[ad_1]

Manufacturers across the euro area are getting more worried about the economic outlook.

Article content

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Article content

Manufacturers across the euro area are getting more worried about the economic outlook.

The industrial confidence, a gauge compiled by the European Commission, dropped to a 17-month low this month and fears of energy shortages and never-ending supply chain disruptions are weighing heavily on the sector.

Of the major four economies, only the readings for Germany were above the regional print, and looking at the broader 19-member currency area, just another three countries — Austria, Finland and the Netherlands — saw managers more upbeat than the euro-zone average.

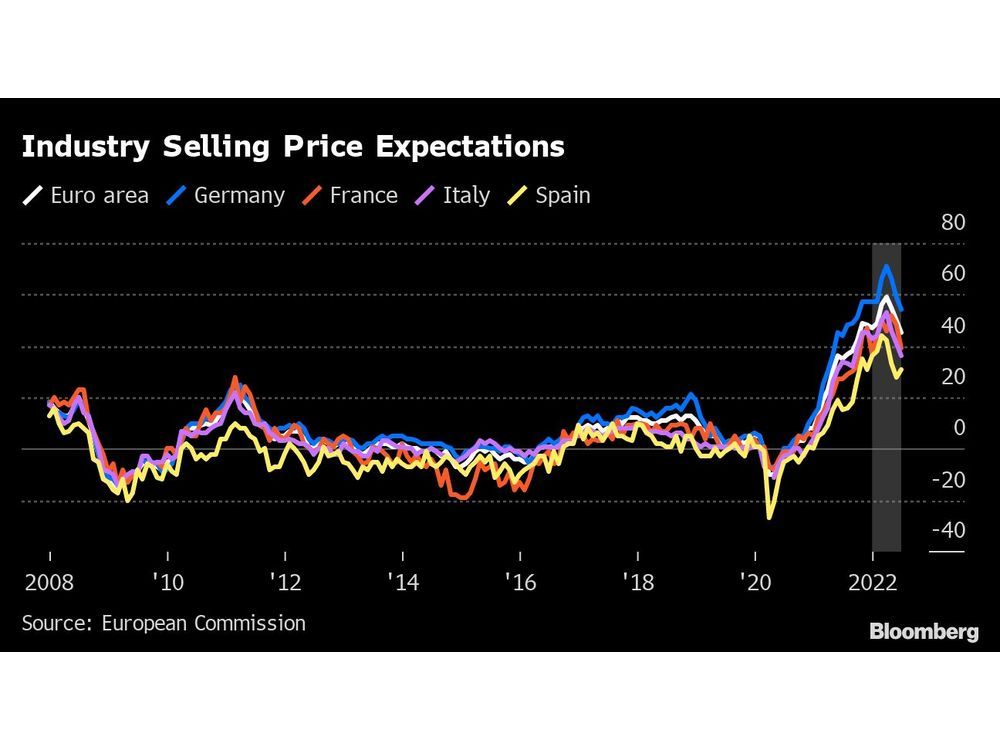

While consumers’ inflation fears are still elevated, selling price expectations at companies declined this month. Manufacturers who since the start of the coronavirus pandemic consistently predicted prices to rise, now say that they will ease over the next few months.

Article content

While the euro area grew a stellar 0.7% in the second quarter, economists and markets fear that surging inflation and a possible Russian energy cutoff threaten to tip the region into a recession. Companies are already suffering from supply bottlenecks that started during the pandemic and have been exacerbated by the war in Ukraine.

Those fears are evident in the European Commission numbers, which are based on surveys across sectors and countries. When asked about obstacles to production, manufacturing managers in two thirds of the euro area put a lack of demand and material shortages as the main factors that are impacting their ability to work at full capacity.

Looking at current exports, order books are slowly coming down from a year-long high. However, the industry’s outlook for selling abroad appears to have improved as the euro weakened. Expectations for the development of export orders over the next three months — which plummeted after Russia invaded Ukraine in February — are almost at the region’s long-term average.

[ad_2]

Image and article originally from financialpost.com. Read the original article here.