[ad_1]

Nvidia Corporation NVDA was surging over 12% higher on Thursday in a continued uptrend that began on Oct. 13 after the stock reached a new 52-week low of $108.13.

Although Nvidia retraced with the general markets on Tuesday and Wednesday, falling a total of 7.6%, the pullback was bullish because it allowed the stock’s relative strength index to cool.

When consumer price index data was released by the U.S. Bureau of Labor Statistics on Thursday morning, showing inflation ticked lower in October, bullish momentum entered Nvidia and caused the stock to surge.

An uptrend occurs when a stock consistently makes a series of higher highs and higher lows on the chart.

The higher highs indicate the bulls are in control, while the intermittent higher lows indicate consolidation periods.

Traders can use moving averages to help identify an uptrend, with rising lower time frame moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term uptrend.

Rising longer-term moving averages (such as the 200-day simple moving average) indicate a long-term uptrend.

A stock often signals when the higher high is in by printing a reversal candlestick such as a doji, bearish engulfing or hanging man candlestick. Likewise, the higher low could be signaled when a doji, morning star or hammer candlestick is printed. Moreover, the higher highs and higher lows often take place at resistance and support levels.

In an uptrend, the “trend is your friend” until it’s not, and in an uptrend there are ways for both bullish and bearish traders to participate in the stock:

- Bullish traders who are already holding a position in a stock can feel confident the uptrend will continue unless the stock makes a lower low. Traders looking to take a position in a stock trading in an uptrend can usually find the safest entry on the higher low.

- Bearish traders can enter the trade on the higher high and exit on the pullback. These traders can also enter when the uptrend breaks and the stock makes a lower low, indicating a reversal into a downtrend may be in the cards.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Nvidia Chart: Nvidia’s most recent higher low within its uptrend was formed on Wednesday at $137.59, and the most recent confirmed higher high was printed at the $148.91 mark on Tuesday.

On Thursday, Nvivia was surging to new highs, but hasn’t yet signaled that the next temporary top is in.

- If Nvidia closes the trading session near its high-of-day price, the stock will print a bullish kicker candlestick, which could indicate higher prices or even a second gap-up-open could come on Friday.

- If the stock closes the trading session with a significant upper wick, a retracement to the downside could be on the horizon.

- It’s also possible that Nvidia could set up an inside bar pattern in order to consolidate Thursday’s big move north. If that happens, traders and investors can watch for the stock to break up or down from the mother bar on higher-than-average volume to gauge future direction.

- Nvidia is trading above the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending above the 21-day, both of which are bullish indicators. When Nvidia eventually retraces, to at least print another higher low, the stock may find support and stage a reversal at the eight-day EMA.

- Nvidia has resistance above at $161.37 and $180.73 and support below at $145.75 and $135.43.

See Also: Taiwan’s Lithuania Chip Plan Fuels Tensions With China

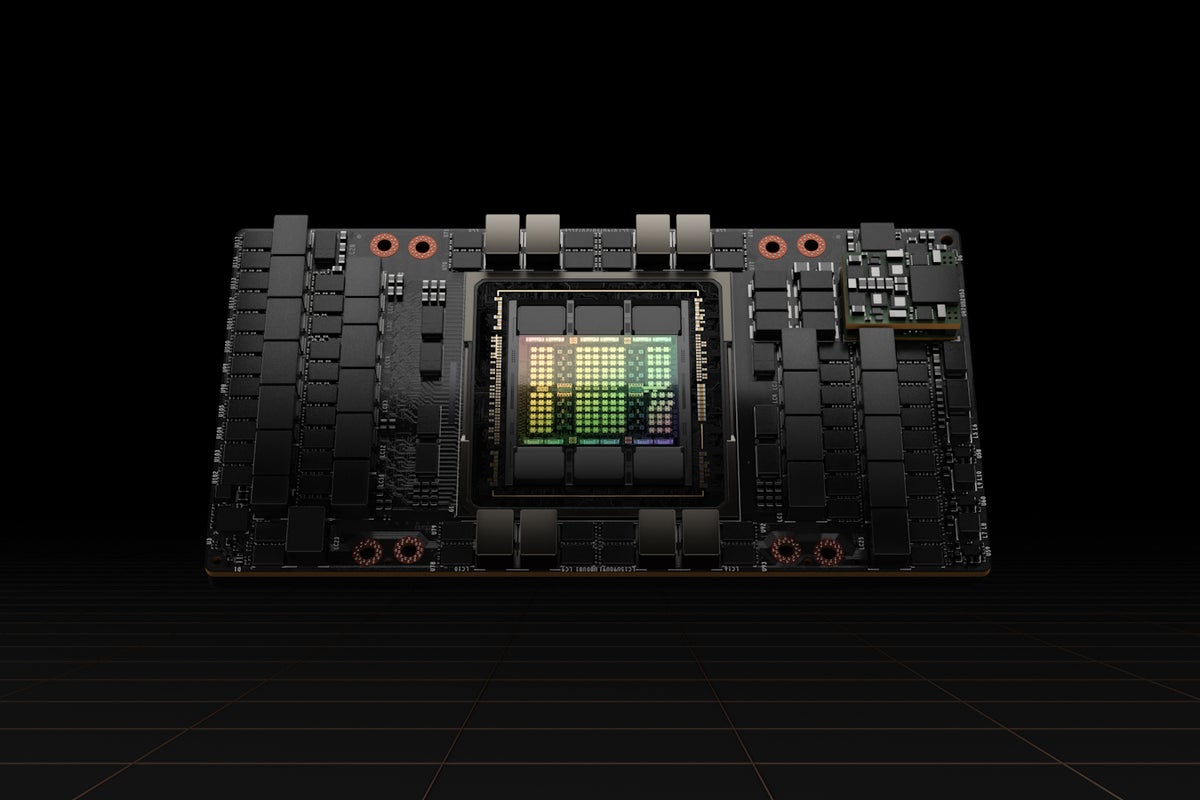

Photo courtesy of Nvidia.

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.