[ad_1]

Capital markets suffered a difficult year in 2022. Amid an inflationary bear market, the traditional investing playbook proved woefully inadequate. The NASDAQ and high-yield debt, the darlings of yesteryear, have, with few exceptions, fallen from grace. US Treasuries, the most common hedge against stock volatility, have suffered their worst drawdown in at least the last 70 years — and it’s not even close.

10-Year US Treasury Drawdown

Times such as these are good opportunities for reflection. Portfolio managers and allocators have to build diverse portfolios that balance growth and capital risk over an intermediate-to-long time horizon. Treasuries have traditionally filled the role of diversifier and risk-off asset. But what if they become less effective hedges against risk assets? Portfolio construction could look very different. That’s why we need to ask the question: If Treasuries no longer fulfill their traditional role, what other strategies or asset classes can enhance diversification and deliver consistent returns?

Managed futures may be just such an asset class — one with the potential for attractive performance, especially amid high volatility.

The Trend Is Your Friend

John Lintner, a co-creator of the capital asset pricing model (CAPM), can inform and motivate our exploration. In The Potential Role of Managed Commodity-Financial Futures Accounts (and/or Funds) in Portfolios of Stocks and Bonds, he wrote:

“Indeed, the improvements from holding efficiently selected portfolios of managed [futures] accounts or funds are so large — and the correlations between the returns on the futures portfolios and those on the stock and bond portfolios are surprisingly low (sometimes even negative) — that the return/risk trade-offs provided by augmented portfolios consisting partly of funds invested with appropriate groups of futures managers . . . combined with funds invested in portfolios of stocks alone (or in mixed portfolios of stocks and bonds), clearly dominate the trade-offs available from portfolios of stocks alone (or from portfolios of stocks and bonds). Moreover, they do so by very considerable margins.

“The combined portfolios of stocks (or stocks and bonds) after including judicious investments in appropriately selected sub-portfolios of investments in managed futures accounts . . . show substantially less risk at every possible level of expected return than portfolios of stock (or stocks and bonds) alone. This is the essence of the ‘potential role’ of managed futures accounts (or funds) as a supplement to stock and bond portfolios suggested in the title of this paper.

“Finally, all the above conclusions continue to hold when returns are measured in real as well as in nominal terms, and also when returns are adjusted for the risk-free rate on Treasury bills.”

This passage offers several tantalizing clues on the possible role managed futures could play in a portfolio: They may improve the risk/return profile of stock and bond portfolios, exhibit meaningfully low correlation with these traditional assets, and improve returns on both an absolute and risk-adjusted basis. Let’s evaluate each of these claims in turn.

The Economic Rationale

The primary driver of returns for managed futures is trend-following or momentum investing — buying assets that have recently risen and selling or shorting assets that have recently declined. These strategies are typically applied to liquid futures contracts across equity indices, interest rates, commodities (energy, agricultural, and industrial), and currencies, among other markets. Since most investors have no commodities or FX exposure, even from the simple perspective of traded instruments, managed futures could introduce new sources of risk and return.

Momentum investing has a rich academic history and is recognized as an essential factor that can explain stock portfolio performance. Trend-following is similarly robust. Brian K. Hurst, Yao Hua Ooi, and Lasse H. Pedersen analyzed a time-series momentum strategy over 137 years and found that it performed well across different macroeconomic environments and tended to outperform during times of macro-stress.

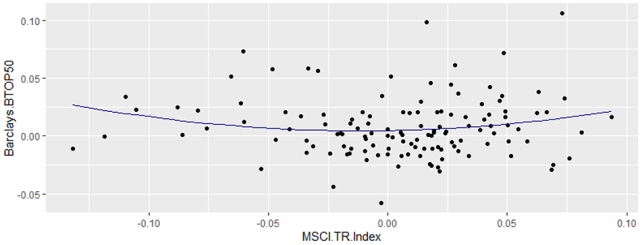

The Barclays BTOP50 Index (BTOP50) seeks to replicate the all-around composition of the managed futures industry in trading style and overall market exposure. The chart below depicts BTOP50’s quarterly returns from January 1990 to April 2022 relative to those of the MSCI World Index and features the fitted line for a second-degree polynomial. The plot shows a distinctive “smile” characteristic of trend-followers. This suggests that managed futures strategies tend to be “long volatility” and outperform in both extreme up and down markets.

Barclays BTOP50 vs. MSCI World Index

Set Up and Approach

The BTOP50 serves as our benchmark for the performance of managed futures strategies. We calculate returns and summary statistics either on a monthly or quarterly basis over the January 1990 to April 2022 observation period.

Stylized Facts

The summary statistics for the BTOP50 along with indices for other key asset classes are presented in the table below and are derived from quarterly total return data. Confidence intervals (95%) for skew and excess kurtosis are shown in parentheses.

| Barclay’s BTOP50 | MSCI World Total Return Index |

10-Year Treasury Total Return Index |

ICE BofA Corp Total Return Index |

US Dollar (DXY) | Goldman Sachs Commodity Index |

|

| Median | 1.51% | 2.24% | 1.51% | 1.59% | 0.13% | 1.81% |

| Mean | 1.45% | 2.96% | 1.30% | 1.55% | 0.27% | 1.55% |

| Volatility | 4.27% | 8.32% | 3.84% | 2.83% | 4.23% | 12.68% |

| Skew | 0.771 | -0.569 (-.967, -.199) | 0.224 (-.112, .619) | -0.147 (-.807, .544) | 0.285 (-.086, .802) | -0.275 (-1.143, .717) |

| Excess Kurtosis | 1.815 (-.209, 5.82) | 0.728 (-, 1.786) |

-0.1085 (-.538, .790) | 1.471 (.512, 2.86) | 0.2367 (-3.91, 2.005) | 2.2816 (.962, 4458) |

| Shapiro-Wilk Test | <.0001; Reject | <.0001; Reject | .5627; Fail to Reject | .0253; Reject | .7556; Fail to Reject | .0014; Reject |

According to the data, managed futures have, on average, produced positive returns and exhibited approximately half the volatility of global stocks over the last 32 years. The 95% confidence interval for skew suggests that the BTOP50 has distinctly positive skewness, which is unique among the asset classes in our analysis. Even “safe-haven assets,” like US Treasuries and the US dollar, during risk-off periods do not exhibit statistically significant positive skewness.

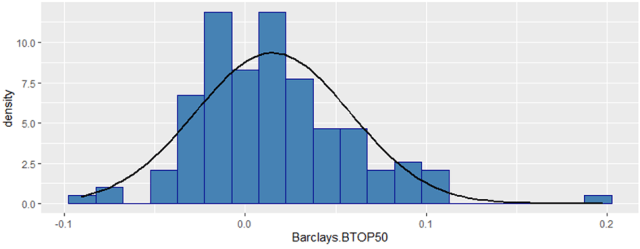

The visual evidence of this effect is illustrated in the histogram below. The confidence interval for excess kurtosis isn’t quite conclusive at the 95% level, but it still implies heavy tails for the BTOP50. Moreover, the Shapiro-Wilk test disproves the hypothesis of normally distributed returns. The Shapiro-Wilk fails, however, to reject normality for 10-year Treasury and DXY returns. That indicates that these series are relatively well behaved.

Barclays BTOP50 Quarterly Returns Distribution

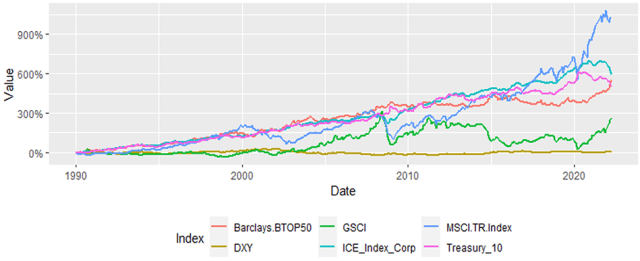

The cumulative return of the BTOP50 and comparative assets over the sample period are presented in the following chart. The BTOP50, our managed futures proxy, is the third-best performing asset class, slightly edging out Treasuries and falling just shy of investment-grade corporates. Over the 1990 to 2010 subperiod, which features the dot-com bubble and the global financial crisis (GFC), trend-following was the top performer largely because the strategy avoided both these large drawdown events and actually posted positive returns in 2008 and 2009.

Index Cumulative Return

However, since then — and until fairly recently — strategies built to profit from price trends have struggled. Since the GFC, markets have lagged below their historical norm. This presents a challenge to trend-followers. The underperformance of the 2010s period may be due in part to the deluge of money that flooded into a historic bull market. A period of mean reversion was inevitable.

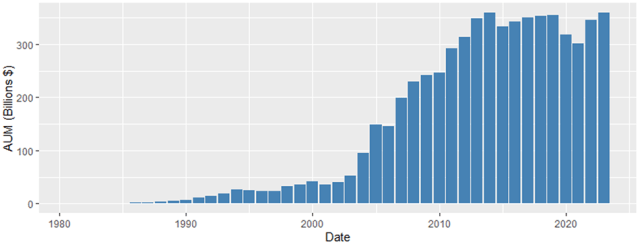

Managed Futures AUM (Billions $)

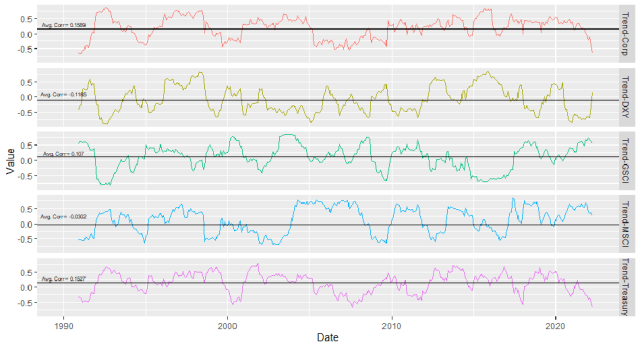

Another critical aspect of managed futures, according to the cumulative return plot, is the low correlation they have with the other “traditional” asset classes. The chart below details the rolling 12-month correlation of the BTOP50 with the five other asset classes. The solid black line in each plot shows the average correlation over the entire observation period.

BTOP50 and Other Asset Classes : Rolling 12-Month Correlations

While the correlations vary over time, trend-following demonstrates structurally low correlation with the other asset classes. Let’s examine each series in turn. The correlation with equities is statistically indistinguishable from zero. Equities are often the most risky asset in diversified portfolios, which is why they are often hedged with assets that perform well when stocks struggle. Over the past 20-plus years, Treasuries have filled this role and, up until 2022, performed it well. But 2022 revealed significant gaps in portfolios that rely solely on bonds for downside protection. Amid today’s high-inflation, sagging growth, and high volatility, trend-followers have excelled. When it comes to diversification, managed futures have done exceedingly well.

When Things Get Extreme

Between the smile-plot and correlation diagram, we are building the case that managed futures have a very important role to play in portfolio construction. Specifically, managed futures strategies have produced consistently positive returns across market regimes and perform particularly well in the tails. Let’s dig a little deeper into this latter point.

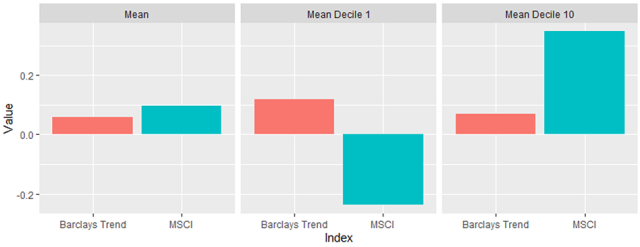

The first panel in the plot below shows the average rolling 12-month return for the BTOP50 and MSCI World over the full sample period. The MSCI World has provided an average return of ~9.75% since 1990, while the BTOP50 has returned ~5.80%. Over a long enough time interval, the series with the highest expected return will probably outperform all other assets. However, as the cumulative return plot demonstrates, the path to such returns will likely be punctuated by possibly long periods of significant underperformance and volatility.

In the second and third panels, we sort the returns into deciles based on the MSCI World’s performance and demonstrate how managed futures fare when the MSCI World did particularly well or poorly. The third panel reveals the average 12-month return for the 10th and best decile. During periods of “good” returns for the MSCI, the average top decile return for the MSCI World is a very good ~34%. On the other hand, the average return for top-decile managed futures is only ~7%. So, when equity markets are in a real bull run, stocks are by far the best investment.

The second panel shows the average 12-month return for the first and worst decile. During periods of “bad” returns for MSCI, the average bottom decile return is approximately –24%, while the average return for managed futures is a positive ~12%. This is the critical point: Managed futures have a positive expectation in both up and down markets, but it is in down markets when their hedging benefits are strongest: Just when they’re needed most.

Mean 12-Month Return by Decile

Now, simple averages are one thing, but what about the extreme cases? The next chart depicts the maximum and minimum return for the top and bottom deciles of the MSCI World and the corresponding performance of the BTOP50.

Maximum and Minimum 12-Month Return by Deciles

The second panel shows the maximum return for the 10th and top-performing decile. During its best 12-month return period since 1990, the MSCI World returned ~55% while the BTOP put up ~24%. In a ripping bull market, managed futures can produce solid returns, though they ultimately won’t keep pace with stocks. Since the BTOP50 has much lower volatility, this is hardly a surprise.

The first and third panels visualize the “bad times” for stocks. The first shows the maximum return for the first decile, the 90th percentile, of the MSCI. The least amount that the MSCI has lost over a 12-month period is approximately –13.5%. In contrast, when the MSCI was down ~13.5%, the BTOP50 was up ~30%. Likewise, the third panel shows the worst, or 100th percentile, 12-month return for the MSCI: a merciless -47%. Over this period, the BTOP50 also lost money, but only a manageable –2.6%.

Bringing it all together, we have two important observations:

- Trend-following has a long-run positive expected return and, moreover, a positive expected return in both bull and bear markets.

- Managed futures have an asymmetric return profile. They generally fail to keep pace with equities in bull markets but can still produce solid returns. In bear markets, however, they significantly outperform stocks, generating positive returns or, at minimum, much less downside.

Concluding Remarks

The elevated volatility of 2022 left few asset classes unscathed. We need to understand what worked well, what didn’t, and how we can better position our portfolios for the future. Managed futures/trend following is one strategy worth considering. Trend-following sits on a foundation of strong empirical evidence and decades of positive returns. Moreover, the history of managed futures suggests that the strategy works particularly well in times of macro-economic volatility: It acts as a source of non-correlated return right when investors need it most.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / maybefalse

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.