[ad_1]

Mark J. Higgins, CFA, CFP, and Raphael Palone, CFA, CFP, will be presenting at the Planejar Annual Conference in Sao Paulo, Brazil, on 24 October 2022. Their program compares the US Federal Reserve’s response to post-COVID-19 inflation with its policies following the Great Influenza and World War I in 1919 and 1920.

“I think the major impediments [to international coordination of monetary policy] are that it sounds fine in theory, but when the exchange rate objective seems to conflict with domestic urgency, domestic urgency wins out. It’s very difficult politically to appear to be subordinating domestic policy to international exchange rate stability, even though in the long run that may be a desirable thing to do.” — Paul Volcker

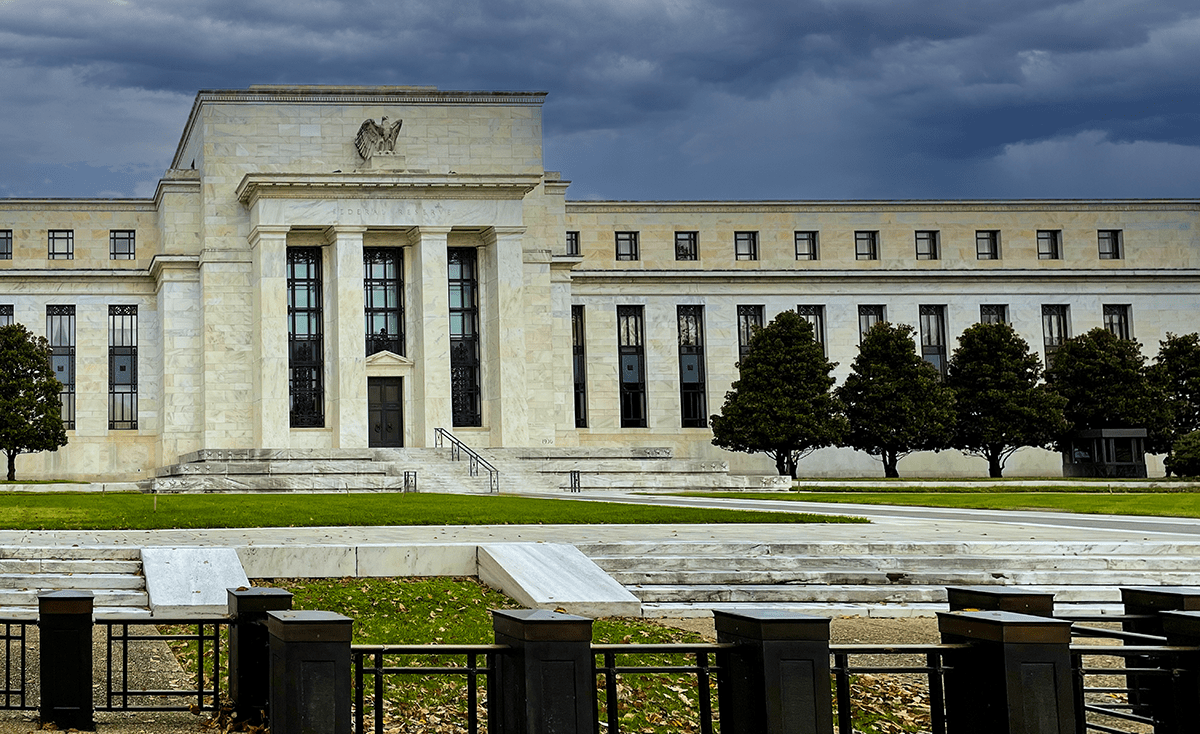

The US Federal Reserve’s aggressive monetary tightening is at a scale that the world has not seen since the early 1980s. Over the past year, US securities markets have suffered substantial losses, yet the US economy and financial system remain on reasonably solid ground. The situation abroad is more precarious. Higher US interest rates and a strong dollar are disrupting cross-border capital flows and straining the finances of countries holding large amounts of dollar-denominated debt.

The impact of Fed policy on the global financial system is yet another feature of the COVID-19 pandemic that caught investors off guard. But much like post-pandemic inflation, it is hardly unprecedented. Ever since World War I ended, US monetary policy has shaped cross-border capital flows, central bank policies, and debt-servicing sustainability throughout the world. This is a power that the United States assumed when it became the world’s largest creditor after World War I and the world’s primary reserve currency issuer after World War II.

Fed policies will undoubtedly rattle the world again over the coming months. In fact, the United Nations Conference on Trade and Development issued an ominous report earlier this month warning of potentially severe ramifications in some of the most vulnerable nations. Beyond these generalities, however, how Fed policy will play out across the globe is difficult to predict. But one question is worth pondering: Will the Fed adjust its policies in the interest of global financial stability?

There are two scenarios from history that may help answer this question.

Ben Strong and the Roaring ’20s

The Fed tightened monetary policy aggressively in 1920 for a familiar reason: to tame inflation. That led to a sharp but relatively short depression. The economy recovered in 1922 only to start overheating in the mid-1920s. This put the Fed in a difficult position. Blamed in part for having caused the depression of 1920 to 1921, Fed leaders feared repeating their mistake and were biased against raising rates prematurely. Complicating matters further, the Fed was under intense pressure from European central bankers to keep rates low. Why? Because if the Fed raised rates, gold would flow from Europe to the United States, as investors sought higher returns on capital. This would threaten post-war reconstruction by reducing the European money supply and forcing European central banks to raise interest rates to stem the outflow of gold.

The Fed’s commitment to European reconstruction was first tested by the United Kingdom in 1925. After World War I, the pound sterling had largely forfeited its reserve currency status to the US dollar. But the UK’s political leadership wanted to restore it. Amid calls from leaders of the Bank of England and his Conservative Party to reestablish the gold standard, Winston Churchill, serving as chancellor of the exchequer, caved to the pressure. The pound, he announced, would return to the pre-war fixed ecxhange rate of $4.86. This substantially overvalued the pound, instantly rendering UK exports uncompetitive. That increased gold shipments from the UK to the United States and created problems for both countries: The UK suffered a painful recession, while the US money supply went through a rapid and unwanted expansion.

In spring 1927, fearing the Fed would again raise interest rates amid increasing inflation and speculation, central bankers from the United Kingdom, Germany, and France traveled to the United States to lobby in favor of easy monetary policy. New York Federal Reserve Bank Governor Ben Strong helped convince his fellow Fed leaders to accede to the Europeans’ demands. But they went a step further: Instead of holding rates steady, they cut them. The Federal Reserve Bank of New York reduced the rediscount rate from 4.0% to 3.5%. The cut was approved with only one dissenter, Adolph C. Miller, whose words proved prescient. He described the decision as “The greatest and boldest operation ever undertaken by the Federal Reserve System, and . . . one of the most costly errors committed by it or any other banking system in the last 75 years!”

This was not an exaggeration. The Fed’s overly accommodative monetary policy fueled rampant speculation in the late 1920s. This concluded with the catastrophic crash in October 1929, which triggered the Great Depression. The Depression, in turn, created the harsh economic conditions that enabled the rise of the Nazi party and Japanese militarists.

Paul Volcker and the Great Inflation

Fed chair Paul Volcker announced his famous monetary tightening program on 6 October 1979. Volcker understood it would have enormous consequences outside of the United States. But he didn’t let that affect his policy decisions. His priority was taming US inflation first and then dealing with the consequences, both foreign and domestic, as they emerged.

Volcker’s monetary tightening persisted for nearly two years. As inflation moderated and the US economy could no longer sustain the austerity, the Fed began easing rates in July 1981. The US slowly emerged from the severe recession of 1981 to 1982, and the subsequent price stability helped fuel nearly two decades of prosperity.

Other nations did not fare as well. The situation in Latin America was especially painful. Indeed, the 1980s are often considered Latin America’s lost decade. The sharp and sudden increase in US interest rates caused the dollar to appreciate substantially against many foreign currencies. Many Latin American countries had loaded up on US dollar-denominated debt, often with floating rates, throughout the 1970s. Now they faced higher interest payments in dollar terms just as their own currencies were plunging in value. Mexico was hit especially hard, defaulting on its foreign debt in August 1982.

While the Fed did provide significant aid to Mexico, among other countries, the international pain did not dissuade Volcker from his course. Domestic US concerns took clear priority. This element of Volcker’s philosophy is what most distinguishes it from Strong’s.

What Does This Mean Outside the United States?

The extent to which the Fed will adjust and recalibrate its policies based on their global impact is unclear. But we expect the Fed to follow Volcker’s model more than Strong’s. The current political atmosphere in the United States is focused on domestic concerns. All else being equal, the Fed will likely mirror the perspective of the American people.

So, when it comes to US monetary policy, foreign governments would be wise to prepare for a lot of Volcker and hope for a little Strong.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Douglas Rissing

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.