Article content

(Bloomberg) —

[ad_1]

The UK’s bleak economic outlook and rising interest rates are finally biting into the country’s housing market, the latest figures from Britain’s lenders show.

Author of the article:

Bloomberg News

William Shaw

Publishing date:

Jul 29, 2022 • 10 minutes ago • 2 minute read • Join the conversation

(Bloomberg) —

This advertisement has not loaded yet, but your article continues below.

The UK’s bleak economic outlook and rising interest rates are finally biting into the country’s housing market, the latest figures from Britain’s lenders show.

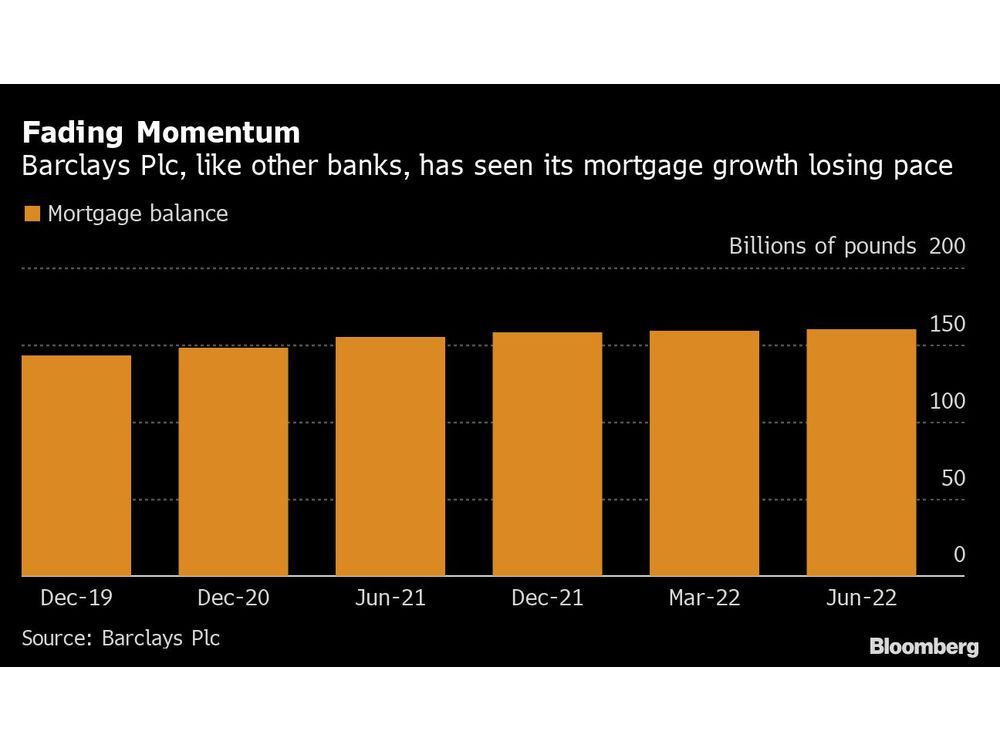

NatWest Group Plc reported net mortgage growth of £3.3 billion ($4 billion) in the second quarter on Friday, down from £3.6 billion in the same period last year. Barclays Plc reported near stagnant growth in home loans earlier this week while Lloyds Banking Group Plc sees property prices falling in the year ahead.

“House prices are still rising but the rate of growth is slowing,” Ray Boulger, senior mortgage technical manager at loan broker John Charcol, said by phone. “The twin pressures of increased cost of living and energy costs, combined with mortgage-rate increases, are having an effect on people’s willingness and ability to move.”

This advertisement has not loaded yet, but your article continues below.

Property prices in Britain have soared to record levels over the past two years, with many buyers chasing bigger homes away from city centers as the Covid-19 pandemic struck. Banks have in turn enjoyed brisk business in mortgages, albeit with slim margins while the base rate was at rock-bottom and lenders competed fiercely to pour capital into home loans.

NatWest’s economic assumptions still contain a base case of 2% house price growth next year. Yet Lloyds, the UK’s biggest mortgage lender, thinks higher interest rates along with the squeeze on household budgets will lead to falling prices.

Lloyds said on Wednesday its open mortgage book rose just 1% in the three months through June and now stands at £296.6 billion.

This advertisement has not loaded yet, but your article continues below.

Barclays, meanwhile, saw £0.5 billion of mortgage growth to £159.6 billion in the three months to June, a 0.3% increase from the equivalent figure at the end of March.

For now, there’s a rush to lock in rates before the Bank of England’s expected series of hikes to combat inflation, forcing UK lenders to pull some mortgage products to avoid being overwhelmed by surging demand. Mortgage approvals fell more than forecast in June while unsecured debts rose, according to Bank of England data on Friday. Lenders authorized 63,726 home loans, down 3% from May and the fewest in two years.

Back in September, borrowers could get a five-year fixed rate mortgage at under 1%, but now most rates start at around 3%, Boulger said.

“In the next six months it’s going to slow right down,” he said. “Higher interest rates haven’t been a big factor up to now but will be a big factor going forward.”

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.