 2017 article launching her seventh white paper, “You can’t be an independent woman without being a financially independent woman!”

Risky Business

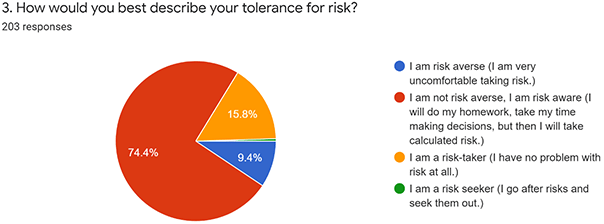

Perhaps things have changed in a decade, and perhaps Rich Thinking has been a part of that change. We hope so. But if it was ever true that women were excessively fearful about risk, it’s not true anymore. Fewer than one in 10 women said they were risk averse, while nearly three quarters said they were risk aware, not risk averse. And about 16% self-identified as risk taker and said they had no problem with risk at all.

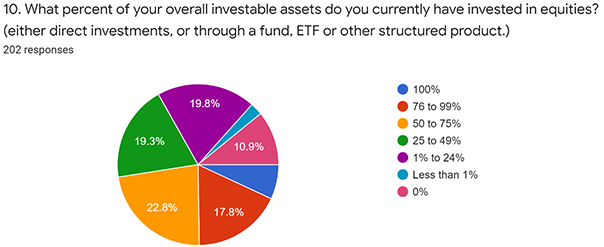

Given that equities are currently at all-time highs, this “risk-aware, not risk-averse” mindset shows up in asset allocation. Although women have historically been seen as badly underweight in equity investing, just under half of survey respondents indicated that more than 50% of their investable assets are currently in stocks, whether through shares, funds, or exchange-traded funds (ETFs), and a quarter say their equity exposure is over 75%.

We don’t need no education.

Men didn’t participate in this online survey, but after 20 years working for big, small, and medium investment firms run by them, Barbara knows that the traditional approach to getting people to start investing is to bombard them with charts, graphs, and books and to suggest they maybe take a course or three. And that works for some.

But only a fifth of survey respondents said they began investing because of a course (10%) or a book (9%). Most credited mentors (18%), family and friends (8%), or self-service online/social trading (18%). That said, there are many ways to get started: The survey gave respondents seven different pre-set responses, yet nearly 30% picked “Other.”

That women don’t need to read a book or take a course is good news: The top choice when we asked what path was most important for their investing success was “just get started investing as soon as possible,” with nearly half (45%) of all respondents picking this answer.

As a new decade begins, both measured by Rich Thinking reports as well as the Western calendar, we are excited to see how women and finance will change further

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/d3sign

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.