[ad_1]

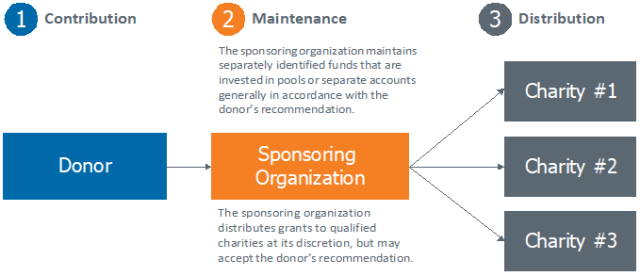

Donor-advised funds (DAFs) are a unique type of charitable giving vehicle that require a specialized approach to strategic asset allocation decisions. At a basic level, DAFs need to be open to unlimited donors, each of whom can have unique charitable intentions, time horizons, and risk tolerances. As a result, a sponsoring charity may need to provide a spectrum of asset allocation recommendations built for the diverse objectives and constraints of its donor base.

So what are the basic features of DAFs and what are the critical factors to consider in the asset allocation decision for a given donor? And what might some sample donor scenarios look like?

Donor-Advised Funds:

The Basics

One key advantage DAFs offer donors is that the sponsoring organization handles the investment along with its administrative and compliance responsibilities and its associated costs. That said, while the donor retains advisory privileges and the sponsoring organization will generally agree to donor requests, the donor does relinquish ultimate control of the assets. This is why it is especially important that sponsoring charities exercise responsible stewardship over those assets.

Managing Investment Policy: Factors to Consider

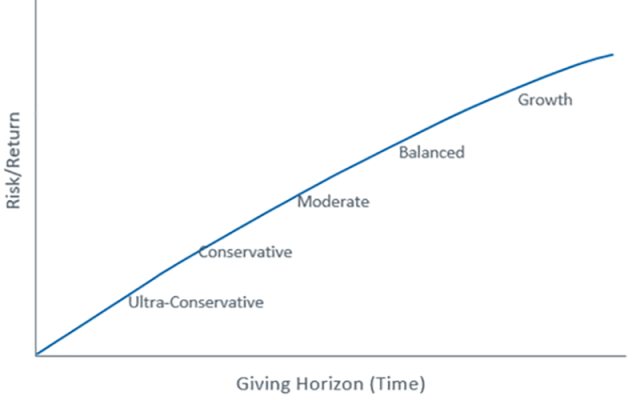

When managing any individual investment program, certain factors come into play when making decisions around proper portfolio positioning. For DAFs, this requires creating a spectrum of asset allocation recommendations built for a range of different objectives and constraints. The following chart illustrates what this spectrum of asset allocation options might look like.

Donor Advised Funds: Asset Allocation Options

Below we outline five key factors that may be important to address during the asset allocation discussion with a donor.

1. The Donor’s Intentions and Time Horizon

Understanding a donor’s intentions is the first priority. Specifically, is the donor planning to distribute all of the funds immediately or over the near term? Do they intend for the fund to last for several years, a lifetime, or several generations?

The answers to these questions are critical, especially as they relate to time horizons. All else being equal, the longer the time horizon, the greater the ability to take on risk. Why? Because the longer the time horizon, the better the assets can “ride out” short-term market volatility, which allows for higher equity allocation.

For donors who intend to distribute the entirety of their fund within a few years, a portfolio with a less risky asset allocation — with a high level of shorter duration, investment-grade fixed income, for example — might be appropriate for them. On the other end of the spectrum are donors who want to grow their assets over 20 years without making any major distributions along the way. For this cohort, a portfolio with a more aggressive asset allocation, with, say, a heavy dose of public equities, could be a better fit. Donors who intend to make an annual distribution in perpetuity — let’s say 4% of the market value of their portfolio each year — would likely fall somewhere in the middle of the spectrum. For them, a more balanced allocation that aims to preserve purchasing power with room for modest growth might be a good option.

Of course, framing these conversations with donors in the right way can be among the most important inputs in the investment process and can help instill confidence. Donors need to know that your organization cares about their intentions and has the skills and knowledge to help them achieve their objectives.

2. The Return Objective

The return objective should be based on the donor’s intentions and time horizon: If the intention is for the fund to maintain a distribution in perpetuity while preserving purchasing power, the chosen asset allocation will need to be able to achieve a minimum level of return.

Conversely, if a donor plans to distribute the fund over the next three years, the donor might have lower return requirements and not need to pick a portfolio with aggressive growth objectives and the higher volatility that often comes with it.

There is a wide range of return objectives possible — and the different portfolio options typical to a given DAF provide for these different objectives. There is no one-size-fits-all, but a donor’s intentions and time horizon can help them determine the right return objective for their specific situation.

3. Risk Tolerance

The donor’s aversion to risk should be gauged from both the objective and subjective perspective. On an objective level, the appropriate amount of risk relative to the donor’s return/distribution targets makes it more likely that those targets will be met. On a subjective level, a donor’s personal risk tolerance can help determined how they will respond if an account experiences outsized or unexpected levels of volatility. Will such outcomes sour their outlook on the DAF as a charitable giving vehicle?

While determining risk tolerance might be equal parts art and science, including risk tolerance in the portfolio selection process can help to balance the objective and subjective considerations relevant to determining the right portfolio for a given donor. Specifically, risk tolerance helps with setting and managing expectations for the performance of the portfolio ahead of time, and can be instrumental in measuring and defining success over time.

4. Liquidity

DAF distributions can be requested at any time, so liquidity is an important consideration with the investment of DAFs. Given the potential for an erratic frequency of distributions, we believe DAF pools should only be invested in liquid, readily marketable securities. Specifics around distribution needs may also factor into asset allocation decisions given the need to balance staying fully invested with the ability to liquidate investments for the cash necessary for distributions.

5. Unique Circumstances

Responsible investing assets have grown remarkably over the last decade. As a result, many DAFs have provided responsible investing portfolio options to their donors. A portfolio option that requires investments screen for environmental, social, and governance (ESG) criteria would be one iteration of this.

Responsible investing can appeal to donors who are looking to align their investment portfolio with their personal values or intentions. It is important to understand what your donor base might be interested in and provide an appropriate investment portfolio option or options.

These five factors form a framework by which donors can be matched with a portfolio consistent with their objectives and constraints. So what are some sample donor scenarios and how might they map to different portfolio objectives?

Sample Donor

Scenarios

As we have discussed, we feel it is important to have a range of portfolio options available to match the widest range of donor intentions and objectives. As you might expect, these portfolios should run the gamut from conservative to aggressive and provide a reasonable number of investment pools. Reasonable means neither so few that donors cannot choose one that fits their needs, nor so many that the management of the DAF as a whole becomes difficult or the pools end up too small to take advantage of economies of scale.

In the table below, we provide some examples as to how different donor time horizons and intentions might map to a given portfolio orientation. To be sure, these are only examples and are meant to be directional rather than explicit recommendations. The ultimate decision is best made with a firm understanding of a given donor’s intentions and the actual portfolio pools that are a part of your DAF.

| Time Horizon | Donor Intention | Return Objective/ Risk Tolerance | Portfolio Orientation |

| 1–3 years | A donor would like to give out money immediately to address a specific need, such as supporting a food bank during an economic downturn. | Low/Low | Conservative |

| 1–10 Years | A donor would like to distribute the fund in annual installments to a charity over a set period, such as seven years. | Medium/Low | Balanced |

| Perpetuity | A donor and future generations would like to have money available to make periodic distributions to charity with no set frequency or distribution percentage. | Medium/Medium | Balanced |

| Donor’s Lifetime or Perpetuity | A donor would like to make a charitable distribution of 3.5% of the market value of their fund, while preserving purchasing power, in perpetuity. | Medium/High | Growth |

| 20-plus Years | A donor would like to make a donation now and have it grow tax-free for 20 years before making a donation to a nonprofit organization of their choice. | High/High | Aggressive |

Source: PNC

Summary

As a charitable giving vehicle, the DAF can satisfy a wide range of donor objectives and constraints. Its popularity is therefore understandable. Having an investment policy framework that can accommodate a spectrum of donor intentions can help donors succeed in meeting their objectives and allow a sponsoring organization to have an effective and long-lasting charitable solution for its donors.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Wokephoto17

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.