[ad_1]

“The pandemic crisis now rests on a fulcrum. On one side is Covid-19 and every possible action that might prevent people from contracting and dying from infection.

“On the other side is everything else that matters: livelihoods that allow people to feed and shelter their families; civil liberties; the education of children; social well-being, including the prevention of loneliness, isolation and domestic violence; and all other medical conditions, from cancer and heart disease to dental emergencies.” — Joseph A. Ladapo, MD, PhD, Wall Street Journal

Sooner or

later, the threat of the novel coronavirus epidemic will fade. The virus will

not be eradicated, but we will adapt and learn how to live with the risk of

SARS‑nCoV-2 infection. (The virus will also adapt, something very much on the

minds of researchers and public health officials.)

Our parents, grandparents, and ancestors lived with the risk of polio, smallpox, plague, cholera, typhus, and a host of viruses and bacterial infections in the epic battles between human beings and infectious disease. They didn’t live happily with these risks, but humanity survived. In fact, it has thrived. How do we know? Today the world population is about as large, healthy, and wealthy as it has ever been, which gives a clue as to who is winning the never-ending war between viruses and human beings.

Most people confront viral risk on a daily basis and always have. “I’ve always lived with [the possibility of] dengue fever,” recalls Victor Canto, PhD, a respected economist, prolific author, and investment manager. Canto is a member of our discussion group, which also includes Drew Senyei, MD, who was interviewed in April. Dengue fever is also called breakbone fever, not because it breaks your bones but because it feels that way. You don’t want it. But in Canto’s native Dominican Republic, an upper middle-income country, it is endemic and you are exposed to that risk whether you like it or not.

Life is risk. We adapt, innovate, and make intelligent trade-offs to go forward. We manage risk, because we cannot live risk-free, even if we wanted to. In fact, to change is to take risks, and all economic progress comes from change.

The Old Normal

If you have any historical perspective at all, you know that the Old Normal with which people lived for almost the entirety of human existence resembled Canto’s Dominican Republic. Except it was much worse.

The

accompanying graphic shows a 1937 public health poster from that archetypal

First World country, the United States. The milk truckers who transported milk

from the dairy farmers to consumers were exhorted not only to avoid people who

were suffering from diphtheria, smallpox, and a long list of other diseases,

but to report them.

This was a sensible policy. To paraphrase the celebrated investor and armchair philosopher Clifford Asness, there are no libertarians in pandemics.2 But the sad part is deputizing milkmen as epidemic informants was necessary policy not that long ago.

BUT I AM NOT A LIBERTARIAN ABOUT THE CORONA VIRUS and the enormous health and economic dangers it entails (economic dangers do become health dangers to the vulnerable).

— Clifford Asness (@CliffordAsness) March 15, 2020

We’ve made so much progress against viruses and bacteria that the 1937 poster feels like a dispatch from another planet. Not long before that, in 1924, a bacterial infection took the life of US president Calvin Coolidge’s young son, Calvin, Jr. But only a few years later, human ingenuity and innovation brought us “sulfa drugs,” antibiotics, and changed our lives for the better forever. And, on 14 March 1942, a young woman in Connecticut named Anne Miller was the first American treated with penicillin, a new broad-spectrum antibiotic much more effective than sulfanomide. She recovered quickly after facing near-certain death from septicemia when all other treatments had failed. She lived to the age of 90.

Now we

transplant organs regularly, reattach retinas painlessly by shining a laser

beam into the eye, and, on an experimental basis, repair defective human DNA

using a technology called CRISPR. We are accustomed to medical miracles. But we

should not take them for granted. The war between viruses and human beings is

still raging, and probably always will.

We have

made strides against bacteria. They are still evolving, but we are winning.

Viruses, however, may present a more challenging adversary. New viruses

keep arriving. While we wait for the COVID-19 virus to become low-level

endemic, as its predecessors did, we can only hunt for vaccines and treatments

to blunt its spread and lethality. Novel coronaviruses — SARS, MERS, and

SARS-CoV-2 — are particularly nasty. We have no neutralizing antibodies, and COVID-19

knows no borders and rapidly burns through the population.

So we

should not be entirely shocked that we have reverted to technologies from the

1918–1919 influenza epidemic — masks and social distancing — to fight a

21st-century coronavirus and the associated COVID-19 disease. But, as

Ladapo said in the epigraph, the costs of using only these technologies and no

others are extraordinary. They are: “everything else that matters.”

We did

not evolve to live in social isolation and idleness, and we are neither

productive nor happy in that condition. Eventually many of us will suffer or

die from the second-order effects as human progress stalls and then falls into

reverse — unless we act vigorously to counteract these second-order effects.

The New Normal: Lockdown Economics

What is new this time is that public authorities in much of the world, including the governors of nearly all 50 US states, have issued emergency orders that have locked down large swaths of economic and social activity. Schools, restaurants, religious services, weddings, and funerals, as well as many of the factories and offices that produce the world’s goods, have all been shuttered. Internal and external travel restrictions have compounded the economic paralysis.

These lockdowns, which can be beneficial when properly deployed, have delivered an enormous economic shock — one so large, it is a “crisis” by any historical measure. In the United States, the decline in GDP in just three months has wiped out five years of economic growth. On a per capita basis, the standard of living may have fallen to 2004 levels. Government employment is down 1.5 million jobs and is at year-2000 levels. Not even in the Great Depression was any one quarter’s economic decline so precipitous. Worse, the economic freefall has been devastatingly uneven. Some industries — air travel and hotels, for example — have been almost obliterated, while online shopping and delivery jobs boom.

Many core

commonwealth goods provided by governments are at risk. Many necessary

medical procedures are being postponed. Government revenues have collapsed

while debt levels rapidly expand.

The Economic Prognosis: Great Depression 2.0, or a Rapid Plunge Followed by a Quick Recovery?

But we do

not expect Great Depression 2.0. Why? Because unlike the first Great

Depression, this one was imposed by political authorities in an attempt to

control the spread of a virus. What can be imposed from above can be relieved

from above.

When the

virus is controlled and the restrictions are lifted, pent-up supply and pent-up

demand will collide. The boom could be tremendous as workers rush to reclaim

jobs and begin to spend confidently, and as capital, of which there is no

shortage, is deployed in recapitalizing damaged businesses, many of which will

be under new ownership. The trick is achieving a balance between two goals: the

need to control the virus so the coming boom is not stopped in its tracks, and

the need to avoid any more capital destruction than is absolutely necessary.

If we knew exactly how to do this, we’d tell you. We don’t. But in an earlier piece, we said that the effects of an economic shutdown are nonlinear. A two-week shutdown is like a long, boring vacation. A two-month shutdown is a monumental pain in the neck, but one we can recover from: The Germans earn as much in a year as Americans do in 10 months, and Germany is quite a nice place.

But beyond two months and basic infrastructural goods and services begin to fall apart. Human capital decays as people’s skills atrophy, and our children’s intellectual growth stagnates as they miss more and more school. We are approaching five months with only a moderate liberalization of economic activity. After two years, we’ll likely be headed back to the Dark Ages. We don’t know if the trip will send us to 1993, 1933, or 1333. But, whatever the destination, we cannot let that train leave the station.

We do expect some changes in behavior to occur, but they won’t alter our basic nature: Humans seek out connection and try to make progress. People adapt well to new normals that bring that connectedness and progress: It’s no mystery why today’s internet, mobile phone, and social media firms have been the fastest-growing global companies the world has ever seen. Apple is the largest company by market cap in the world, almost equal in value to the whole Russell 2000 (!). Amazon is everywhere. Facebook has 2.6 billion users — one out of every three men, women, and children on the planet. Zoom went from an unknown company to a global giant in less than a year.

Better yet, the word zoom has gone from a company name to a newly minted verb — “I’ll zoom you in the morning” — in a few months. It took years for Xerox and Kleenex to become generic words for the products they represent, but today’s world moves faster.

People will strive to return to their old normal lives, and they will pull along the parts of the new normals that they like. Social interaction — for business, education, family life, fun, and spiritual renewal — is just too valuable to abandon in pursuit of an illusory bubble of safety. Just as the social distancing of the 1918–1919 flu pandemic soon gave way to the Roaring ’20s and widespread electrification and work-saving appliances, among other innovations, and the little-remembered but very serious 1957–1958 flu pandemic yielded to the groovy 1960s,3 the medium-term future will look a lot more like “business as usual,” enhanced by innovations, than it will the dreary present.

The Utilitarian Calculus

During

acute crises, from wars to natural disasters like famine, earthquakes, and

hurricanes, the collective power of government rises in response. It directs

the economy in a wartime production mode; it provides water, food, and shelter

after hurricanes; and even pursues narrow one-time projects: going to the moon,

walking on it, and then coming back (with rock samples), for example. But

dealing with regularly occurring and dispersed and unpredictable novel viruses

requires a different decision-making approach.

The only way to balance the conflicting COVID-19 needs, dangers, and short- and long-term goals is to think of them as an optimization problem that requires balancing decisions to achieve the highest utility when summed across all people. This balancing act goes back to Jeremy Bentham’s utilitarian calculus, an Enlightenment-era attempt to put numbers to happiness and tragedy that has annoyed those who do not understand it ever since.4

The

utilitarian calculus holds that any action should maximize the summed utility

of all the people in the world, taking into account positive and negative

aspects of utility — death is very negative but it is possible to imagine a

fate worse than death — and including the effects that you can see and those

you cannot.5

Utilitarian-calculus problems are familiar to philosophy and ethics students: How many trolley passengers would you sacrifice to save a pedestrian?

This way of viewing ethical problems is not the right way to frame the COVID-19 dilemma. It is the only way. Many object to utilitarianism on the grounds that there are moral absolutes. But extreme examples and polar cases are revealing. For example: Would you be willing to reduce the world’s economic output to exactly zero — meaning nobody eats, starting right now — to save one life? Of course not.

So

there is a number, an unacceptable level of cost, beyond

which the saving of one life requires too much sacrifice from everyone else.

At the other pole, would you pay one dollar to save that life? Of course, you would. So between those two extremes of cost, there is an equilibrium. That equilibrium, wherever it lies, is the utilitarian solution to the problem. Of course, we don’t know what that solution is, but we know there is one. One can begin by framing the problem in the right terms.

This

“utilitarian calculus” may seem cold, but it is at the heart of humanism, the

philosophy to which we subscribe and upon which Western civilization is based.

It is part of the political economy of how we organize to provide commonwealth

goods and maintain our personal and economic freedoms. Without it, how else can

we make pandemic-related decisions that involve trading years of life now

against years of life in the future? Any other framing necessarily leads to a

narrow, suboptimal solution that will favor one person or group over another

for no morally acceptable reason, or worse, yields to full external control of

everyday life.

A riskless society is “unattainable and infinitely expensive.”

To return to where we started, life cannot be free of risk. Today, we face a risk that didn’t exist when milkmen were on the lookout for scarlet fever cases in the 1930s: nuclear war. We also face climate risk, which existed even if we didn’t know it. We were ignorant of it because we have short memories: The Little Ice Age lasted from the 1300s until the 1800s and caused a series of famines that drove Europeans to explore and settle in the Americas in search of new land. This, in turn, lead to the almost total destruction of the native population. Some millennia earlier, Doggerland, a shelf of well-populated land that connected the present day British Isles and Continental Europe, sank beneath the sea because of warming and the consequent sea-level rise. Now that’s risk!

A riskless society is “unattainable and infinitely expensive,” the physicist Edwin Goldwasser said. This phrase is the title of the contribution by one of us (Siegel) to the CFA Institute Research Foundation’s anthology analyzing the Global Financial Crisis of 2007–2009. The impossibility of eliminating all risk is even more germane to the current situation than to a financial crash. We could isolate every individual from every other, work nonstop on a vaccine — but who would do the teamwork? — and only permit social functioning to resume when the vaccine is found and widely distributed.

But by then we would have impoverished ourselves all the way back to the standard of living found in Doggerland before it sank. A few axes and shards of pottery remain to tell us how life was lived then. We cannot allow that to happen. So we had better take the steps needed to assure that it doesn’t.

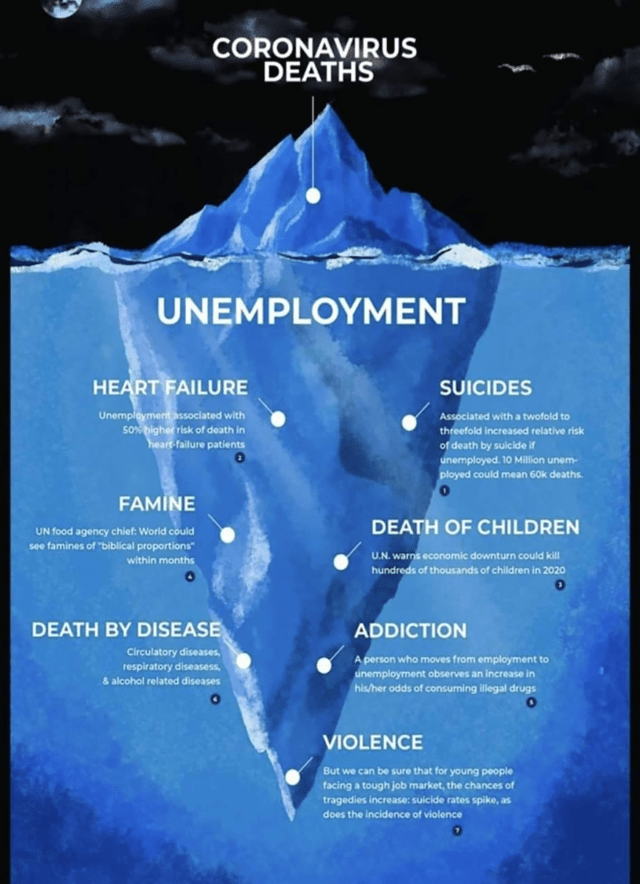

The COVID-19 Iceberg

The great

19th century French economist Frédéric Bastiat famously distinguished “what can be seen” from “what cannot be seen.” Policymakers

focus almost entirely on the former while neglecting the effects on the latter.

This observation is relevant to the COVID-19 pandemic.

What

formerly could not be seen is rapidly being seen, as the graphic below

demonstrates: Disruptions to the global food supply chain, medical and

psychological effects such as stress-related heart disease, untreated

complications of diabetes and cancers, suicides, homicides as violence spirals

upward, and the slow death, aided by drugs and alcohol, that accompanies the

sudden poverty of the wallet and of the spirit.

The COVID-19 Iceberg: What Can and What Cannot Be Seen

Note: “Death by disease” should also include death due to delayed medical diagnosis and treatment. Coronavirus deaths during the pandemic period must be compared with deaths from economic causes and delayed or forgone medical treatments over the next five to 10 years, not just over the pandemic period.

Another major loss is from delayed or avoided medical diagnoses and treatments. Doctors are unavailable. Fear of infection keeps patients from going to the hospital. Cancer treatments are being skipped. Reports of heart attacks are way down, not because coronavirus is good for your heart, but because marginal symptoms are being ignored instead of investigated.

Bill Gates has pointed out yet more casualties:

And Gates calls himself an optimist!

In the

long run, by which we mean the decade or two after the SARS-nCoV epidemic has

been brought under control — it probably will not be eliminated — we are more

concerned about deaths from these related causes than about the immediate toll

of the COVID-19 disease. They will likely outnumber deaths from the virus

itself.

This recitation of losses is not intended to suggest that we should just “let it rip” and allow the pandemic to run its course out of concern for the economy and the well-being of those who do not catch the disease. That would be insane. We enumerate these costs so that the global optimization problem is framed correctly, that’s all.

Last Word

As we adapt to the SARS-CoV-2 virus — for that is what our almost infinitely adaptable species is going to do — we expect to be on the other side of Ladapo’s fulcrum where “everything else that matters” is renewed. What matters are livelihoods that allow people to feed and shelter their families; civil liberties; the education of children; economic and technological growth; social well-being, including the prevention of loneliness, isolation, and domestic violence; and the treatment of all other medical conditions, from cancer and heart disease to toothaches.

So let’s get to the other side.

The

sooner, the better.

1. Interestingly, the Dominican Republic has a higher PPP GDP per capita today than the United States did in 1937, adjusted for inflation. (PPP = purchasing power parity.)

2. Asness noted both the health and economic aspects to the emergency, adding that “economic dangers do become health dangers to the vulnerable.” To that I would add that we all become the vulnerable if the economic damage is sufficiently large.

3. A short, sharp depression followed the 1918–1919 pandemic and a deep but brief recession followed the 1957 pandemic. So the 1920s did not roar and the 1960s did not groove immediately.

4. The utilitarian calculus is not an abstract problem in philosophy: When it comes to autonomous vehicles, the rules have to be coded in algorithms. There is already a surprisingly large literature on this topic. See Bergmann, Lasse T., et al., 2018, “Autonomous Vehicles Require Socio-Political Acceptance — An Empirical and Philosophical Perspective on the Problem of Moral Decision Making,” Frontiers in Behavioral Neuroscience.

5. The solution must be physically, economically, and morally possible. We cannot (at present) enrich ourselves by mining asteroids, or save lives by traveling back in time and killing Hitler, or declare everyone economically equal without also considering the consequences to productivity.

More insights from Laurence B. Siegel are available on his website. For correspondence, he can be reached at [email protected].

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the authors. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the authors’ employers.

Image Credit: ©Getty Images / Paul Souders

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.