[ad_1]

The golden age of fixed income is over.

The days when investors could rely on traditional bonds as safe, income-producing securities that hedge equity risk and deliver returns that keep pace with inflation are finished.

While it may not have felt like it, long-term investors had it pretty easy over the last 90-plus years. A diversified portfolio of 60% stocks and 40% high-quality bonds yielded a 9.0% annualized return between 1926 and 2019.1

Historic Annualized Returns Have Been Solid

| Bonds | Stocks | 60/40 Portfolio | |

| 1926–1929 | 4.2% | 13.2% | 10.1% |

| 1930–1939 | 4.6% | 1.4% | 4.7% |

| 1940–1949 | 1.8% | 11.2% | 7.8% |

| 1950–1959 | 1.3% | 19.0% | 11.8% |

| 1960–1969 | 3.5% | 9.3% | 7.2% |

| 1970–1979 | 7.0% | 7.5% | 7.7% |

| 1980–1989 | 11.9% | 17.1% | 15.4% |

| 1990–1999 | 7.2% | 17.4% | 13.5% |

| 2000–2009 | 6.2% | 1.4% | 3.8% |

| 2010–2019 | 3.2% | 13.2% | 9.4% |

| 1926–2019 | 5.1% | 10.8% | 9.0% |

Source: Dimensional Fund Advisors. Stocks are represented by a composite of the S&P 500, CRSP Deciles 3–5 for mid-cap stocks, and CRSP Deciles 6–10 for small-cap stocks. Bonds are represented by five-year Treasury bonds.

Even in a more granular, decade-by-decade examination, the ubiquitous 60/40 portfolio generally earned returns in the mid-single digits. In the decades when it didn’t, the 1930s and 2000s, poor stock market performance explained much of the shortfall. In the 2000s at least, that could have been addressed with broader stock market diversification — in value stocks, for example — since large-cap growth stocks endured the worst of the downturn.

Those mid-single–digit returns have largely met institutional and retail investors’ stated needs. The former often have spending policies of 4% to 5% of the portfolio’s rolling value. Add in 2% for inflation and 1% for portfolio expenses, and they require annualized returns of 7% or 8%. For individual investors, many of whom are still guided by the imperfect 4% rule, a similar 7% return is required.

In the years ahead, achieving those numbers looks much more difficult. Today’s high stock market valuations are part of the problem. Before when Shiller CAPE ratios reached these levels, returns fell far below the 10.8% long-term average. But bonds are the much bigger culprit.

The starting yield for bonds is a strong predictor of annualized future return. The current yield on the 10-year Treasury is 0.60%. We cannot expect bonds to contribute much to portfolio returns in the coming decade.

Assuming such rates of return for fixed income, we’d need an 11.3% annualized return from equities to meet the 7.0% return threshold in the 2020s. That’s possible, but not likely.

Today’s low interest rate environment provides a tailwind for stocks, and there is historical precedent for stock outperformance during such periods. Low bond yields in the 1940s and 1950s led to subpar fixed-income performance, but strong double-digit equity returns more than made up for it. Of course, the Shiller CAPE valuation level was much lower then. With the stock market trading at a CAPE ratio of 25 and above, history is not likely to repeat itself.

Longer Duration? More Credit Risk?

Rather than hope for outsized stocks returns going forward, we’re better off trying to generate more from fixed income. Traditionally that has meant extending duration or assuming additional credit risk.

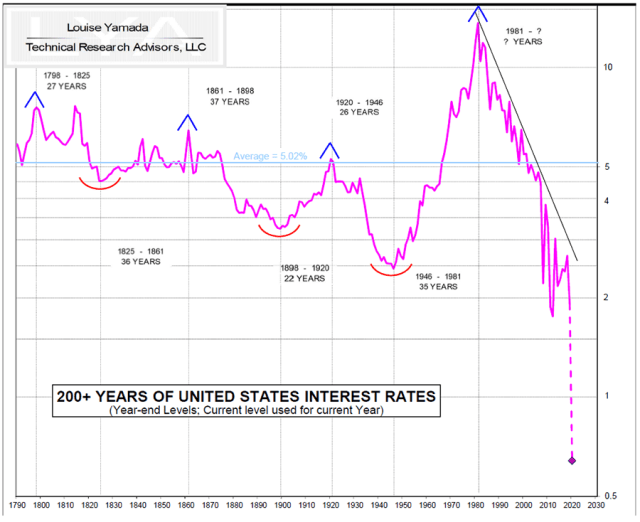

Interest rates historically move in long-term cycles, as shown in the graph below. Right now, they’re at 200-year lows. Since they’ve trended down for almost 40 years, the cycle might be nearing an end. While they could stay low for some time or even fall further, even with negative rates, there must be some downside boundary at which point investors simply hold currency. This implies yields can’t decline much further.

The Interest Rate Cycle Is Aging

On the other hand, rates have ample room to rise. The risk is asymmetric: Even if they only return to where they were a year ago — 2.0% — long-duration bonds could still see significant damage. The Bloomberg Barclays Aggregate Bond Index currently has a duration of around six years, which implies roughly 8.5% in price decline if interest rates rise to 2.0% from today’s 0.60%.

So extending duration to reach for incremental yield doesn’t seem worthwhile when 10-year and 30-year Treasuries yield 0.60% and 1.4%, respectively,

Additional credit risk is also probably a bad idea. For many long-term investors, owning bonds is about hedging stock market risk. If they weren’t worried about short-term price fluctuations, equities might compose a much larger portion of their portfolios, maybe even 100%, based on their superior long-term return potential. But because many institutions and individuals need to make regular portfolio withdrawals, the risk profile of stocks warrants a more balanced asset allocation. Credit risk does not provide this balance.

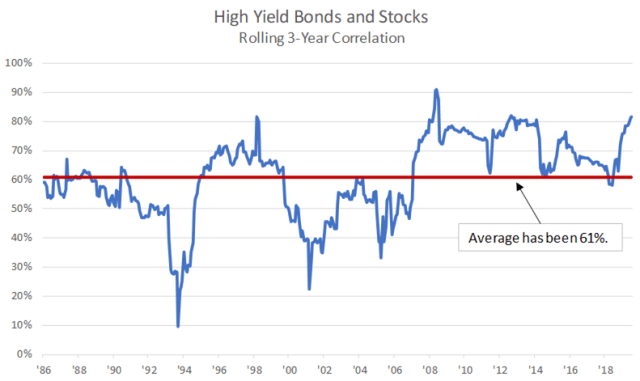

After all, credit is positively correlated with the stock market. High-yield bonds, as measured by the Bloomberg Barclays U.S. High Yield Corporate Bond Index, have had an average correlation of 61% with the S&P 500. But the three-year rolling correlation has reached as high as 91%, often peaking around bear markets, when diversification is needed the most. In fact, this index declined 26% in 2008 when the S&P 500 fell 37%. With today’s high stock valuations and an uncertain economic future in the wake of the COVID-19 crisis, overweighting credit to boost fixed-income returns appears unduly risky.

Credit Exposure Is Not a Risk Hedge

That leaves us in our present predicament with both stocks and bonds overvalued based on historical norms. The traditional levers to generate incremental return come with considerable uncertainty, yet investors continue to rely on their portfolios to meet operating budgets and living expenses. If we stick with the traditional approach, we’re likely in trouble.

That means we have to rethink portfolio management and risk control. The current stock/bond paradigm uses stocks for growth and bonds for protection and income generation. Fixed income hedges against stock market downturns, such as the aftermath of the dot-com bubble from 2000 to 2002, the global financial crisis (GFC) from 2007 to 2009, and the current COVID-19 bear market. But such periods tend to be infrequent and short-lived. So instead of restricting 40% of our portfolios to securities meant to minimize losses once per decade, we should reconsider the overall structure of our portfolios.

A New Fixed-Income Focus?

Maybe the focus should be delivering liquidity during crises without sacrificing long-term returns to minimize downside risk. We still want to optimize returns in normal markets. Bear markets have averaged 14 months, with the longest occuring in and around the Great Depression from 1929 to 1932 and in the aftermath of World War II from 1946 to 1949 and lasting around three years. While regulation and risk controls make such lengthy and severe downturns somewhat unlikely, let’s take a conservative approach and assume the stock market could crash and stay low, if not at rock bottom, for five years.

With spending policies and withdrawal rates of 4% to 5%, a five-year crisis window implies 20% to 25% of a portfolio should be held in Treasuries and other safe, liquid securities. Given the flight to quality that occurs during crisis periods, such a position should at least hold its value amid a downturn. The assets could be sold for required withdrawals or laddered to come due at regular intervals that roughly align with cash needs.

But what about the remaining 15% to 20% of the portfolio that would have been in fixed income but is now freed up? A greater allocation to stocks is one possibility. This would optimize long-term growth but sharply increase short-term volatility. For behavioral reasons, this may not be the best strategy for those prone to heightened emotions during recessions and bear markets. After all, an optimal portfolio is hardly optimal if clients don’t stick with it.

Alternative investments, as per the endowment model, are another option. However, most of these assets — direct real estate, private equity, or hedge funds — also have economic exposure. They may have low correlations over time, but they can crash during stock market declines or after a bit of a lag. They also can have liquidity constraints. Again, such securities might not be the best option for the loss averse or those who need ready access to cash.

Catastrophe Bonds, Private Loans, Multi-Strategy Bond Funds

But what if we expand the definition of fixed income to include catastrophe bonds, private loans, and multi-strategy bond funds? A portfolio that included such securities would provide a risk profile that, over time, recalls that of a traditional 60/40 portfolio. But the expected returns would approach the 7% range that investors require. To be sure, other investments fit this profile as well, but these three demonstrate that bonds can be redefined in a practical, investable way that better positions portfolios to meet their objectives.

For bearing the risk of natural disasters and other insurable “perils,” catastrophe bonds have yielded returns around 7% as measured by the SwissRe Cat Bond Index. Accordingly, investors risk losing the principal if a covered catastrophic event occurs. Catastrophe bonds have tended to earn positive returns with relatively low volatility and less downside risk than stocks. One of their most unique and attractive features is their lack of economic exposure. A recession doesn’t trigger a hurricane, so catastrophe bonds are among the few assets that can advance during a broad-based bear market. In fact, the SwissRe index earned positive returns in both 2002 and 2008 when stocks declined.

Private lending involves buying loans that do not trade on exchanges. These loans can be purchased through online platforms, private pooled investments, or interval funds, and can include student loans, small-business loans, personal loans, and potentially other categories. Headline yields are usually quite high, but so are expenses — and there are lots of them. Yet these investments can still net 6% or so.

The generally short duration of private lending investments is a big part of their appeal. They often have three-year terms, so they can have low interest rate sensitivity, which makes for low correlation to traditional bonds. Despite this short duration, risk is often higher than traditional bonds because defaults increase when unemployment spikes. Default risk is offset to some degree by automated repayment plans. But losses can occur during economic stress and largely track credit card charge-offs.

Multi-strategy fixed-income funds seek to engineer return streams with low correlation to traditional stocks and bonds. Expected returns are higher than for the overall bond market — often because of allocations to defensive equities. So these funds are not always pure plays. But that’s the point of such investments. They offer some defensive ability in bear markets, but higher returns over time. Traditional bonds are unlikely to pull this off, so such alternative fixed income strategies are necessary.

While there is plenty to criticize about the above approaches, the data suggests they can in combination help address low expected bond returns while hedging equity risk.

Since some of these investments are relatively new, they don’t have long return histories. But data going back to mid-2016 is available for all the funds that cover these asset classes,2 and an equally-weighted portfolio composed of them has outperformed the Vanguard Total Bond Market Index fund (VBTLX) with less volatility.

Moreover, an equally weighted portfolio of alternative fixed-income funds was fairly defensive during the early 2020 stock market downturn. Returns were flat compared to a 5.0% gain for the Vanguard Total Bond Market Index fund. But that is to be expected during a flight to quality. Still, just holding its value amid a plunging stock market is an accomplishment shared by few asset classes. And while a low or rising interest rate environment won’t be kind to the overall bond market, it shouldn’t meaningfully impact the returns of the other funds. So a total bond market focus may only work during short crisis periods.

Alternative Bond Funds Can Improve Share Ratios

| Annualized Risk and Return, June 2016 to April 2020 |

| Asset Class | Cat. Bonds | Alt. Lending | Multi-Strat | Equally-Weighted | Total Bond Market |

| Fund | SHRIX | LENDX | BIMBX | Portfolio | VBLTX |

| Return | 2.2% | 5.4% | 6.1% | 4.7% | 4.1% |

| St. Dev | 6.0% | 2.9% | 3.9% | 2.6% | 3.5% |

| Sharpe | 0.13 | 1.41 | 1.21 | 1.23 | 0.78 |

| 2020 YTD Return | 0.1% | -3.2% | 2.8% | 0.0% | 5.0% |

Source: Morningstar, DFA, Armbruster Capital Management, Inc.

By swapping out 50% of the traditional bond portfolio for alternative fixed-income securities, we achieve expected returns over time of 3.5%.3 This is still below the historical average for high-quality bonds, but it is far better than the anticipated 0.6% for high-quality bonds in the future.

To achieve a 5% expected return on the fixed-income portfolio, 75% of the bond component would need to be replaced by alternative fixed-income funds. If these funds truly hold their value in crisis periods, having less invested in Treasuries would be a practical strategy and further minimize the long-term performance drag associated with holding ultra-safe bonds.

While the data doesn’t go back far enough to assess how such a dramatic re-imagining of fixed income would perform over an extended period, the evidence suggests that higher returns with fixed-income–like instruments are achievable without completely abandoning prudent risk controls.

Waiting for more data to “prove” the validity of such an approach is a luxury we can’t afford. The real-world risks to long-term portfolios — both our clients’ and our own — are too severe to stick with the status quo.

1. We used 36% in the S&P 500, 12% in CRSP Deciles 3–5 (mid-cap stocks), 12% in CRSP Deciles 6–10 (small-cap stocks), and 40% in five-year Treasury bonds to build our hypothetical portfolio.

2. We used the Stone Ridge High Yield Reinsurance Risk Premium Fund (SHRIX) to represent catastrophe bonds, the Stone Ridge Alternative Lending Risk Premium Fund (LENDX) to represent alternative lending, and the BlackRock Systematic Multi-Strategy Fund (BIMB) to represent multi-strategy fixed income. The hypothetical portfolio of these funds is equal weighted.

3. We assume expected returns in the coming decade will be 0.6% for 10-year Treasuries, 7.0% for catastrophe bonds, 6% for private loans, and 6% for multi-strategy fixed-income funds.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Mischa Keijser

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.