[ad_1]

On-chain data shows the Bitcoin Puell Multiple is currently retesting the downtrend line, will the metric be able to break above it this time?

Bitcoin Puell Multiple Has Gone Up A Bit During Recent Days

As pointed out by an analyst in a CryptoQuant post, a trend reversal could be nearing in the BTC market.

The “Puell Multiple” is an indicator that measures the ratio between the current daily Bitcoin mining revenues (in USD) and the 365-day moving average of the same.

What this metric tells us is how much the BTC miners are making right now compared to the average during the last year.

When the value of the multiple is greater than 1, it means miners are raking in more profits compared to the mean for the past 365 days.

On the other hand, values below the threshold suggest miners are under pressure right now as their income is lesser than the last year average.

Historically, the crypto has tended to form cyclical bottoms whenever the indicator has declined below the 0.5 mark.

Now, here is a chart that shows the trend in the Bitcoin Puell Multiple over the last few years:

The value of the metric seems to have been slightly going up recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin Puell multiple sunk down a few months back, and entered into the historical buy zone.

Since then, the indicator has been on a gradual upwards trajectory, and is now retesting the “downtrend” line.

This downtrend line has been providing resistance to the metric since around a year ago. In the chart, the quant has also marked how the trend was like in the past whenever the indicator was on a downtrend.

It looks like the Bitcoin Puell Multiple found rejection multiple times from a similar downtrend line during both the 2018-19 bear and the 2020 COVID crash.

After forming the bottoms during these two periods, the metric eventually broke through the line and a bullish trend followed in the price of the crypto.

The analyst notes that this is now the third time that the Puell Multiple is retesting this level during the current bear, so it’s possible it might break through it this time.

If the historical trend is anything to go by, then the indicator breaking the line now may lead to a bullish reversal for Bitcoin.

BTC Price

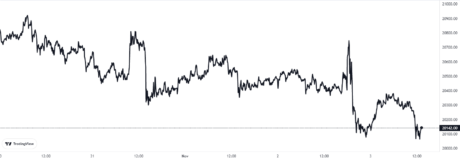

At the time of writing, Bitcoin’s price floats around $20.1k, down 3% in the last week.

Looks like BTC has been going downhill | Source: BTCUSD on TradingView

Featured image from Maxim Hopman on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Image and article originally from www.newsbtc.com. Read the original article here.